Short narrative of the life of a crowd-investor

Equity crowdfunding is a rapidly growing sector across the globe with the lion’s share of activity in the EU taking place in the United Kingdom, France, Germany, Italy, Spain and the Netherlands. The early origins of this form of Fintech can be traced back to a platform launched in Canada at the end of 2009. While other forms of crowdfunding also arose between 2006–2009, perhaps as a direct result of the hardship encountered accessing ‘institutional’ financial resources during and after the Great Recession.

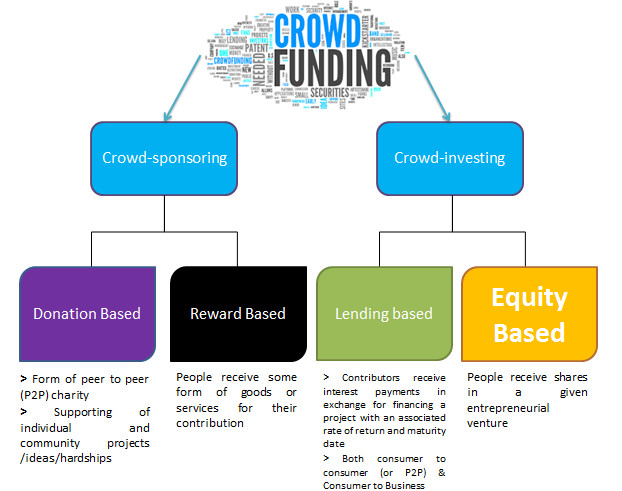

Before I tell you my story, here is a quick top-line view of the market; Crowdfunding as a whole comprises of four market segments which fall into two categories, as depicted below:

Equity crowdfunding, the focus of this post, means everyone can own a piece of the ‘next big thing’. It allows the many to be part of the innovation that changes our societies (for better or worse, that’s now up to you). Imagine having been an early investor in Facebook or in Apple/Microsoft before TAT-8 replaced TAT 7 (from galvanic to fibre optic cables). Besides, having quite a bit of spare cash now it would have meant being involved in the digital revolution that changed the world.

In this digital world of ours that was formed during this revolution, being part of the ‘next big thing’ is both a lot easier in terms of accessibility and a lot harder. Confused? Let me explain. To become part of future in the making, as a crowd-investor, the first hurdle is choosing a platform, there are 510 active platforms in the EU (Jan 2017) of which 143 alone are based in the UK, and it is not always clear what form of crowdfunding these are offering. Secondly, once you’ve identified one you like, platforms usually have a multitude of investment opportunities available, from seed stage ventures to startups which are raising for the second or third time. In other words there is a lot to sift through in terms of opportunities and information.

Perhaps the biggest hurdle to become an equity based crowd-investor is consciously giving up your money and accepting that you might never see it again. Many will think twice when faced with this risk warning. However, to be part of ‘the next big thing’ you have to allow yourself to let go of any such inhibitions towards financial risk taking. Intrinsically motivating yourself to pour your spare cash into someone else’s venture while accepting that being part of something, no matter how small, is a lot more important than the potential extrinsic reward that might or might not be waiting for you at the end of that ‘journey’.

‘What’s next’ is a question that keeps most of us occupied and you can become part of that what is next by being a crowd-investor. Firstly, I always remind myself that enjoying the journey to that what is next is (more than) half the fun. So a first step is letting go and being mindful of your actions pertaining these investments. I invest small to medium sized amounts in next-gen startups which I know might fail, so part of of letting go is also not focusing on short-termism. These investments usually take time to materialise into returns, if providing any ROI at all.

While typing in ‘equity crowdfunding’ into Google will render useful results to get started. I would recommend Crowdcube (UK) as it is a great platform to invest with, being the platform of my personal preference it has great costumer service, platform features and UX. It has recently become the market leader after a great first quarter in 2017 (it also operates under partnership form in Spain).

Yet crowd-investors might also prefer Seedrs. In Germany I am using Companisto, the market leader there, while in Netherlands I would probably recommend Symbid. There are a few others which I haven’t used yet such as Invesdor (Finland), FundedByMe (Sweden) and SeedMatch (Germany).

The reason for excluding some other platforms is quite simple, I micro-invest and not the type that people might associate with MoneyBox. For example SyndicateRoom would require a minimum investment of £1,000 and that’s a bit to steep for my budget, being a (spare) cash-strapped millennial. Besides, I enjoy being a brand ambassador and am usually an end user of the goods or services that are provided by the startups I invest in (e.g. Monzo, a next-gen bank). In whatever way you look at it, spending some of my spare cash (most platforms allow investments from as little as £/€10) and time means I potentially am part of that what will revolutionise our societies and you could be too!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.linkedin.com/pulse/become-part-future-making-leonard-burger

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @danchima! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit