One of my favourite quotes (among many others) is this

"Avoiding danger is no safer in the long run than outright exposure. The fearful are caught as often as the bold. "

- Helen Keller

Because it is truth in it's most brutally simplistic form.

Now I'm generally pretty punk-rock when it comes to investing. I will laugh-off losses while I hold for recovery and go for high-risk high-return options a lot of the time. Some people will probably see me as irresponsible for this attitude, but frankly, one of the primary reasons I developed this outlook is that the market nowadays is rigged to incentivise this sort of behaviour.

When in Rome... do as Romans do.

If you look at the environment we deal with as investors and speculators, then since the banking and sovereign debt crises in the last decade, the marketplace has been steered towards incentivising higher risks through a variety of means such as record low interest rates which destroy the profitability of low-risk investments.

In making safe options unviable, governments thus hoped to push people who would usually leave their wealth in cash accounts and ISA's and the like into higher risk options such as equities as a means of stimulating investment into these markets which were routed in the last big crisis.

Thus, safe options nowadays offer returns as little as 2% and figures this small are regularly eaten up by inflation or simply underperformance (bear in mind that central bank inflation targets are usually around 2% per annum).

Therefore to beat inflation and to guarantee decent returns for our money, we need to be aiming higher and this necessitates higher risk behaviour.

To demonstrate this point a little further, I'm going to use a screenshot or two from Aviva's new Wealthify service.

This is a pretty typical ISA style investment startup. There's lots of these coming onto the market offering ultra-low barriers to entry (I.e. $1) and very little in the way of commitment.

A pretty standard feature is that they will give you a projection of your risk/reward over a certain period of time.

I decided to look through a few configurations here to see what Aviva's own statistics told me using the following input figures:

- £1 startup.

- Regular monthly inputs of £100

- !0 year plans.

- Overall amount invested of £12,000

In the "Cautious" configutation, this yields the following projections.

In the "Adventurous" configuration however, we get the following projections.

We can see some clear differences here, so lets analyse them and see if we can draw any meaningful conclusions.

Now, what I want to draw your attention to is the range of each configuration on offer from Aviva.

By "range" I mean the difference between the best case scenarios, the mean average, and the worst case scenarios.

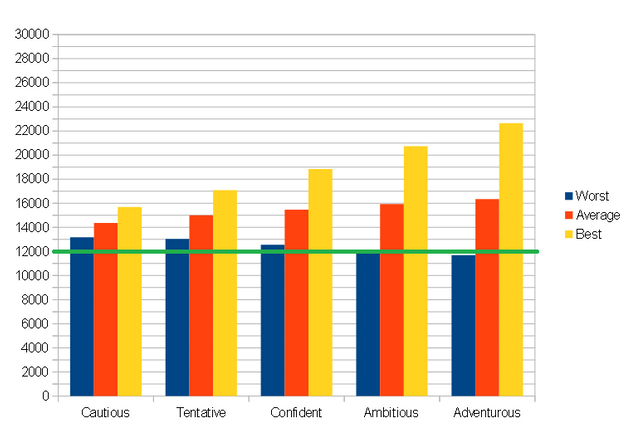

Here's a bar chart to demonstrate this a little better.

I have marked out £12,000 threshold with a green line and this can be seen to represent 0% losses and 0% gains.

Firstly, I'll point a few things out.

Even in the worst case scenarios, we are usually still looking at a net gain (except for the "Adventurous configuration - I'll get to that in a minute). The difference in the range for worst-case scenario from "Cautious" to "Adventurious" is only £1493. This amounts to about 12% of our total 10 year investment figure. Pretty small beer for a 10 year plan. It's about £140 per year or £2.70 per week.

The "Adventurous" configuration returns a worst-case figure that is below the break-even point of 0% profits/losses. HOWEVER, it should be noticed that this projected worst-case loss for this configuration is about -2.591666666666667 OR... in cash terms, about £300 over 12 years.

Now I think this is pretty yawnworthy stuff in terms of what we're actually risking. The net risk boils down to something like £30 per annum and even then only the worst possible outcome would lead to you taking this hit and even then it is a matter of pennies.

In my humble opinion, then risk assessments like this show that time and time again, taking educated risks pays off in the long run. For those of us who are ambitious in our investing outlooks and who want to make significant money over the long term rather than just take profits for pocket money now and again, then we have to start accepting that we must take more risks and not flinch at the thought of losing money. This is the cost of opportunity and we need to be braver, look it in the eye, and accept it as simply something we have to deal with.