Markets keep pushing higher until the President presses drone attack buttons. 56 Percent Club updates shows there are nerves jangling below the surface. In the same time markets make new highs, silver and gold mining and uranium poke their heads out.

Portfolio News

Market Rally

US markets were pushing new highs through most of the week with China deal slated for January 15 signing.

Trump’s decision to approve the killing of Iran’s top military commander, Maj. Gen. Qasem Soleimani, changes all of that. Stocks slide and energy stocks climb

Iran Tensions

This attack brings big risks according to Washington Post (not a friend of Donald Trump or Mike Pompeo)

- another protracted regional war in the Middle East

- retaliatory assassinations of U.S. personnel stationed around the world;

- an interruption in the battle against the Islamic State

- the closure of diplomatic pathways to containing Iran’s nuclear program

- backlash in Iraq, whose parliament voted on Sunday to expel all U.S. troops from the country.

Bought

The Bank of New York Mellon Corporation (BK): US Bank. Trade of the day from CNBC team was Goldman Sachs (GS). That prompted me to add Bank of New York Mellon to another of my portfolios - it is a bit of a sleeping giant. See TIB493 for the initial rational including comparisons across the sector. This chart from there - the light blue line - lagging 104 points over 3 years. Close half that gap is a great trade.

Vertex Pharmaceuticals Inc (VRTX): US Pharmaceuticals. Biotechnology has been catching a bid. Trade of the day idea from CNBC team.

iShares Silver Trust (SLV): Silver. With price closing at $16.74, bought a July 2020 17/20 bull call spread as a hedging trade. With a net premium of $0.65, this offers maximum profit potential of 361% if price moves up 19.5% on or before July 2020 expiry.

Let's look at the chart which shows the bought call (17) and sold call (20) as green rays and green text with the expiry date the dotted red line in the centre. There are other trades on the chart with longer expiries.

A repeat of the blue arrow price scenario will see this trade reach the maximum before July expiry. The 2019 high would yield 104% profit. The drone attack made this trade look a whole lot better (trade was on before that).

Carrefour SA (CA.PA): French Supermarket. With price closing at €15.13 bought a March 2020 15.2/16.2 bull call spread. With net premium of €0.40 this offers maximum profit potential of 150% for a 7% move up in price. See TIB496 for the most recent prior trade and rationale.

Lennar Corporation (LEN): US Homebuilding. Review of last week's purchase of DR Horton (DHI) suggested that Lennar was the laggard that had the most to gain from a continued uptick in US housing. Added a small holding - not enough to write covered calls. Will review to see how price moves. See TIB498

Corn Futures (CORN): Corn. One contract opened on a limit order - i.e., on the way down. I doubt the market noise around Iran will get in the way of a China deal being signed. That said Iran and China are friendly.

Sold

NVIDIA Corporation (NVDA): US Semiconductors. With price closing at $239.91, closed out January 2021 175/225 call spread leg of a call spread risk reversal. Profit on the call spread alone was 70%. Closing out the sold put (150) at last price would ramp up the return to 167%. Trade set up in March 2019. I retain a holding in the stock with average entry price of $143 - buying in at $150 would be a slight increase in average cost.

Novartis AG (NOVN.SW): Swiss Pharamaceuticals. Jim Cramer idea to trim for profits based on a good price move and strong markets. 4.6% profit since September 2019.

Wisdom Tree Cocoa (COCO.L): Cocoa. In October, West African cocoa buyers agreed to raise minimum rate they would pay for cocoa. This was expected to push a surge in supply in the medium term. Decided to take profits before this pushed through to lower prices and banked 20% profit since January 2018. I must say I had missed the initial news in October.

I did have a pending order sitting at 52 week high ($2.78) - I took that lower to close the sale

Chicago Wheat Futures (WEAT): Wheat. One contract closed on trailed stop loss for $2.50 (0.64%) per contract profit

Soyabeans Futures (SOYB): Soyabeans. One contract closed on trailed stop loss for $4.10 (0.43%) per contract profit. One contract replaced on limit order.

Shorts

Vanguard FTSE Europe Index Fund ETF (VGK): Europe Index. With price closing at $58.91 bought a February 2020 56/54 bear put ratio spread. With net premium of $0.01875 this provides protection for a price drop between 5.2% and 9.1%

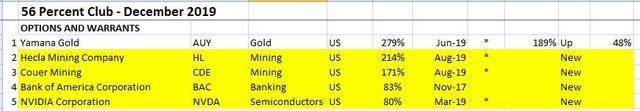

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time.

What stands out

- No change at the top with Australian payments technology company, EML Payments (EML.AX) holding its place but going down 6%

- No departures and 3 new entrants and two coming back, Yamana Gold Inc (RNY.DE) and Muenchener Ruckversicherung (MUV2.DE) (8 vs 3)

- New entrants bring strong clues about markets sentiment in uranium, Centrus Energy (LEU) and semicondcutors, Nvidia Corp (NVDA) and silver, Hecla Mining (HL). Market is rising but nerves are jangling

- European Mid Caps and Japan still feature

- Three of the stocks were bought in the last 12 months (starred).

On the options side same deal - four new entrants marked in yellow

- Quite some change here with only 1 stock left from last list (5 vs 4)

- All 3 off the list were sold - ETFMG Cybersecurity ETF (HACK), US homebuilder, Lennar (LEN) and US healthcare provider UnitedHealth (UNH)

- New entries for semiconductors, Nvidia Corp (NVDA) and Silver Mining, Hecla Mining (HL) and Couer Mining (CDE). New entry for Bank of America (BAC) is the first time this particular trade makes the list. BAC has been here before.

- 4 of the contracts were bought in the last 12 months (starred)

Of note is 56 Percent Club cutoff date was December 31 - the Iran event happened after that. The market was already giving clues about some jangled nerves with the rise of gold and silver and uranium onto that list.

Income Trades

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Strike 26 naked put expired in my favour (Dec 27) with 0.84% premium for 3 weeks work.

Apache Corporation (APA): Oil Producer. With closing price of $26.21 sold January 2020 strike 24 naked put (1.7% premium to closing price with 8.8% coverage)

ENGIE SA (ENGI.PA): French utility. With closing price of $14.52 sold January 2020 strike 14 naked put (0.41% premium to closing price with 3.7% coverage). Price has held above 14 since breaking up in September 2019 with 4 failed tests.

9 new covered calls written and one partial fill completed (XOM) at average premium of 0.56% for the week and coverage ratio of 6.42%. Averages for the month now stand at 0.93% premium and coverage of 8.06%.

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $642 (8.9% of the open). Price drifted lower all week until the drone attack and bounced off the lows to end where it started the week in the middle of "no mans" land. Technically price is forming a triangle with a higher high needed to confirm a reversal of the short term downtrend.

3 trades closed for average profit of $109.44 (1.52%) per contract.

Ethereum (ETHUSD): Price range for the week was $12 (9% of the open). Like Bitcoin, price drifted lower through support at $132 and bounced with the drone attack to push back above the $132 level. This shape looks a bit more convincing as there was a higher low confirmed (but not yet a higher high)

3 trades closed for average profit of $3.98 (3.14%) per contract.

Ripple (XRPUSD): Price range for the week was $0.01254 (6.4% of the open). Price shows the same downward drift and then the spike back up but without making a higher high.

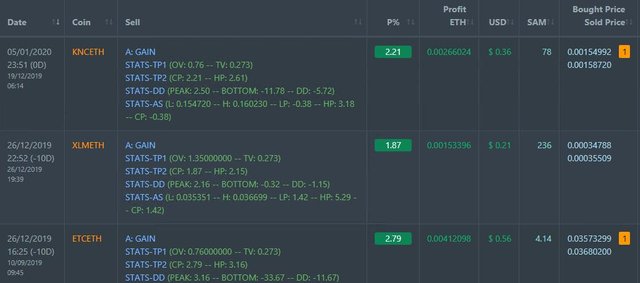

CryptoBots

Profit Trailer Bot Trades closed in prior week were average 2.33% profit. One new closed trade (2.21% profit) bringing the position on the account to 10.13% profit (was 9.98%) (not accounting for open trades).

Dollar Cost Average (DCA) list now at 6 coins with KNC moving off and onto profit after one level of DCA.

Pending list remains at 10 coins. PT Defender has not been updated to keep pace with Profit Trailer changes. Pending trades are still open - will have to track them manually.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 12 trades on GBPNZD, USDJPY, XAUUSD, EURJPY, AUDCHF for 8.33% profits for the week. Trades open on USDJPY, XAUUSD, EURUSD (4.74% positive). Good to see some of the long gold profits booked. Iran tension is keeping the 3 open trades moving ahead.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

December 30, 2019 -January 5, 2020

What's your risk on the SLV trade, if the trade goes against you, do you get out of the trade at a certain unrealized loss?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Data is there. Net premium is 3.9% of the trade day closing price (3.8% of strike) - so that is the risk in the trade. I will exit as soon as price passes the sold call strike (20) if I am paying attention. The closer to expiry that happens the better the profit potential as trade has lost more time value.

I do not run an exit strategy for trades like this that go against me. Too often I have seen a trade drop 50% and then bounce back and reach the maximum. More disciplined options trades like to run a 50% loss of premium exit - choose a rule and run with it. Do not cry when a 50% loser becomes a 300% winner.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.37% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit