I have been doing a fair amount of reviews on cryptocurrencies but today I want to change it up and remind young investors (millenials) to not forget about equities, index funds, actively managed funds & emerging market funds! They are very important and add to your overall portfolio's diversification. Yes, ETFs have much lower risk (Beta) and lower return (Alpha) in comparison to cryptocurrencies. However, fret not, for I will discuss exciting ETFs which I believe will be highly profitable in the coming decade in traditional finance!

I recommend using Robinhood (free brokerage platform - 0 fees :) for investors (especially millenials) who love a simple and easy User Interfaces (UI) and a friendly User Experience (UX) (kind of like Coinbase's nice and easy interface).

Before I go on to talk about my Top 4 Thematic ETFs, I want to define what Thematic ETFs are. Based on Investopedia's definition, "Thematic exchange-traded funds (ETFs) are funds that prioritize the selection of investments and their inclusion in the portfolio based on a predetermined theme or specific issue". Essentially, I will be discussing different themes or trends that I foresee will bring alot of value in the coming decade and century even and the ETFs which I believe are best suited towards capturing the upside of these trends. There are not too many ETFs focused on the disruptive themes that I will be discussing & that is why I am so excited to present these to you! Please watch the videos and read the Fact Sheets for the ETFs that I link for a more in-depth synopsis on the ETFs (These include the Performance, Holdings & Details of the Index Funds)

1. ARKK - ARK Invest Disruptive Innovation ETF - Fact Sheet

Sector Exposure in: Biotech, Machine Learning & AI, Robotics, Autonomous and/or Electric Vehicles, Clean Energy Production & Storage, E-Commerce, Internet of Things, 3D Printing, Blockchain, Bitcoin & P2P

Top Holdings: Bitcoin Investment Trust, Tesla, Twitter, Stratasys, Athena Health, Illumina, Intellia Therapeutics, Amazon

Performance: NAV YTD - 87.41% vs MSCI World Index YTD - 22.40% (As end of Q4 2017)

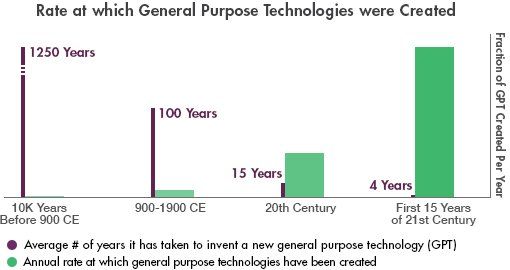

Note: On the Landing Page of Ark, they have an interesting chart which shows the rapid pace of innovation we are going through today vs. time, shown below:

“Disruptive innovation is not priced correctly by traditional investment strategies because people don’t understand how big the ultimate opportunities are going to be. They aren’t sizing the opportunity and they aren’t analyzing the disruption.” - Catherine D. Wood, CIO of ARK Investment Management LLC

Statistics According to ARK Invest's Research:

- Genomic sequencing of human DNA is projected to grow at a 200% annual growth rate.

- By 2020, computers will only represent 9% of all connected devices, down from 98% in 2000.

- By 2035, investments in automation and robotics will generate over $12 Trillion in additional GDP.

- It took the 3D Printing sector twenty years to reach a market value of $1 billion. It took only five years for it to reach $2 billion, and analysts believe it will grow 400% in the next ten years.

*ARKK is a condensed version containing a combination of the cornerstone themes and holdings of other great ARK ETFs & Index Funds including ARKG (Genomic Revolution), ARKW (Webx.0), ARKQ (Industrial Innovation) & PRNT (3D Printing) and gives you the best of everything (ARKK actually has had better performance than the others focused on a subset theme)

2. BOTZ - Global X Funds Robotics & Artificial Intelligence ETF Fact Sheet

Industry Exposure in: Industrial Machinery, Electronic Components, Instruments & Manufacturing Services, Heavy Electrical Equipment & Components, Health Care, Semiconductors, Aerospace & Defense

Top Holdings: Yaskawa Electric, Keyence, Fanuc, NVIDIA, Mitsubishi Electric, Intuitive Surgical, Omron, Daifuku

Performance: NAV YTD - 58.54% vs Indxx Global Robotics & Artificial Intelligence YTD - 57.62% (As end of Q4 2017)

Note: Advancements in robotics & AI are making machines smarter and more capable than ever before, allowing robots to take on increasingly sophisticated tasks for faster and more accurate production.

Statistics According to Global X Funds Research:

- The global robotics market is expected to expand over 10% per year from 2014 to 2020, reaching $83 billion in total by 2020

- In China, Germany, Japan, South Korea and the US, robotics adoption is estimated to enhance productivity in many industries by up to 30% by 2025.

- The AI analytics market is estimated to grow from $8.2B in 2013 to $70B by 2020.

3. LIT - Global X Funds Lithium & Battery Tech ETF Fact Sheet

Access to Companies in: Lithium mining, refining & battery production

Top Holdings: Albemarle, EnerSys, Panasonic, Tesla, Samsung SDI, LG Chem, FMC Corp, Sociedad Quimica y Minera

Performance: NAV YTD - 63.36% vs Solactive Global Lithium Index YTD - 62.78% (As end of Q4 2017)

Note: Falling costs and rising production of Lithium-ion batteries is leading the shift from fossil fuels to renewable energy and electric vehicles (EVs).

Statistics According to Global X Funds Research:

- Sales for light-duty Electric Vehicles is expected to grow from 2.7 million units in 2014 to 6.4 million by 2023

- Global revenues from lithium-ion battery sales is anticipated to post a Compound Annual Growth Rate of 43.1% in reaching a projected US$36.5 billion by 2020.

- With a worldwide consumption of 182,903 metric tons of lithium carbonate equivalent in 2014, the lithium demand is expected to double, reaching 410,055 metric tons by 2025

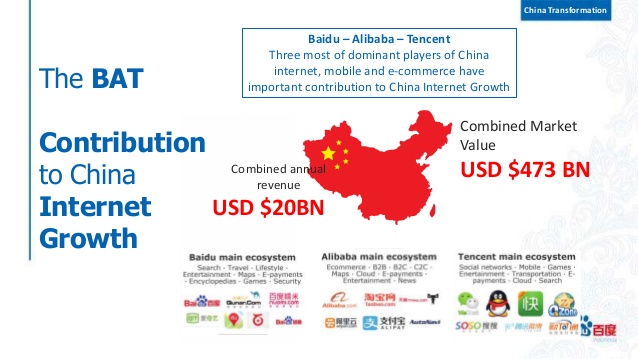

4. MCHI - BlackRock iShares MSCI China ETF Fact Sheet

Top Sector Exposure: Information Technology, Financials, Consumer Discretionary, Real Estate, Energy, Telecom

Top Holdings: Alibaba Group Holding, Tencent Holdings, China Construction Bank, Baidu, China Mobile LTD, CNOOC LTD, Ping An Insurance

Performance: NAV 1 Year - 53.03% vs Benchmark - 54.07% (As end of Q4 2017)

Note: With a population of 1.3 billion, China is the second largest economy and is increasingly playing an important and influential role in development and in the global economy. China has been the largest contributor to world growth since the global financial crisis of 2008.

Statistics According to BlackRock iShares Research:

- China has contributed nearly half of the MSCI Emerging Markets Index’s 31% year-to-date total return and now accounts for 30% of the index’s forward earnings expectations

- Currently, China is 28% of the MSCI Emerging Markets Index, a figure which will rise to nearly 50% after the full inclusion of mainland Chinese equities into the index in a process that begins next year.

I use Robinhood for stock trading too! Great app! I like how it says in the photo above "Krusty Crab Stocks, great time to buy" Haha!! I love fine details of humor!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@jacuzzisurfer It really is, I hope you liked some of my ETF picks?

HAH, yeah lolol 🤣

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Daddyku from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly & Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit