Santa Rally keeps US indices moving ahead with confidence. Trade action in a quiet market week is a mix of bottom fishing in France, some hedging trades in Gold and Silver, profit taking in technology and trailed stop losses working in agriculture and crypto and lots of covered calls

Portfolio News

Market Rally

Markets focus on consumer spending data and China trade to drive a strong end in a light volume week - a strong Santa rally.

Bought

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Average down in one portfolio.

iShares Silver Trust (SLV): Silver. Bought January 2021 strike 17 call options in one portfolio. Price has to move up 12% from closing price of $16.58 to break even.

Tyson Foods, Inc (TSN): US Food Manufacturer. Jim Cramer idea with Tyson well positioned to supply pork to China struggling with African swine fever outbreak. Dividend yield 1.84%

Yamana Gold Inc (AUY): Gold Mining. Bought January 2021 strike 4 call option for $0.55 call premium. Price has to move up 19% to reach break even. This feels like a solid hedging trade for any surprises in China trade or US elections or inflation rising.

Electricite de France S.A. (EDF.PA): French Utility. Following a review of expiring options from the week before I studied the charts. Price looks like it has bottomed out. Bought a June 2021 10/12/8 call spread risk reversal. Net premium on the call spread was €0.69 offering maximum profit potential on its own of 189% for a 21% move from closing price of €9.91. The sold put premium of €0.61 brings net premium down to €0.08 and ramps up profit potential to 1637%. Risk in the trade is if price drops below €8.08 at expiry or does not hold above €10.08 on expiry.

Let's look at the chart which shows the bought call (10) as a blue ray and the sold call (12) as a red ray and the sold put (8) as a dotted red ray with the expiry date the dotted green line on the right margin.

The maximum profit is around the level of the early 2019 highs. The sold put level is below the 2019 lows and was last seen at the bottom of the 2017 selloff. I have modelled an Elliot Wave from the 2017 lows - get a repeat of that and this trade will pass the maximum profit on the 3rd leg and should stay above that level through legs 4 and 5.

Carrefour SA (CA.PA): French Supermarket. Following a review of expiring options from the week before I studied the charts. Price looks like it has bottomed out. Bought a December 2020 15/18 bull call spread funded in part by selling a September 2020 strike 14 put option. Net premium on the call spread was €0.94 offering maximum profit potential on its own of 219% for a 19% move from closing price of €15.12 (in-the-money). The sold put premium of €0.88 brings net premium down to €0.06 and ramps up profit potential to 3433%. Risk in the trade is if price drops below €14.06 at September expiry (-7.5%) or does not hold above €15.06 on December expiry (-0.4%).

Let's look at the chart which shows the bought call (15) as a blue ray and the sold call (18) as a red ray and the sold put (14) as a dotted red ray with the expiry date the dotted green line on the right margin.

The maximum profit is around the level of the 2019 highs. The sold put level is below the 2019 lows and was only breached once after the big selloff in 2018. Price only needs a modest price move similar to any of the recent moves (compare the two blue arrows)

Vodafone Group plc (VOD.L): UK Telecom. Averaging down entry price in one portfolio. 5.06% dividend yield is attractive but could be under pressure with a high debt load.

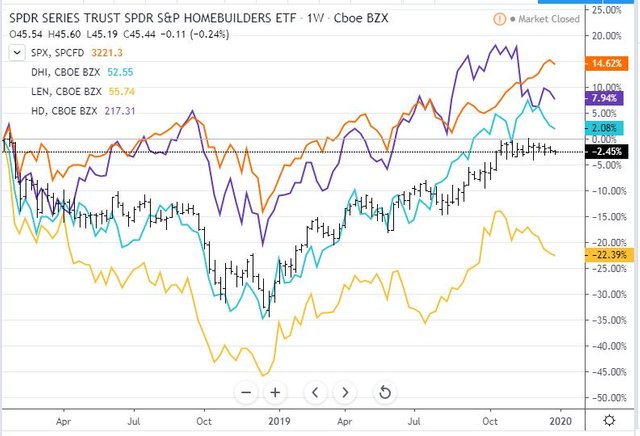

D.R. Horton, Inc (DHI): US Homebuilding. 2019 has been a strong year for US home builders with reducing interest rates driving new home starts. One of the talking heads picked that as trade of the day citing the way price has lagged S&P 500 since the November high (a drop of 8 percentage points). I bought a small holding on instinct and also wrote a covered call against the stock. 1.32% dividend yield.

A comparative chart shows DHI (blue line) outperforming the equal weighted SPDR Homebuilders ETF (XHB - black bars) and the S&P 500 for 2019. The 2 year chart shows the whole sector lagging the S&P 500 (orange line) - maybe the better purchase was Lennar (LEN - ochre line). I did close out a Lennar trade profitably a little while ago.

Sold

NVIDIA Corporation (NVDA): US Semiconductors. With price opening at $238.13 closed out January 2021 175/225 call spread leg of call spread risk reversal. Call spread profit on its own was 68% since March 2019. I have left the sold put (150) open - had I closed that out, profit would be 143%. (Dec 20 trade). A quick look at the updated chart shows price smashing through the sold call level at the first attempt.

The sold put level is just above the 2019 lows and would represent an averaging down on my stock position.

ETFMG Prime Cyber Security ETF (HACK): Cybersecurity. With price closing at $41.67, closed out March 2020 38/41 bull call spread for 66% profit since August 2019. (Dec 20 trade)

Soyabeans Futures (SOYB): Soyabeans. Two contracts closed on trailed loss at average per contract profit of $7.80 (0.8%)

Income Trades

44 covered calls written at an average premium of 1.00% with coverage ratio of 8.39%. 3 of those trades have been levered up with sold puts as well.

Cryptocurency

Bitcoin (BTCUSD): Price range for the week (23 to 30 Dec) was $640 (8.3% of the high). Price tested up to resistance below $7761 and drifted lower into the middle of "no mans land" holding around the October lows

2 trades closed on trailed stop loss at average per contract profit of $169.10 (2.4%). One new contract opened on a 4 hour reversal (Dec 24)

Ethereum (ETHUSD): Price range for the week was $16 (12% of the open).Early part of the week mirrored Bitcoin with a push higher and a drift lower with the end of the week seeing a higher high breaking out of the range.

One trade closed on trailed stop loss at average per contract profit of $1.50 (1.2%)

Ripple (XRPUSD): Price range for the week was $0.01444 (7% of the high). High for the week comes on day one with price also drifting to the middle of "no mans" land.

One trade closed on trailed stop loss at average per contract profit of $0.002 (1.1%)

CryptoBots

Profit Trailer Bot Two closed trades to be reported next time

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 7 trades on AUDUSD, AUDNZD, NZDUSD, AUDCHF, USDJPY, EURGBP, EURJPY for 0.44% profits for the week. Trades open on XAUUSD, AUDCHF, USDJPY, GBPNZD, EURJPY (6.15% positive). The star trade is long XAUUSD - sure hope he banks it.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

December 20-27, 2019

Hi, @carrinm!

You just got a 0.38% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit