Attention shifts from earnings to corona virus. The change of mood during the week has made a few trades made early in the week look a little sad, especially in oil and interest rates. Big win in Amazon helps to ease the pain.

Portfolio News

Market Nerves

Markets worldwide react to the extent and scale of the corona virus outbreak.

I watched the US announcement of the public health emergency - markets actually got a little calmer as they moved into the close with the press conference running. Was encouraged to see Australia make a similar move over the weekend.

Treasury yields flatten further and some of the curves invert again. This time there is real concern as the impact on Chinese GDP is hard to estimate other than by referring to data around SARS and MERS outbreaks - this one has steeper take up rates. There are also big risks in the way supply chains are interconnected. PBOC has announced a huge injection through the repo markets starting February 3

I shared a chart last week showing how soybeans markets are reacting - the updated chart shows prices testing right down to prior lows. This has been the most accurate measure I have seen of the extent of the problem.

Cannabis Carnival

New York State make progress in legalizing with Governor Cuomo adding legalization in his budget proposal for the new fiscal year.

Good news for my holdings and timing was after my trades were made.

Bought

Cronos Group Inc. (CRON): Canadian Marijuana. Bought a January 2022 8/12 bull call spread. With a net premium of $0.85 this offers maximum profit potential of 370% for an 60% move from $7.46 opening price. This might feel like a stretch but price was at $12 in September 2019 - just 5 months ago. At the end of the week I averaged down in one portfolio with a net premium of $0.80. Liquidity that far out is not that good - I will keep a low ball bid open for a while.

Let's look at the chart which shows the bought call (8) and 100% profit as blue rays and the sold call (12) as a red ray with the expiry date the dotted green line on the right margin. The maximum profit is only one third of the way to the 2019 highs. The spike up before the big spike up (blue arrow) is big enough to take this trade to the maximum with two years to go.

Now I have started to look at using sold puts as a way to fund premium - 5 strikes are available which coincides with the support level since 2018 (the pink ray). Example: a January 2020 strike 5 put is $0.96 which more than covers premium for a January 2022 8/15 spread (i.e., wider than I bought). There is a chance one could get a bid accepted for a January 2022 15 strike call option for that - bid as is 0.80/1.20 now. That would leave an open ended call trade but price would have to double to pass the bought strike (for free). Not totally for free as there is risk of price dropping below $5 and staying there. The trade I like the look of is for January 2021 10/22 spread (cost $0.80) paired with a December 2020 strike 5 put (premium $0.91) = a wider spread and closer in put expiry.

Tilray, Inc (TLRY): Canadian Marijuana. Added a holding in one portfolio to write covered calls at 5.3% premium. This feels like a good return for the risk of stock falling more than 5%. Added in another portfolio to average down and to write covered calls on new holdings - wider coverage.

United States Oil Fund, LP (USO): Oil. One of the talking heads suggested that oil price hit was overdone. Rather than buy any producers, he was buying oil. I looked at call spreads with a year to go and bought a January 2021 11.5/12.5 bull call spread. With a net premium of $0.4075 this offers maximum profit potential of 145% for an 11% move from $11.25 closing price.

Note: this trade was made before the corona virus hit oil markets hard.

Tyson Foods, Inc (TSN): Jim Cramer idea to average down. Also wrote covered call at 1.13% premium.

Valaris plc (VAL): Offshore Oil Driller. Averaged down the stock holding that I was assigned on a sold put. I was assigned 75 shares - bought 325 shares to round up to a round number. Was a bit late in the afternoon session to write covered calls. Written next day at 2.88% premium

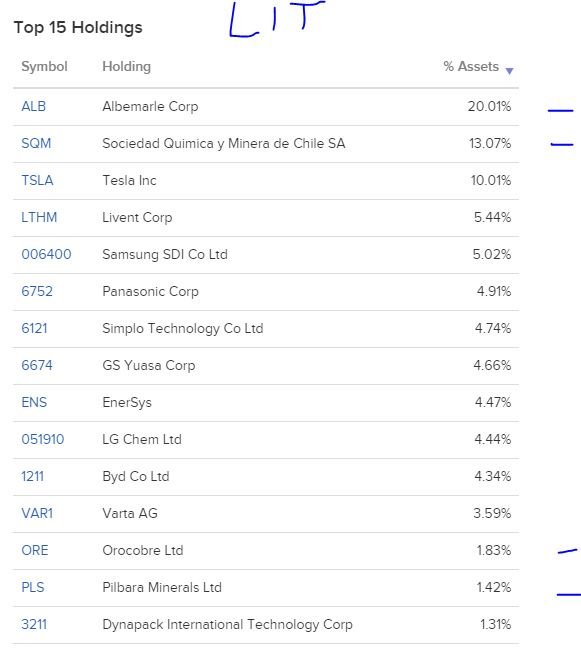

Global X Lithium & Battery Tech ETF (LIT): Lithium. Lithium prices have been recovering. Tesla (TSLA) earnings gave the whole sector a bit of a boost. Add in the mood of the Davos Conference on the importance of tackling climate change - we may have seen the bottom. I added to my holding in one portfolio at $28.69. I also sold a March 2020 strike 27 put option (1.11% net premium) to drive some income and find a lower entry point if price does slide.

The chart shows price breaking the weekly downtrend and retesting a level. Chart goes back to 2015/16 lows. The driver of this break up is partly the lithium miners - two plotted Albemarle (ALB - blue line) and Chile Minerals (SQM - yellow line) who are both well placed to ramp up production when prices move up. The other driver is Tesla (TSLA - red line) which is 10% of the ETF. To date I have been using SQM and a few Australian explorers and producers as my vehicle of choice focused on mining and exploration.

https://etfdb.com/etf/LIT/#holdings

Next picture is the mix of top 15 holdings - the ones marked with a dash are lithium miners. The rest are involved in processing or battery manufacture. I will spend time in the next week picking through targets for adding in any laggards - example Livent (LTHM). Livent was only listed in late 2018 but it is lagging by 38 percentage points since listing. Other laggards are EnerSys (ENS) and GS Yuasa Corp (6674.T)

Sold

United Health Group (UNH): US Healtchare. 23% blended profit since August/October 2019. Jim Cramer idea for initial entry and to take profits after a strong run.

Huntington Bancshares Incorporated (HBAN): US Regional Bank. Financial stocks are roiled by the Fed speech making the short term view mediocre. Rolled out February 2021 strike 15 call option to January 2021. As it happens the trading cost to sell the February call was higher than the value of the trade = ouch. I rolled out January to February just just two weeks ago.

This series of rollups is becoming an expensive trade.

Fifth Third Bancorp (FITB): US Regional Bank. Also rolled out February strike 31 call options to August 2020 same strike - also an expensive move but I did cover trading cost.

Amazon.com, Inc. (AMZN): Online retail. Amazon announced stellar results in the week which pushed price up 12% in one day. This took price over the top of the 1750/1930 bull call spread I am holding for an 18% profit. I toyed with the idea of holding onto the short 1660 strike put option until June 2020 expiry. Just felt the risk of a global recession marching in and forcing me to buy $166,600 worth of Amazon stock was too uncomfortable. In the portfolio that I hold some Amazon stock I sold 1 share to fund the buy back - this gave me 20% profit since October 2018. The profit on the sold put contract was 341% - making for a tidy profit overall. I was happy with the trade as it was cash neutral - i.e., I used someone else's money to score a big dollar terms winner.

Updated chart shows price spiking on earnings through the sold call strike (1930) and making a new all time high (inside the blue ring). The sold put (dotted red ray in the dotted green line) looks quite safe as a floor price - but I closed it anyway.

Chicago Wheat Futures (WEAT): Wheat. One contract closed on manually trailed stop loss for $0.50 per contract profit (0.09%).

Soyabeans Futures (SOYB): Soybeans. One contract entered on reversal on a 4 hour chart (shown as win in the chart at the top of the post. Reverse was temporary but contract was closed on manually trailed stop loss for $4.00 per contract profit (0.45%).

Shorts

Invesco QQQ Trust (QQQ): Nasdaq Index. Monday selloff was perfect opportunity to complete the ratio spread on the hedging trade I set up last week. I sold a 194 put with same expiry for $0.45. This was more than enough to fund the $0.42 net premium left open. This extends protection to 12.4% from the Monday close of $218.10.

iShares 20+ Year Treasury Bond ETF (TLT): US Interest Rates. The talking heads suggested that rise in bond prices was overdone. I bought a January 2021 144/138 bear put spread. With a net premium of $2.78 this offers maximum profit potential of 116% for an 4.5% move from $144.25 closing price. Part of me is thinking to turn this into a ratio spread to make the trade cash neutral - the long bond game is a popular investment and an entry 4.5% lower could be attractive.

Note: this trade also opened before the big correction at the end of the week.

Deutsche Bank AG (DBK.DE): German Bank. Share price has moved more than the coverage ratio on the covered call I have written with a 12% move up on the week. This type of move tells me the market feels that Deutsche Bank's problem are behind - might be worth buying back the stock. With the risk of stock being assigned at €8.40 I sold a February expiry €8.40 put option for a premium of €0.19. That gives me an entry price of €8.21 if the stock gets assigned.

Expiring Options

Australian Dollar (AUDNZD). Short Australian Dollar trade reached expiry. I had bought a 1.04 and a 1.0485 strike put option and had sold a 1.00 strike put option. With price closing at 1.03417 both bought puts expired in-the-money and the sold put expired in my favour. So I now have an open short AUDNZD position with a breakeven of 1.0213 which is 1.26% percent below the current price. This brings in a trade management choice - hold the position; or close the position and take the loss. Let's check the updated chart which shows price trading above breakeven (dotted pink ray).

I have drawn in a zone covering all the lows since 2016 = a buyer zone. Price has only dropped below 1.02 once in 2015 (and never before that since the Australian Dollar was floated). Now there is a market dynamic that is different this time - cororna virus is likely to make a dent in China's economy. China is Australia's largest trading partner - Australian Dollar is a likely casualty. That said, China is largest buyer of New Zealand food products. The fundamental challenge is which currency will hurt more? I did choose to the let the trade go to expiry rather than closing it out - spreads are lower on forex trades to exit.

See TIB359 and TIB360 for the trade setup - a short Australian Dollar trade

Income Trades

Covered Calls

16 contracts written at average 1.91% premium with 7.39% coverage bringing monthly to date average premium to 1.47% at 8.58% coverage.

Naked Puts

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. One trade expired in my favour - added new trade for March expiry at one strike lower (27 vs 28.

L Brands, Inc. (LB): US Retail. Long time owner of L Brands, Les Wexner announces the possibility of breaking up the business. This pushed prices ahead over 20% close to the covered call strike price. I added in a naked put below the announcement level to squeeze in some extra income (and gain a possible lower entry price)

Naked puts also written on Cisco Systems, Inc. (CSCO), and Commerzbank AG (CBK.DE).

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $1294 (15.6% of the low). Price bounced off support at $8400 and surged through the level at $8891 to reverse on the $9500 round number - a level not seen since November 2019

7 trades closed at average profit of $153.38 per contract (1.75%). One of those positions has been open since November 2019. Only one position open

Ethereum (ETHUSD): Price range for the week was $25 (15.7% of the low). Price confirmed the reversal on an inside bar day and then raced right through the $177 level almost without pausing also passing November 2019 levels.

6 trades closed at average profit of $6.54 per contract (3.83%).

Ripple (XRPUSD): Price range for the week was $0.03618 (16% of the low). Price moved higher from the prior higher low and paused briefly at resistance at $0.24754 with a bearish engulfing bar. The momentum was more bullish than bearish with price pushing right through the $0.26 level and making a higher high. These round numbers seem to be more pertinent - price is holding below $0.26 right now.

6 trades closed at average profit of $0.004 per contract (1.71%).

Exits were a mix of price targets hit and trailed stop losses. I set price target mostly at the level of the prior entry in the staircase of trades (sometimes halfway to the entry above that) and trail stop losses once a trade goes past breakeven plus spread.

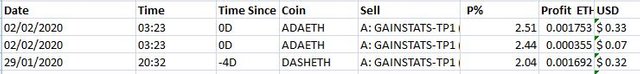

CryptoBots

Profit Trailer Bot Three closed trades (2.33% profit) bringing the position on the account to 10.67% profit (was 10.60%) (not accounting for open trades).

Dollar Cost Average (DCA) list drops to 6 coins. Pending list remains at 9 coins. I have not reinstalled PT Defender.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 17 trades on AUDNZD, USDCAD, EURUSD, CADCHF, GBPUSD, USDJPY, CHFJPY for 0.88% losses for the week. Trades open on AUDNZD (0.01% negative). A losing week with corona virus hitting oil and CAD and undisciplined trades on GBP on the day European Parliament was voting on Brexit - always best to stay away from those sorts of news days.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. LIT composition image is credited below the image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

January 27-February 2, 2020

@carrinm, In my opinion weeks back in a way whole world was looking like came out for the Global Protests but now whole world is fearing about the Coronavirus. Stay blessed.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit