Again, this post was originally written on the blog over at; www.themoneylifejuggle.com/blog

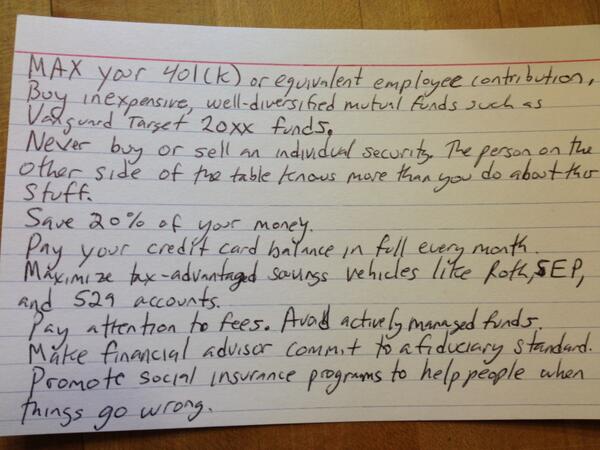

Some of you out there who are interested in finance, saving and investing may be aware of the 'index card' that Harold Pollack created when conducting an interview. Basically this small index card held all the basic financial rules you will ever need to know.

I will mention what Harold jotted down and expand on them a little.

So what are they?

- MAX YOUR 401(K) OR EQUIVALENT EMPLOYEE CONTRIBUTION

Make use of the free money that your company matches. If you use something like a Roth IRA - your money will grow tax free and not be taxed on withdrawal. Pay attention to fees on your 401(k) and any other account - avoid actively managed funds. Compounded growth is the idea.

- BUY INEXPENSIVE, WELL DIVERSIFIED MUTUAL FUNDS

Lower your risk and still get good annual returns on a common mutual fund that has a history of annual growth. Harold specified the Vanguard 20XX funds.

NEVER BUY OR SELL AN INDIVIDUAL SECURITY - THE PERSON ON THE OTHER SIDE OF THE TABLE KNOWS MORE THAN YOU DO.

SAVE 20% OF YOUR MONEY

This is something that I wish I did the day I started work. Every paycheck put aside 20% of it into savings. Once its in a savings account decide where the money will go. Either invest it to get higher returns or if you want security put it in a high interest savings account (accept the fact you will not get a good rate of interest at the bank, which is why you should look at investing some elsewhere). You will be amazed how much money you have saved after even a few months of doing this and to be honest, after a couple months of doing this you don't even notice the change in lifestyle. You simply learn to live with 20% less accessible money.

- PAY YOUR CREDIT CARD BALANCE IN FULL!

Goes without saying! but those 29.99% APR interest rates will chew you up and spit you out if you don't get on top of them.

- MAXIMIZE TAX ADVANTAGE SAVINGS ACCOUNTS - FOR EXAMPLE ROTH OR 529 ACCOUNTS.

Those are the main takeaway points, in my opinion, for the standard investor but Harold Pollack's card has a few more pointers on it:

Credit to Harold Pollack for creating the index card and sharing his photo of it.