It’s all about the fees.

Management fees, performance fees, entry/exit fees, advisor fees, benchmark fees, trading fees, operating fees, total expense ratios, fund-of-funds fees, fees, fees, fees.

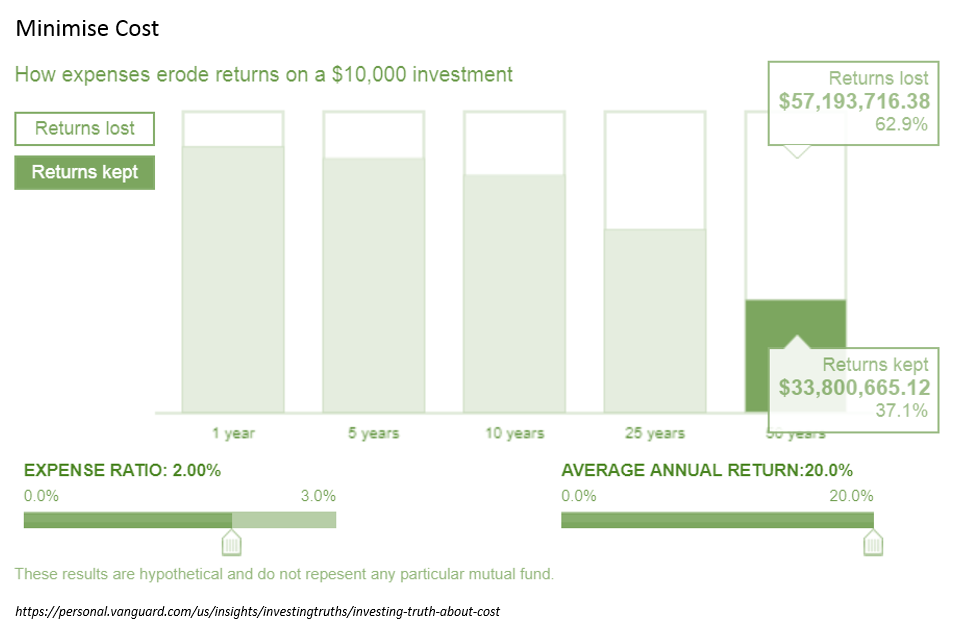

The traditional mutual fund industry has a myriad web of opaque and confusing charges that are levied on your investment return. The Tyranny of fees outline by Heinzl (2013), explains how 2% in fees can destroy nearly two-thirds of your returns, see graph adapted by Vanguard. This can cut you short of thousands of dollars’ worth of growth.

Indices and Exchange Traded Funds(ETFs) have lower fees than actively managed portfolios in the traditional finance space, however, Indices and ETFs do not offer the convenience of investing in Crypto currencies on a secure, one stop, easy solution where one can hold Crypto Indices and ETFs cost effectively.

Looking at Crypto markets, the abundance of fees is drastically reduced, however, there are still costs and other fees which remain high and erode the compounding power of interest and your beta return. If you invest in Crypto you will most likely have two to ten Cryptocurrencies at most. This is due to a ‘homemade’ diversification strategy, the crypto price and due to trading costs.

Holding these Cryptos involves firstly, having to convert fiat currency into Crypto. This involves a fee. Secondly, transferring your Crypto into a wallet for storage or into a Crypto exchange, which, involves a fee. A Crypto exchange will act as a wallet and as a trading platform where buyers and sellers interact. Thirdly, this market place provides numerous Crypto currency conversion rates and pairs, from one Crypto into another, which involves trading fees, bid/sell spreads. Lastly, for some not familiar to trading, bid/ask spreads, can lead to loss of price and hence, your Crypto growth. If you want to transfer this back to an outside wallet or to fiat, withdrawal fees apply.

Looking at similarly placed Crypto providers of diverse portfolios, fees account for anything between 3% — 20% performance fee, entry/exit fees of 0.5 % and withdrawal fees, not to mention conversion fees needed initially to convert your ETH or BTC into that Token/Crypto X.

Some actively managed ‘Crypto hedge funds’ also charge hefty profit sharing fees and performance sharing rules for their Crypto or ICO ‘selections’. These all lead to lower returns for the investors without sufficient risk diversification, ease of use and cost-effectiveness. It’s all about minimising cost.

At Hedge we will price our services competitively and provide investors with instruments that diversify their portfolio in a cost-effective manner. Our fees do not involve multiple transactions, with our Index and CTI rebalancing automatically, providing you with a professionally created rulebook based and convenient way to participate in the Crypto markets without losing downside and exposure to unnecessary risk.

Our total expense ratio will be lower than the competitors, and place cost-effectiveness in the hands of the investor.

The financial instruments we are creating are Crypto-Indices, Index Instruments and a Crypto Investment Platform. See our Token details or register for community updates and our whitepaper.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@hedgetoken/why-ctis-crypto-traded-indices-are-cost-effective-2864b27a2811

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit