In this post I want to talk about which coins you should buy.

Now – again, this is not investment advice nor should you make your decisions exclusively from one source. I’m just offering my experience as an investor and financial markets nerd.

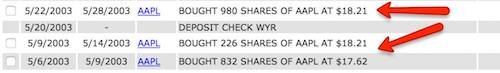

My name is Carter and I’ve been investing since 2003 (stocks/securities for a while, crypto starting in 2013). Check out my first big investment in Apple (this is from Scottrade):

BOO YA! If you do the math, that translates into a cool $6M+ after stock splits.

So why am I not on a yacht pouring champagne on my lambos?

Because I sold those stocks about 2 months later, right before they released the iPod. I needed beer money. FML.

Over the years, however, I realized that everyone has a story like this. Maybe not with Apple stock but there’s always some “I almost bought this” or “I sold this too early.”

The good news is I learned my lesson during the 2009 crash and starting researching all the top investors for the best possible strategies.

This translates perfectly to the current cryptocurrency market and I want to share my findings with you. This has worked very well and consistently out performs all other models when I back test it with software.

Here’s what I learned and what you can do about it (3 parts):

1. The people who tend to win big in emerging markets tend to buy and hold the largest market cap assets with 90% of their money.

On average, you will make more money over the next 12-36 months if you buy the top coins (Bitcoin, Ether, Ripple, etc) than if you try to place bets on small coins.

The best example of this is penny stocks. How many people do you know that had great returns with penny stocks (legally) over the long run? Versus how many people do you know that made great returns with top performing stocks?

Penny stock people will flash big numbers at you the same way someone who won their first hand of BlackJack will tell you they’re an expert. In high risk environments, the house always wins.

The key is to dollar cost average buy the top coins in the market (like the PDF from email 1 lays out) and focus on how you can BUY MORE. The death wish is when you decide the budget you have can’t increase so you need to get the best return possible with it. That’s a fear mentality and it leads to poor decisions.

In other words, buy the big coins. If you want to make more money, don’t go for higher risk coins, get a side hustle that makes you an extra $1,000 that you can use to buy more big coins.

I know it’s tempting to buy into these high risk coins. I get it, especially when you see some of them going up 50% or even 500% in a day.

Just realize that none of the guys who are rich will ever do that. They’ll be up huge one day and down the next. If one coin goes big, the other 10 they bought will tank.

Follow the system. Boring always wins in investing (and in emerging markets, will still make you huge returns). You’ve been warned.

2. If you still want to buy smaller market cap coins, only invest in companies that have a killer team and track record.

I’ve done a bit of angel investing in Silicon Valley and this is the #1 indicator of success.

The latest coins will promise you that they are going to solve the world’s problems with their token. Their website is going to be really flashy. They will tell you how much money they’ve already raised and you are going to miss out if you don’t buy some of these coins.

But all you should care about is how long has the company been around (should be more than 1 year) and what other successful projects have the team members been a part of.

This is REALLY important right now because most of these coins, whether you realize it or not, are hungrier than you are to make big money. They are selling you on investing in their platform. They are not friendly, kum-bay-ya, save the world types – they want to make millions and millions of dollars.

There’s nothing wrong with that, but you need to be sure that they’re going to make the money from their token and not from your investment.

Whatever you do, don’t buy a coin just because you see it going up or down on the price tickers. There is nothing closer to gambling than that. Do your research, buy into a team you believe in.

Side note: I bought into Steem for this reason. Yes I believe in the platform and the thesis but the bigger component is how killer the team has been. Very impressive!

3. Follow the news. As the market heats up, pay attention to what exchanges start listing new coins.

A good example is when Coinbase listed Litecoin on it’s exchange – the price went through the roof.

Same in China – when OkCoin allows ETH to be sold, volume increased significantly.

Realize that most people in this market do NOT want to get into the deep technical exchanges to convert one coin to another. They want to log in, press Buy and make money.

As the market grows, you’ll see exchanges start to offer services that allow for a better buying experience with new coins. When you see this happen, you’ll see a large spike in price of that coin.

If you’re paying attention, you can make big money with low risk.

I hope this helps you in your cryptocurrency journey and helps you make a more informed decision about what coins to buy. Here’s a quick summary:

1. Buy the big market cap coins. If you want to get bigger returns, focus on generating more cash to buy more of those big coins…NOT buying higher risk small cap coins.

2. If you want to buy small cap coins, do your research on the team.

3. Pay attention to what coins are listed on the exchanges in the coming months.

Do you agree? Disagree? Comment below and let me know.

Thank you for your time and I hope to see you all on the moon!

Carter

Welcome to STEEM!! Yes it is an awsum platform indeed. So far I did not regret my decission to join just 2 weeks ago. Way to go! :D

About the investments... welllllll don't we all love to find this little undervalued gem, that might explode in value? It's SO tempting. And yet, you're right. One thing though I have to ask you. I just learned that DGB is into gaming. A huge market, hence the price REALLY went up. Maybe too much too fast. Or maybe not? Well, that is the challenge with the huge market cap coins now. The risk of losing 50% is, well, what would you suggest here? Coins are not a company like Apple, where you can be confident that it will rise again after a crash, because there is a lot of concrete behind it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good plan. Bitcoin / Ether / Litecoin / Monero / Dash will likely form your base, and small play money to moonshot coins.

I recommend :

Viritas Vertasium - future of the stock market and hedge funds

Chronobank Time - future of decentralized hiring (IMO)

There's many many more winners, but focus on coins with a purpose, not general purpose, and hopefully pay dividends.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. I think I also spend a lot of time with finance guys who look at the small coins through the lens of spending $100,000 - $1,000,000 at a time which can swing the prices considerably. So important to believe in the tech and the team so you hodllll

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins with dividend, and purpose are best. Purpose first :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dividends are always tough in startups because there isnt a lot of transparency. "Leftover" cash or tokens can be translated a lot of ways. I suppose a blockchain could solve that though :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Carter, I listen nearly all your stuff. Big fan.

Idk if you address this in another post, however what would you consider the "large" and "small" mcap? Aside from the obvious, I'm more interested in where you cut it off.

Also, I'm not asking for some arbitrary value or number instead what is your thought process in making the cut off?

Also, where did you /where can I learn tech analysis? I'm looking to be a bit more involved, but want to learn the basics before I get further into crypto.

Thank you for your hard work!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article. I fully understand what you're talking about. Sell the coins that you know nothing about. Do proper research on any coin you buy. If the market falls at least you can hold your coins knowing they have a long term future. I really advice people to take a look at: https://www.coincheckup.com This site is really helpful in my coin research. I don't know any other sites with so much indepth analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit