Catchup post for trade action coming through options expiry in one portfolio - the last update. A few exercises, a few assigned and some hard lessons about options trading and time. Note: there is some overlap in the reporting as I held some positions in multiple portfolios. Charts here are all new for this edition.

Book Launch

I did launch The Iceberg Effect - a co-branded effort with my mentor and partner, Dean Holland. Discover the untold secret of affiliate marketing success. Free - just pay $7.96 shipping https://mymark.mx/IEOrder

Bought

Bank of America Corporation (BAC): US Bank. With price closing at $34.71 bought leg of 27/40 bull call spread exercised. Sold leg expired. Breakeven for the holding is $30.44 which is an implied gain of 14%. I will be writing covered calls until this gets assigned.

Sold

Assigned on covered calls.

Apache Corporation (APA): US Oil Producer. 0.01% blended loss since April/September 2019. Income from covered calls and naked puts added 1.86%

SPDR S&P Pharmaceuticals ETF (XPH): US Pharmaceuticals. 8.1% profit since July 2018. Income from covered calls added 5.32%

Shorts

Invesco QQQ Trust (QQQ) and SPDR S&P 500 ETF Trust (SPY) hedge trades both closed out-the money. These are cash neutral ratio put spreads which are fine to expire worthless

Archer-Daniels-Midland Company (ADM): US Agriculture. $45.25 close for strike 36 sold put option - expires in my favour to close out call spread risk reversal fully.

The Walt Disney Company (DIS): US Media. $144.33 close for Strike 120 sold put option - expires in my favour to close out call spread risk reversal fully. CNBC Options Action team was exactly right that $120 was a floor following the completion of the 21st Century Fox acquisition. I will keep writing naked puts on this stock each month. See TIB412 for the detailed discussion on the trade rationale.

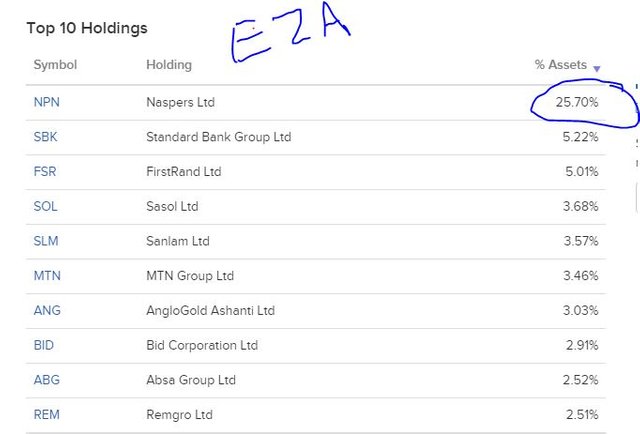

iShares MSCI South Africa ETF (EZA): South Africa Index. $48.53 close for 44.04/36.04 (was 48/40) bear put spread. Strike was changed on these options to account for a $4.705 dividend in December. Prior to the dividend this spread was just in the money ($46.28 close the day before). The updated chart tells the story of price that is breaking down but not hard enough.

I have shown the restated strike price as a light blue ray with the start point the time of the change. Price did test once below 48 before restatement but came nowhere close even to breakeven (fluoro green ray). This is a frustrating trade - I know the South African economy is in a big mess. But the external view of the market is being clouded by a rising gold price and a major holding in the ETF that is not really South Africa.

Source: Eftdb.com

Example: Naspers is the largest shareholder of Tencent - it is 25.7% of the ETF. I guess the real challenge is the options do not go out far enough in time - I am going to keep giving it a go and maybe use ratio put spreads to fund the bug-in-my-head concept OR go back to shorting South African Rand

Expiring Options

Long list of options expiring out-the-money with 4 big themes failing - China trade war resolution, tariffs not helping steel and aluminium producers, oil prices affecting oil services especially and shale oil and rising interest rates to help regional banks. Add in a few old time sectors falling on hard times.

Oil and Oil Services

Alerian MLP ETF (AMLP): US Shale Oil. $8.84 close for strike 11 call option.

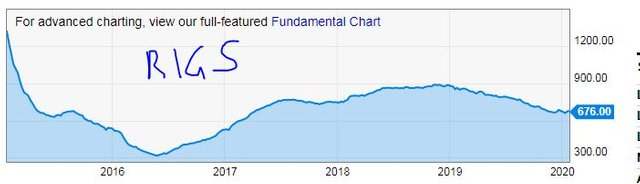

Updated chart shows timing of trade entry just as the momentum ran out. Two factors at play here - first is the impact of tariffs (marked) on slowing economic growth (reduced demand for oil) and next chart is supply growing from US shale - growing rig count into the end of 2018.

Source: https://ycharts.com/indicators/us_oil_rotary_rigs/chart/

SPDR S&P Oil & Gas Exploration & Production ETF Oil. (XOP) $22.37 close for 35/50 and 40/50 bull call spread. At the risk of getting repetitive with charts running out of momentum the next one is a little different.

Price kept moving along the blue arrow price scenario until the October 2018 selloff - it did not recover. Question is was there a trade management opportunity to save half the premium on that fall? I fully expected a resolution to the trade dispute in less than the 2 years to expiry. Got that one wrong. Maybe there is a trade management rule to consider - sell the bought call when its price equals the net premium paid and leave the sold call to expire (and risk being short up there if price rebounds).

VanEck Vectors Oil Services ETF Oil Services. (OIH) $12.67 close for 26/35 bull call spread.

Fluor Corporation (FLR): Oil Services. $20.47 close for 47.5/65 bull call spread.

Transocean Ltd. (RIG): Offshore oil driller. $5.97 close for 10/20 bull call spread. Offshore oil drilling has been a tough sector to invest in.

Emerging Markets and China

Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR): China Index. $30.61 close for 33.71/43.71 bull call spread. This trade was set up before the US-China trade dispute began and expiry has come too close to the signing of the Phase 1 trade deal to make enough impact.

Updated chart shows price reacting to the first round of steel and aluminium tariffs not long after trade entry. Trade had no chance.

Steel and Aluminium Tariffs

AK Steel Holding Corporation (AKS): US Steel. $3.12 close for 4/7 bull call spread. This trade was set up to see if price could benefit from tariff protection. It did not work - that said, steel was a very profitable avenue starting in September 2013 into 2014 in US and in 2016/18 in Europe.

US Regional Banks

My investing coach was always keen to keep his options trades out-the-money. He would roll up and scale in progressively to be sure to back the winners. I do not scale in (mostly).

Fifth Third Bancorp (FITB): US Bank. $29.45 close for 35/45 bull call spread. First trades at strike 17 in August 2012 rolled up profitably until January 2014 - then starts the slide wiping out all the gains. The updated chart shows the challenge starkly - price turned over right at the time the trade was set up. Momentum lost.

This coincides with interest rates starting to flatten with bank stock prices a strong leading indicator (chart shows 10 year Treasury yields)

https://ycharts.com/indicators/10_year_treasury_rate

Huntington Bancshares Incorporated (HBAN): US Bank. $14.71 close for strike 25 sold call option which was part of a bull call spread. I rolled out the bought call (15) before expiry.

Others

J. C. Penney Company, Inc (JCP): US Retail. $0.85 close - how wrong could one get for a 3.5/7 bull call spread?

General Electric (GE): US Industrials. $11.81 close for 15/20 bull call spread. Recovery is happening but not in time for this trade.

Cameco Corporation (CCJ): Uranium. $8.88 close for 10/17 bull call spread.

American Airlines Group Inc. (AAL): US Airline. $28.40 close for 40/60 bull call spread. Growing economy was helping US airlines until the Boeing 737 Max grounded most of American's medium range fleet. See TIB291 for the trade rationale and TIB503 for the updated chart.

The good news is the trade was funded from Delta (DAL) profits

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. Images from Etfdb and Ycharts are credited below the images. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

January 17, 2020

Wow that is quite the portfolio of trades. The market has been doing some wacky things lately and I’ve been focusing my efforts on hedging my long-term income positions with some short-term bearish options. So far so good, we’ll see where these unpredictable times take us though 🤷🏽♂️

Posted via Steemleo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am finding that writing covered calls is a great way to look after those long term positions. Get 1% a month and if the market takes you out - that's OK.

The other tactic that is working well is writing naked puts on gold or silver. I use Van Eck Vectors Gold Mining ETF (GDX). Pick a strike price that gives a 1% return a month away and keep doing it. If you get assigned you will find you are 5% below the current market on your entry.

My next post will have a write up on the approach I use as it is the first week of new expiries.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.38% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit