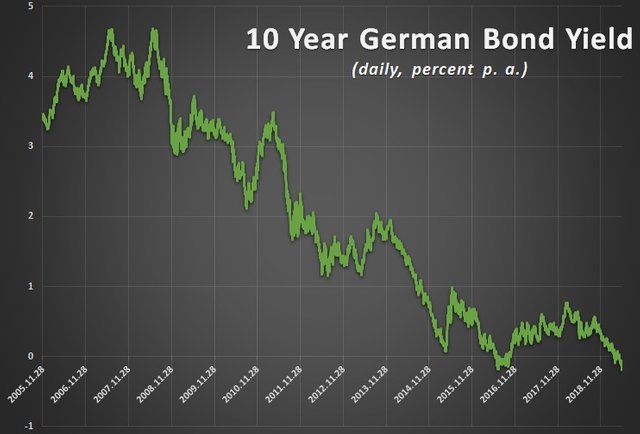

Famous bond investor Bill Gross said, German bonds are “the short of a lifetime” – but too early, in April 2015. The 10-year German bonds were yielding 0.94 percent that day, but later the yield continued sinking, fell below zero. Later, allegedly, the manager was crying silently over his beer – and also changed his job. (Source)

Avoid the vicious trap

The strange, never-before-seen low negative yields were on the new historical low, in summer 2016 at 0.204 percent p. a. – in the negative, below zero. Later they rose again to about 0.7 percent (in positive territory), and today, reached a new historical low by –0,213.

Who cares? – can you ask. Me. Because it can be a good investment opportunity. Maybe the moment of “the short of a lifetime” is now. Why? How can we avoid the same trap in which fell Bill Gross? The reasons why the German bond yields are very low are basically the same, for many years.

Now, has changed anything?

There are a bunch of arguments for decreasing yields today. Or, for staying on these super-low levels for a long time, even for years. Like before: post-crisis vibrations, another beginning economic slowdown. Germany only issues very few bonds, because its budget is balanced. The ECB (European Central Bank) bought and buys a lot of bonds. Interest rates are minimal or negative. Many institutions – banks and insurers, for example – are forced to buy bonds, even with negative returns.

Simple homework math

Nonetheless, I think the yields can find a bottom near these levels. Because I made a simple calculation. Journalists sometimes write in the press that, in the case of negative returns, “bondholders pay for the state (the issuer) to take care of their money”. Investors buy the bond at a 101 percent price, for example. Later, the bond expires and repays only one hundred percent.

However, if someone shorts the bond, then this person, the short seller will gain this one percent. Today he sells at 101 percent, later buys it back to 100, right before maturity. Only the stupid don’t do it, right?

There is the bottom

In reality, the question is, how much does it cost. For short selling, you need to borrow the bond. Nobody will borrow you for free, you have to pay for it. How much that is, I don’t know, but by negative yields, I suppose, it can’t be more than 0.2-0.5 percent per annum or so.

I think this shorting costs can build a price limit for the negative yields. Because if yields fall, even more, many short sellers will appear doing the same business I described.

Some more room to decline

The record low of 10-year Swiss bond yields was by –0.652 percent in 2016, and it is by –0.468 p. a. today. So, I suppose, the German yields also have room to fall further. That’s because I’m not running to short bonds today. And this is the playfield of big investors, who can reach much better costs, conditions by shorting, borrowing or transacting.

But I suppose, if the yield falls to 0.4-0.5 percent, I will search for a cheap bond shorting (reverse) ETF or certificate.

Other techniques

If you think I’m the only fool thinking bond shorting or similar arbitrage can be a lucrative business, read the article of Bloomberg.com. They wrote about similar techniques, how traders are gaining money rolling over bonds with different maturities. Or borrowing money at a negative credit interest rate and investing it in the few remaining, positive yielding bonds.

But someday this has to be over. At the latest when all the bonds with positive returns are exhausted. Then, an avalanche can start rolling in the opposite direction. Short sellers will gain some day.

(Photo: Bond of the City Munich, 1923. Wikimedia Commons)