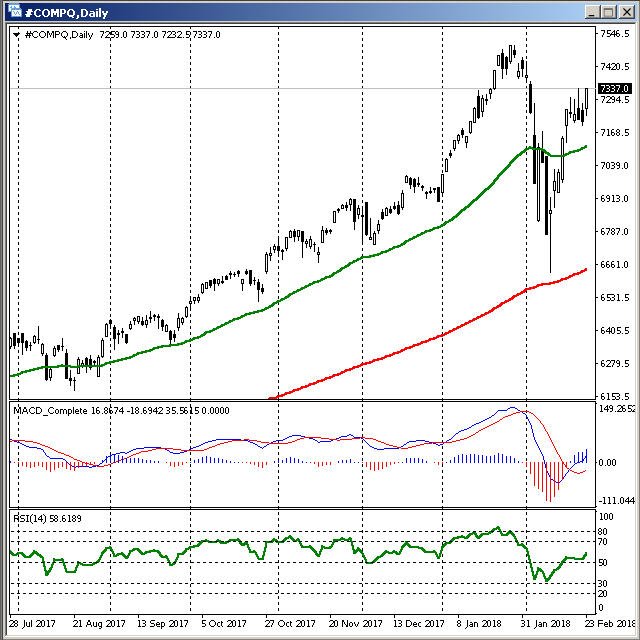

Saturday US Indexes Analysis - Feb 24th, 2018

The strategies discussed below are suitable for swing traders.

In my last week analysis here, I wrote

I'm predicting that it will make a consolidation / sideway for a little while.

And here we are, all three (3) major indexes were barely moving. Being correct for non moving market is somewhat disheartening. :D

With these analysis:

- validly (almost) touching the long term 200 EMA and made a reversal.

- the reversal candles were also strong long-wick-hammer-like candles.

- prices are in equilibrium but moving to the positive side.

- all three(3) indexes were closing the Friday on high.

I’m going to predict that the market is ready for another bull. Friday closing on high, might mean that Monday, we will see the price jumps / making an upward gap. If this happens, we will see either a short consolidation and continue with an uptrend, or just an uptrend directly.

However, if we see the Monday’s price opens below the high of Friday, that means the consolidation period might not be over. If that happens, we will see that the price and / or the long term 200 EMA will move closer one another.

If this blog post has entertained or helped you, please follow, upvote, resteem and/or consider buying me beers :

BTC

ETH

LTC

DOGE

XMR

BTC : 1HqYTjRdZvss32vDrp1T8gRAXTgdqfZ6VS

ETH : 0x1fc22bC528ceE3DaA39555269b70e287dda9aE3E

LTC : LdEiGzjcG36EoZoezDu6rZmdwVcSJHazfr

DOGE : DMYx1w5Sr4uoMnNWymn5nMpCuySSr178TA

XMR : 46QngrRwYgAbQJzW2ZJZ8HEuirkUW2bw84ajWhk73DLG8iT9NqgfzSU4ddRZbeAaLgFeL6gAxzVtGZPHJhFmCDXF3ZEwimT