If you're like me, then you probably have more money than would commonly be considered sensible locked up in the crypto markets. So, naturally, what do you do? Much like anything you have a lot of time or emotional energy invested into... you pore over it's well being.

You check it's vitals daily. No, hourly. No, every 15 minutes. Wait no, every 5 minutes. Okay perhaps I'm exaggerating now but you get the idea.

Research is a very important part of market trading and it's ultimately how we determine where our opportunities and advantages and of course our disadvantages lie.

During a current discussion on a Facebook chat thread, I asserted the following:

"The (crypto) market will not recover until we see primary sources of demand return to it"

To clarify, primary sources of demand are, to me, large demographic groupings who engage in buying and selling.

Whether we like it or not, crypto investors and traders are a minority in society, and we can't run a market based around a few geeks on facebook and a couple of annoying whales who find it amusing to crash the markets once in a while.

This is simple supply and demand 101. We need to have large scale engagement and money moving into the market from a broader demographic of people interested in trading and investing in cryptocurrencies for the markets to recover and function normally.

Now, to move forward onto my main point then if any of you remember the most recent crypto bull market from 2017 then this rally is essentially the event which led us to where we are today in market terms.

From 1st January 2017 the bitcoin markets rallied by over 2000% led by an influx of Chinese money helping fuel a stratospheric bull run in other cryptocurrencies and this is ultimately the event which led us to the current bear market of today.

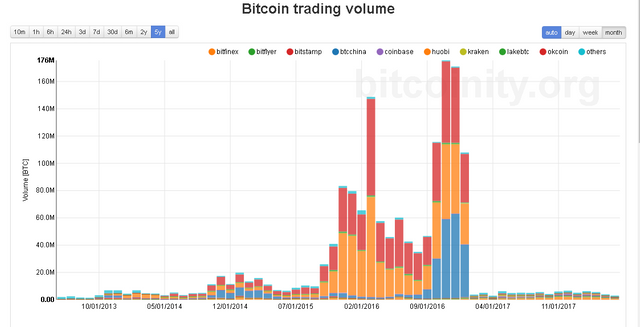

Of course, it spectacularly burst when the Chinese government stepped in to ban cryptocurrency exchanges (though this "ban" was not all that it seemed - we'll get to that later) and the signature of Chinese traders being shut out of the market can be seen in various Bitcoin volume charts such as the one pictured here (which shows the dramatic exit of Chinese exchanges as dominant market actors).

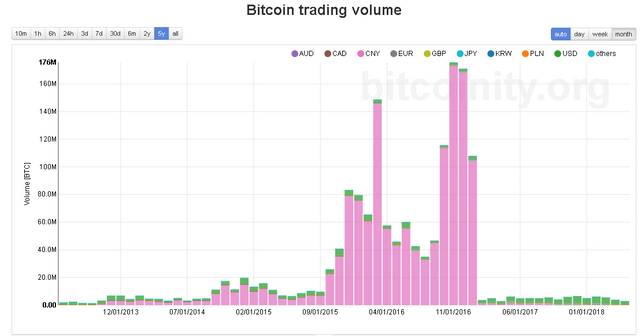

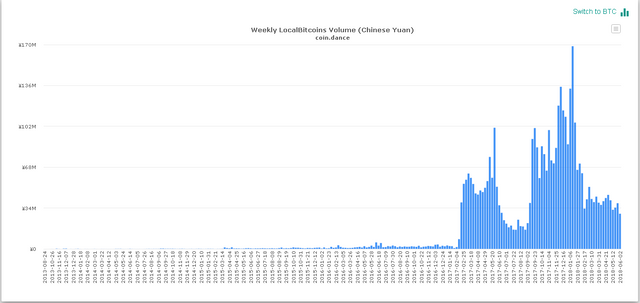

The sudden apparent exit of the Chinese Yen (CNY) from exchange trade volumes can also be observed in the chart pictured below.

So of course, this brings us to present day and the current bear market, and my observation of this led me to conclude that we need some sort of large-scale influx of money from a powerful demographic to return the markets to health and to bring about a new bull market.

I'm of the opinion that for another bull run like this to take place, we're going to require volumes across the board to improve. Not just on Bitcoin (though the performance of the entire crypto market is tied to bitcoin for now) but market wide. So, of course, I've been spending a lot of my time checking out what could possibly replace the Chinese exchange volume.

There are many possible candidates here including:

- Institutional money.

- The Singaporeon cryptocurrency boom.

- The return of westerners to the markets.

- Others besides.

So of course, my research has been looking for signs of a fresh influx of money from somewhere and thus I started to look over volume charts.

What I found unsettled me.

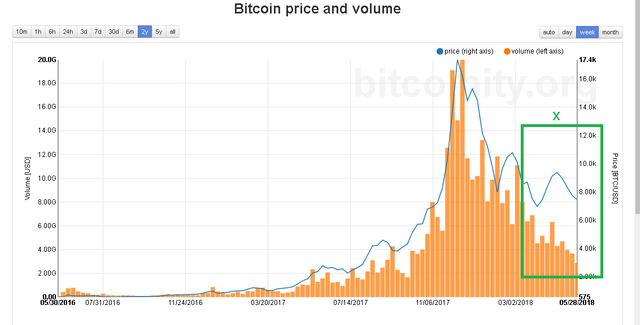

The chart pictured above shows that bitcoin trade volume seemed in fact to be dying off further with a significant and continuing decline in USD denominated trades since 2017 (with a similar decline in JPY and EUR as trading currencies).

Now this seemed strange to me, because I had also sketched out a chart which showed a potential increase in market price performance across the board and which seemed to show that a strong moving band of support had put an end to the bear market (pictured below).

Of course I considered this a bullish signal when I saw it. However, in the grand scheme of things, this perplexed me further. How could this be the case? Declining volumes seemed to be coinciding with improving price performances.

Afterwards, when I ran a comparison on BTC price versus USD volume, I noticed the a huge divergence had opened up between the two statistics which, up to now, had effectively run in sync with each other (I mark the divergence point by outlining it at X).

Price had almost totally diverged from trade volume.

My first thought with this was that there must be market rigging taking place somewhere for this to be possible. Perhaps people deliberately buying above what the volume justifies to pump up the price for instance. So I went on a further search for evidence and came up pretty dry overall. However, it seemed logical that somewhere, price was outperforming reported volume.

This of course implied that there was a source of price signalling which was somehow, not being recorded in mainstream price sources OR that exchange volumes are being radically understated by the exchanges somehow.

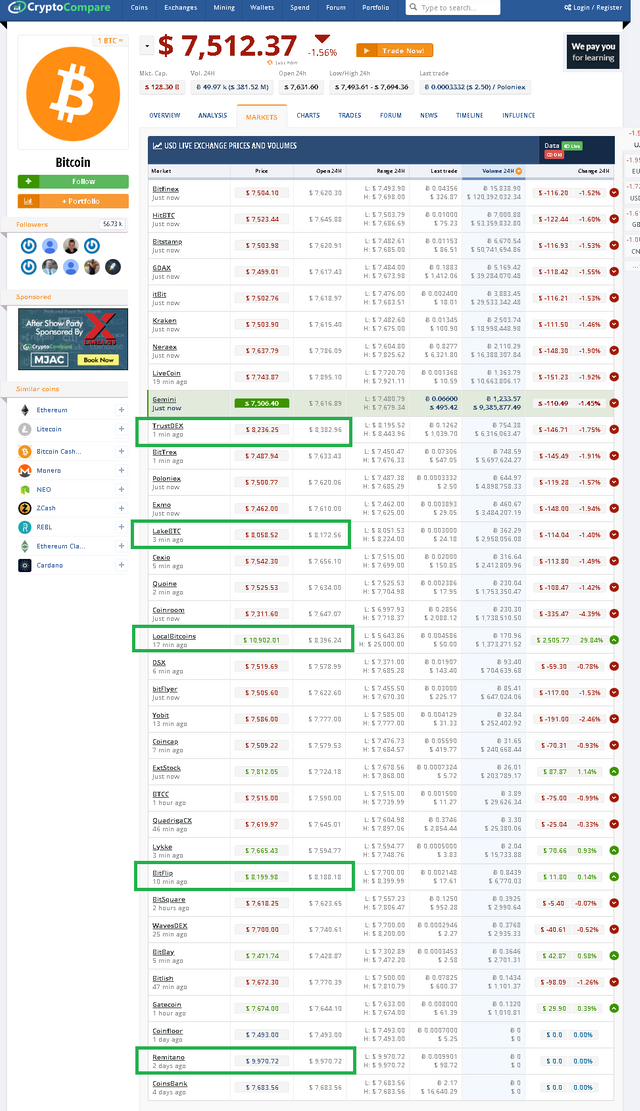

And so, I went hunting for this price source. Eventually, while looking on the cryptocompare website, I discovered something very interesting (I enclose a screenshot below).

It shows that prices on websites such as LocalBitcoins and Remitano and Trustdex have already exceeded the 8k mark, and are already in fact well on their way towards 10k again.

Now I had never heard of Trustdex or Remitano at this point, so of course after a little research I discovered that they were P2P exchanges and differed from traditional web-based exchanges such as Bitfinex and Binance which I was more familiar with.

One of the other sources which was also outperforming the rest of the market (by a margin of almost 50% I might add) was the well known Localbitcoins site which I was more familiar with.

Now I had to stop and think about what this meant. The conclusion was relatively obvious however.

It meant that prices in sources which were not actively being measured by popular price reference sites and were isolated from web exchanges were already well beyond the bottom of the bear market and are back on their way towards a new bull run.

Then, I considered a moment... if exchange volumes are not reflective of the market, what have we missed?

Firstly, one of my prime discoveries here was that Chinese volumes are actually healthy. I enclose a chart denominated in CNY from the LocalBitcoins China.

This shows that although there was a lull when traditional exchanges were banned in 2017, the chinese market still moves about $34million in trade volume every 3 weeks through P2P transfer using the LocalBitcoins site alone.

This was a genuine moment of revelation and, at that moment, I remembered an article I read a few months prior by Civic’s Vinny Lingham.

https://vinnylingham.com/the-1-dont-use-bitcoin-exchanges-ff019774d886

In short, Vinny’s point, is that less and less volume is now running through exchanges.

We don't see a good chunk of the volume which is driving the price, because whales and big-money traders don't generally use exchanges. They use OTC (Over-the-counter) brokers to buy cryptocurrencies in massive quantities without publicly reporting the price paid to avoid impacting the overall market sentiment.

The same goes for institutional investors. Big corporate money will hardly lower itself to using a cryptocurrency exchange. Instead, they will go through an OTC broker to buy and sell their cryptocurrencies without sending any sort of public price signal.

So what was volume like at OTC brokerages? This is an obvious point of research and I came upon this quote from Circle Spokeswoman Jennifer Hanley

"Boston-based Circle handled up to $4 billion in OTC trades monthly over the past year"

To put that into context, if that trade volume was put onto public orderbooks and reflected in the public data, then the equivalent throughput of trade volume would be equivalent to adding 4 exchanges the size of Binance to the market.

In fact westerners are not the only demographic using OTC brokers to avoid using exchanges.

A loophole in the chinese ban on exchanges allows the domestic cryptocurrency market to continue to function because China never banned cryptocurrencies. To clarify, the ban only affected exchanges.

The site news.bitcoin.com reports that Chinese investors are in fact flocking to OTC brokers to get around the exchange ban with Chinese OTC brokers moving "680 Million Yuan (about $100million) Traded OTC in 2 Weeks".

https://news.bitcoin.com/chinese-investors-continue-to-obtain-bitcoin-using-thriving-otc-platforms/

The inevitable conclusion to this research seems to be that sooner or later, exchange prices would catch up to OTC and P2P prices. Setting the scene for a huge upwards correction because the commonly referenced exchange prices are being suppressed by low volumes and dumping on exchanges even as market prices improve off-exchange.

The question is, when will this occur, and by how much?

Firstly, to address the "how much?" point, we can see from the picture posted earlier which shows several sites outperforming the rest of the market that prices on these sites are between 8% and 45% higher than the usual market price reporters.

This is a huge variance, but it's also a significant number at both the low end and the high end.

With this in mind, I'll be looking for something in the middle. I.e. around 25% which would put the BTC/USD price at $9.3K with the rest of the market following not too far behind.

As to the question of "when?", then the answer here is more capricious because the mechanism by which exchange prices catch up to OTC and P2P prices boils down to how quickly exchanges are depleted of transactions and coins and active users through users migrating to OTC/P2P platforms. This will induce scarcity in the web-based exchanges and this should logically influence prices upwards.

Above all, I am convinced that behind the scenes, important market demographics such as the Chinese market, the African market and Institutional Money are not "returning"... they are already here. Arguably, they never went away.

The conclusion? I consider the bear market to be officially over. So buy and hold. We're in for a wild ride.

✅ @intellivestor, I gave you an upvote on your first post! Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cool, thanks for sharing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! More to come soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting theory ! It seems really logical, let's see few weeks how the market will go...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Yari. Needless to say I'm bullish in spite of what I consider to be some very misleading indicators.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit