I thought I'd share some of my investment activity in order to help myself focus on some more positive moves that we can all be doing as most of the world sinks into a dystopian hellscape.

As many of all of the world's governments slip into a financial death spiral, led by the USA, it is important that people make decisions today that will assure that they are not dependent on public services provided by their governments. Unfortunately, as this crisis grows it will hit the poorest people the hardest.

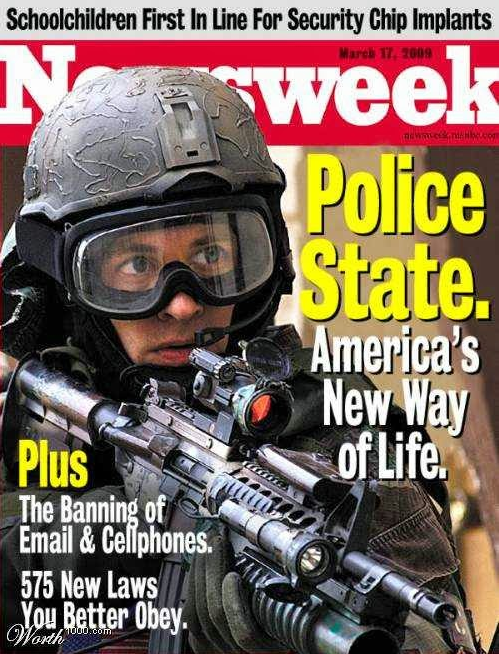

While more and more people resort to protesting because they have nothing left to lose, the governments respond in-kind with more severe and more frequent displays of force which only fuels even more protests.

Just as a dying wild animal is most dangerous when it is in its death throes, so is government. Throughout history, the collapse of empires was coupled with greater and greater tyranny and we are clearly seeing that today in the form of heavily militarized police all over the world initiating violence against peaceful protesters.

So with that out of the way. what things am I investing in and why?

Disruptive technologies. These are businesses and assets that break up entrenched monopolies and industry leaders.

Cryptocurrencies are at the top of this list as they have created an entire global monetary system that does not use banks and does not recognize political borders and boundaries. Among them, Bitcoin and Ethereum are at the top of my list, but I also have interests in ERC20 tokens and continue to educate myself more and more about them every day.

Stocks (Disruptive Companies) There are a few (very few) companies that are also working to disrupt their industries. I invest in those as much as I can. I will also invest in some companies that I think will benefit by being connected with a disruptive company:

- Tesla (TSLA): Tesla has a 5-10 year technology lead over every other automaker in regards to Battery Electric Vehicles, Autonomous Driving, and Safety. They manufacture the three safest vehicles ever tested by NHTSA. Legacy automakers are required by some governments to either sell a certain number of electric vehicles for every gas car they sell or they must buy Zero-Emission-Vehicle (ZEV) credits from another company. Tesla earns ZEV credits for every vehicle they sell and has no need to buy ZEV credits. ZEVs are useless to Tesla but are highly sought after buy Tesla competitors because of their failure to sell any significant number of Zero-Emission cars. Tesla is collecting billions each year from its competitors and Tesla has earmarked those funds to build additional factories to meet the demand for their cars. In other words, all other automakers are funding their own demise.

Tesla's business plan is geared for 50% COMPOUNDED GROWTH Annually.

- Square (SQ): Having been a business owner my whole life, one thing I always hated was getting a merchant account so that I could accept credit cards. The application was lengthy and you had to pay an application fee. You then underwent a criminal background check and a deep-diving credit check. The process left you feeling personally violated. After all that, (if approved) you got the privilege of signing up for a costly equipment lease and monthly service fees on top of the per-transaction fees that you paid just to be able to accept a few different credit cards. Often times, you had to do a SEPARATE application in order to accept American Express.

When I started my laser repair business in 2009, I chose not to accept credit cards because of the incredible hassle, but that year I learned about a small start-up called Square, started by Jack Dorsey (the creator of Twitter. Square promised no monthly fees, no equipment lease, a free credit card reader, guaranteed approval, ability to accept all major credit cards, and a five-minute online signup process. I was skeptical but gave it a try. Holy shit! I couldn't believe it! They did everything and only charged a small per-transaction fee that was lower than a standard merchant account. My customers also loved it, as they had never seen it before and couldn't believe that I was taking payment from them using my phone. Eleven years later, all my businesses use Square and so does my sister's. I bought her a full Point of Sale system for her dog grooming shop and it was inexpensive, full-featured, seamlessly integrated with her accounting system, and more. Now they have premium features that enable small businesses to do all this PLUS marketing, gift cards, payroll, timekeeping, e-commerce, loyalty programs, and more. You can also do nearly all this WITHOUT a conventional bank account!

After a few years of using Square, I logged in one day and there was a loan offer. It had a very low-interest rate and there was no application process for it. Since Square already had all my daily credit card transaction data, they knew the volume I was doing and offered me money. All I had to was click the button, saying that I agreed that the payments would come from 13% of each transaction made and it would be automatically paid off in one year. The money was in my account in 2 business days. This puts them at an advantage in capital lending that no bank will ever have. Because Square also has customers paying with their Cash App on their phones, they have a ton of consumer data as well as merchant data. They stand to make a ton of money leveraging this data advantage to pair customers with merchants like no one else in the world can.

That is about the limit for me as far as stocks go at this time. I keep a close eye on both of these and spend many hours each day learning more about each of these companies and watching their every move. It does not make sense for me to add more to this list as that would take away from my expertise in these few companies, but I am currently researching Lemonade and considering adding it but am not convinced at this time.

For the remainder of my investment portfolio, I invest in ETFs.

.png)

My preferred funds are high growth funds and all of them in technology sectors. My favorites among these are the ARK Invest funds. ARK Invest has an excellent track record and generates high yields by investing in DISRUPTIVE companies and technologies. ARKK (Innovation ETF) and ARKW (NextGen Internet ETF) are the two main funds that I invest in. Both of these funds hold TSLA and SQ. The next ARK fund that I will be investing in is their Robotics and Innovation ETF (ARKQ).

Aside from that, I am investing in my family and my self. I work on continuing to educate myself so that I can advance in my career, invest wisely, and expand our family businesses.

Easiest way to get started buying Bitcoin:

Buy fractional shares of stocks and/or Bitcoin instantly with Square Cash App

Sign up with this link and get $15 free.

Learn More

ARK Invest home page

Tesla

Square

Free Learning Resources

Brilliant.org

Khan Academy

Learn to code on your phone with Grasshopper

.jfif)

.jfif)

.jfif)

.jfif)

.jfif)

“For it will be like a man going on a journey, who called his servants[a] and entrusted to them his property. To one he gave five talents,[b] to another two, to another one, to each according to his ability. Then he went away. He who had received the five talents went at once and traded with them, and he made five talents more. So also he who had the two talents made two talents more. But he who had received the one talent went and dug in the ground and hid his master's money. Now after a long time the master of those servants came and settled accounts with them. And he who had received the five talents came forward, bringing five talents more, saying, ‘Master, you delivered to me five talents; here, I have made five talents more.’ His master said to him, ‘Well done, good and faithful servant.[c] You have been faithful over a little; I will set you over much. Enter into the joy of your master.’ And he also who had the two talents came forward, saying, ‘Master, you delivered to me two talents; here, I have made two talents more.’ His master said to him, ‘Well done, good and faithful servant. You have been faithful over a little; I will set you over much. Enter into the joy of your master.’ He also who had received the one talent came forward, saying, ‘Master, I knew you to be a hard man, reaping where you did not sow, and gathering where you scattered no seed, so I was afraid, and I went and hid your talent in the ground. Here, you have what is yours.’ 26 But his master answered him, ‘You wicked and slothful servant! You knew that I reap where I have not sown and gather where I scattered no seed? Then you ought to have invested my money with the bankers, and at my coming I should have received what was my own with interest. So take the talent from him and give it to him who has the ten talents. For to everyone who has will more be given, and he will have an abundance. But from the one who has not, even what he has will be taken away. And cast the worthless servant into the outer darkness. In that place there will be weeping and gnashing of teeth.’

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit