Markets have their eye on corona virus and on earnings. Earnings appears to be winning as investors think there will just be a delay in the economic rebound. A busy trade week chasing some last chance value ideas, adding to lithium plays on the back of Tesla re-rating, looking for time and bottoms in banks. Profits come in semiconductors, cryptocurrency and agriculture.

Portfolio News

Market Rally

Was a topsy turvy week in markets with prices sagging on corona virus fears and being pushed higher by solid earnings.

Biggest mover of the week was Tesla (TSLA) surging as much as 23% in after hours markets on earnings release.

This dragged the whole lithium sector with it.

Biggest move in my portfolios were much more impressive with big gold discoveries driving Pilbara gold explorer De Grey Mining (DEG.AX) up 244% in the week (and more this week). Got to love a gold discovery at a time when it makes sense to be hedging with gold.

Corona Virus

I do not want to add to any misinformation. I have a friend who is in Tibet. What is going on is not pretty for somewhere a long way away from Wuhan. There is more to this than meets the eye. I have not changed tack on my investing theses but the time might be coming to raise some cash. I did add the hedges to my pension portfolio.

Bought

Nielsen Holdings plc (NLSN): Media Technology. Last Trade idea on CNBC. With the potential sale of the whole business falling through, there is talk of the business splitting its two components and spinning off. Value of the parts is greater than the whole was the thinking. Plus Nielsen now has ability to rate TV streaming services. Also sold a covered call (1.11% premium for 3 weeks)

Cronos Group Inc (CRON): Canadian Marijuana. Following on from last post discussion (TIB506) on using strike 5 sold puts to fund call spreads, I added 2 call spread risk reversals in different portfolios. January 2022 8/17/5 was cash neutral. January 2021 8/15/5 had a net premium of $0.04. Between the two the trades are cash neutral. Risk in the trade is price drops below and stays below $5 at expiry in 2021 or 2022. Options chain shows me alone in this trade

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

Fifth Third Bancorp (FITB): US Regional Bank. Bank stocks took a hit following the Federal Reserve speech last week. Rolled out a February 31 strike call to August 2020 same strike to buy more time. Not sure the extra $0.95 premium will come back but more time might help.

ETFS Soybeans (SOYB.L): Soybeans. Soybean price tested prior lows (on a daily chart) and looked oversold. I added a holding using an ETF rather than CFD's in one portfolio.

Scorpio Tankers Inc (STNG): Oil Shipping. My holding in this stock has dropped below 100 shares following a consolidation. Rounded up and increasing holding size to average down and write covered calls at 1.27% premium. Probably not the best time to be adding to oil shipping - but the small holding was irking me - might as well make some income.

UBS Group AG (UBSG.SW): Swiss Bank. Price looks like it has bottomed. I added a January 2021 12/14 bull call spread funded fully by a December 2020 sold 10.5 strike put. Only when I came to write up the trade did I note that I was already long the 14 strike call options (which means I sold them rather than shorted them). Next day I fixed the trade by selling a 14.5 strike call option still keeping the trade cash neutral. I will buy back the contracts I sold in error.

Let's look at the chart which shows the bought call (12) as a blue ray and the sold call (14.5) as a red ray and the sold put (10.5) as a dotted red ray with the expiry date the dotted green lines on the right margin (the sold put expires earlier). Structure provides 13% downside buffer and needs 19% move to make the maximum profit.

Chart clearly shows price has broken the weekly downtrend and tested a level (dotted green level). The sold put (10.5) is just above the level of the first higher low after the turn. The maximum profit point (14.5) is less than half way to the 2018 high. On the last cycle up, price consolidated for quite a few months (left hand horizontal blue arrow) before moving up. Get a repeat of that pattern and there is enough time for this trade to make the maximum. Of importance is that last cycle move up happened after the Swiss National Bank introduced negative interest rates (which persist).

One could use the 2019 low as the level for a sold put (10) and pay a small premium for the trade. I wanted to be cash neutral. I chose not to go to 2022 expiries as the spreads were wider and I feel the trade has enough time.

Royal Dutch Shell plc (RDSA.AS): Europe Oil Producer. Shell announced results the prior week which disappointed and put the buyback into question. Share price suffered with a drop from €26.41 to a low of €23.11. I added to my holdings of December 2022 strike 30 call options to average down. This contract is well out-the-money but there are just under 3 years to go for a premium only 1.2% of that low closing price.

The updated chart shows the new 100% profit line as a dotted light blue ray. What the trade needs is two blue arrow price moves from current levels. I have cloned two across in light blue. There are some key technical levels on the chart. Price is testing levels from early 2017 and late 2014. They might provide the floor. To get there, price did drop through a strong support level at €24.90. This will provide resistance on the way up - I have modelled a pause at that level for the recovery.

Now this is all a bit moot with China oil demand dropping hard from corona virus effects. My sense is there is enough time for recovery AND I am really looking only to grab back some capital rather than get to 100% profit.

Livent Corporation (LTHM): Lithium Processesing. Following on from my review of the components of the Global X Lithium ETF (LIT) (see TIB506), I added the first of the lithium processors. Livent manufactures chemicals used for lithium batteries and storage solutions. Price had already moved - too bad I did not do this earlier. I wrote covered calls too with 5.6% premium. In another portfolio, I added a December 2020 strike 17.5 call option which is well out-the-money. I wanted to diversify the holdings which are currently a mix of hedge trades and financials. Day two and again this week, averaged down by buying another small holding and writing covered calls (same strike as prior calls at now 3.85% premium)

Unum Group (UNM): US Healthcare. Bernie Sanders did not do as well in Iowa primary as markets feared. This propelled healthcare stocks and took Unum price to $30.21 above the covered call level I wrote (30). I bought another parcel of stock. Will be watching this carefully as expiry approaches.

iShares MSCI Spain Capped ETF (EWP): Spain Index. Price seems to have found a bottom. Averaged down entry price in two portfolios and wrote tight covered calls (0.86% premium and 3.9% coverage for 2 weeks)

Slack Technologies, Inc (WORK): Cloud Computing. CNBC Last trade idea - price has been beaten down and looks like it is recovering. With sale last moth of Twillio (TWLO) I was happy to add something back in cloud computing arena. Wrote covered call at 1.1% premium and 11% coverage for 2 weeks. News this week has taken price above the sold call level.

Costco (COST): US Retail. Jim Cramer idea to add to a quality business less related to China. Averaged down entry price in one portfolio.

L Brands, Inc (LB): US Retail. Holding on a covered call is likely to be assigned. Bought another parcel of stock to average down entry price and wrote a covered call against the new holding for March (2.3% premium)

Sold

ABB Ltd (ABBN.SW): Europe Industrials. With price closing at SFr 24.43, rolled up and out a December 2020 strike 24 call option to June 2021 strike 25 - looking to stay out-the-money and a little more time. This incurred a 16% loss since August 2018 but did release some capital. I am also exposed through a stock holding and a December 2022 strike 24 call option - both profitable.

NXP Semiconductors (NXPI): US Semiconductors. Needed to raise some cash in one portfolio. Sold just below 52 week high for 33% profit since April 2019.

Intel Corporation (INTC): US Semiconductors. Assigned early on a covered call for a 12% blended profit since June 2018/April 2019. Covered call income contributed an additional 3.32%

NYSE Pickens Renewable Energy was Oil Response ETF (RENW). Energy. ETF liquidated driving 17% blended loss since June 2018. Fund manager felt that they were not able to fulfil their mandate. This ETF started life trying to combine energy suppliers and users into one ETF. They then changed it to a renewable energy fund. That did not work the way they hoped. I will switch the funds to Lithium.

Chicago Wheat Futures (WEAT): Wheat. One trade closed on stop loss for $16 per contract loss (-2.85%). This was an extra trade I put on and chose to stop loss protect it rather than wait for breakeven.

Soyabeans Futures (SOYB): Soybeans. 2 contracts closed on trailed stop losses for $0.75 per contract average profit (0.09%). One winner and one loser.

Shorts

iShares 20+ Year Treasury Bond ETF (TLT): US Interest Rates. Converted the January 2021 144/138 bear put spread into a ratio spread which makes the trade a cash neutral trade. My sense is we will see yields rise and then fall and I will be happy to be buying into bonds again 4.4% lower than current price. The sold premium of $3.50 adds another 2.5% discount.

Invesco QQQ Trust (QQQ): Nasdaq Index. With Nasdaq making new highs, I decided to buy back the strike 194 put options I sold last week for 85% profit in two portfolios. Thinking is to trade this a bit as Nasdaq fluctuates rather than just wait for expiry. In another portfolio, I set up a new hedge trade buying a March 2020 215/208 bear put spread. With net premium of $0.79 this offers maximum profit potential of 786% for a price drop of 9.4% from the $227.47 close. I will explore converting this to a ratio spread at a lower sold strike on the days the market trades lower

SPDR S&P 500 ETF Trust (SPY): US Index. With markets making new highs, I set up a new hedge trade buying a March 2020 312/300 bear put spread. With net premium of $1.16, this offers maximum profit potential of 934% for a price drop of 9.7% from the $329.06 close. I will explore converting this to a ratio spread at a lower sold strike on the days the market trades lower

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time.

What stands out

- No change at the top with Australian payments technology company, EML Payments (EML.AX) holding its place and going up 25%

- Uranium processor, Centrus (LEU) drops off the list by a few points (7 vs 8)

- European Mid Caps and Japan still feature

- Three of the stocks were bought in the last 12 months (starred).

On the options side same deal - four new entrants marked in yellow

- Quite some change here with only 2 stocks left from last list (6 vs 5)

- 2 of the 3 off the list were sold - US Bank, Bank of America (BAC) and US chip maker, NVIDIA (NVDA). Silver miner, Couer Mining (CDE) fell off the list with a strong fall as silver prices slid

- New entries for 3D printing, 3D Systems (DDD), French utility, Electricite de France (EDF.PA) and two hedge trades on S&P500 and Nasdaq (red lettering show these are puts)

- All of the contracts were bought in the last 12 months (starred)

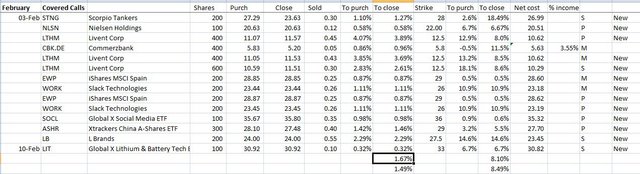

Income Trades

13 covered calls written at average premium of 1.67% and 8.10% coverage bringing the month average to 1.49% at 8.49% coverage. This does include one trade from this week on LTHM. The LIT trade shown on the table is not in the averages.

Apache Corporation (APA): US Oil Producer. Corona virus has had a big impact on oil prices. One casualty is Apache which has seen its price drop below $30 at which strike I have a naked put. I sold another naked put at strike 26 for February expiry. This will reduce my entry price by 1.2% if I am forced to buy the stock at $30. Price did move up 2.1% to close at $28.14 in Friday trade.

Deutsche Bank AG (DBK.DE): German Bank. Last week price traded to a high of €8.61 which took it over my covered call strike of 8.40. I had sold a put at strike 8.40 only to see price drop below €8.40. I added another short put at a strike of 8. I am comfortable buying more stock but keen to get it a little discounted (1.9% additional discount to the 8.4 strike). Of course there is a risk price drops below 8 too - Tuesday close was €8.16

Uber Technologies, Inc. (UBER): Ride Sharing. Strike 30.5 naked put expired in my favour (Jan 31). Replaced it with a short February 28, 2020 32.5 strike put against a $38.53 closing price (1% premium).

Unum Group (UNM): US Healthcare. With price closing at $30.21 strike 30 covered call look likely to be assigned. Sold a March strike 25 put option to grab back some income to cover loss on buying back (if I have to)

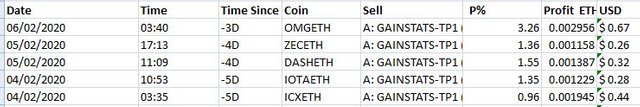

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $1103 (11.8% of the open). Price pushed higher at the start of the week and then confirmed a higher low before racing through resistance at $9954. On Wednesday I noted the rapid move up from XRP - and said to my Facebook group followers that Bitcoin and Ether would follow. They did.

6 trades closed on trailed stop losses at average profit of $194.62 (2.09%)

Ethereum (ETHUSD): Price range for the week was $46 (24% of the open). Like Bitcoin, price dropped at the start of the week, confirmed a higher low and raced through resistance at $201 and tested September 2019 highs at $225.

5 trades closed on a mix of profit targets and trailed stop losses at average profit of $16.29 (8.62%)

Ripple (XRPUSD): Price range for the week was $0.04161 (16.8% of the low). Price made an inside bar off support at $0.24754 on first day of the week and raced ahead over the next two days through $0.26 and $0.27. Momentum slowed around the $0.28 level with a higher low confirmed

2 trades closed on profit targets ($0.25) at average profit of $0.0084 (3.24%)

CryptoBots

Profit Trailer Bot Five closed trades (1.70% profit) bringing the position on the account to 10.82% profit (was 10.67%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 6 coins. Pending list drops to 8 coins

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 5 trades on AUDNZD, GBPUSD for 0.12% losses for the week. No trades open. It looks like the discretionary trader has been taken off the account. Axitrader, who operate the account, have had their Australian licence revoked. They are appealing. I have to migrate the portfolio to a fund based in Singapore to continue the service.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CNBC. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

February 3-10, 2020

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, @carrinm!

You just got a 0.36% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit