The crisis in Greece, Brexit, the banking crisis in Italy, the negative interest rates on government bonds are all falling dominoes one sequence. The crisis of 2008, which is by the statements of politicians and businessmen, we have overcome, actually develops. And do not be misled by the growing markets in the wake of here and there, there are news about the collapse of the financial and political system - that is, one thing is clear explanation: a desperate attempt of two world central banks (ECB and Bank of Japan) by any means to delay disaster by buying from the market all that can.

In this article, we will discuss the causes of the growing financial crisis, let's talk about how to protect their assets, and even to make money.

First, let's look at stock charts largest EU banks.

It is the largest bank in Europe, we see a decrease in 2014 and has almost reached the peak of 2008.

Deutsche bank fourth-largest bank in Europe. Padaenie largest shares, they are cheaper than at the bottom in 2008. During the last 9 years, the bank has fallen in price by 10 times!

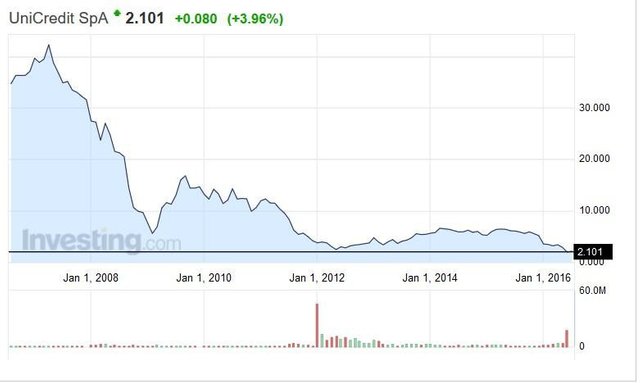

Unicredit. 12 bank in Europe, the largest in Italy. Since 2007, prices have fallen by 20 times!

You can also select banks such as: Commerzbank AG, Banco Santander, Intesa Sanpaolo SpA.

Let's take a a closer look at Italy

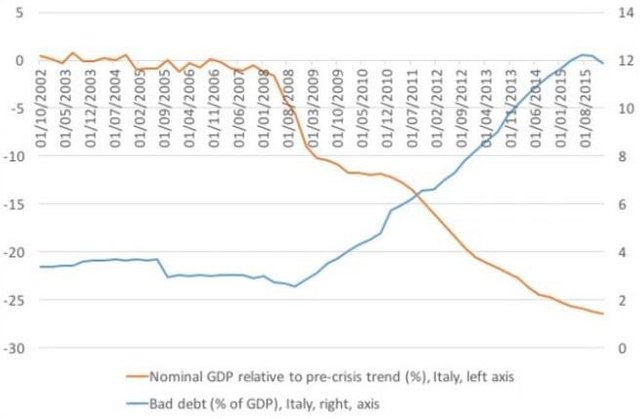

The banking crisis in Italy there was no accident. After the 2008 crisis, the Bank of Italy gradually building up greater and greater credit mass in which the share of "bad" debt rose to 20% in recent years.

As the graph shows, the percentage of bad debts bad Italian banks rose to 12% of GDP by the end of 2015, while the GDP growth declined steadily. At the moment, there are no objective economic assessment of actions of the Italian banks, which have argued that these actions were fraudulent or irresponsible. Yet, when GDP growth is reduced by 25%, even the most conservative banks will have serious problems. Business is ruined, and no one to repay debts. In 2016, the share of "bad" debts left over 20% of GDP.

Italy - the fourth country in Europe in terms of GDP and is one of the weakest (Greece only weaker). The national debt is more than 130% of GDP. Unemployment - a little lower than in Greece, the total portfolio of non-performing loans exceeded $ 400 billion is obvious that the banking system will require significant assistance, which the federal government is not there.. In the best case, using different tricks, banks will be able to repay up to 40% of non-performing loans, but it is obvious that it is almost impossible.

Not surprisingly, the wind blew literate investors - shares of banks are in death throes, and from the ECB reach a completely unequivocal signals - save yourself, the aid money is not, under the laws of the European Union, adopted after the collapse of 2008, depositors strip the last.

Deutsche Bank has a new Lehman Brothers

Once the ECB has called Italy the weakest link in Europe's banking, enraged Italian Prime Minister Matteo Renzi called the weakest and at the same time the most dangerous element not only in Europe but throughout the world Deutsche Bank. If the monetary authorities will allow Europe to fail Italian banks - on the order of Deutsche Bank as a holder of the largest in the $ 75 trillion derivatives portfolio in the world, which includes a large number of financial instruments of Italian banks.

One of the main reasons for the collapse in 2008 was the fact that banks have a huge portfolio of derivatives with a huge shoulder, as well as extremely low reserves.

It is believed that the bank has a good ratio of reserves to capital, reflected in the double digits, and conducts an accurate credit policies.

At the end of its existence, Lehman Brothers had a ratio of equity to reserves only 3%. The fall of the total value of assets in the portfolio to refinance more than 3% of the bank destroyed.

Today, these same figures shows Deutsche Bank with 3.5% reserves and the volume of the portfolio in the $ 75 trillion global GDP roughly equivalent.

Investors are watching the Deutsche Bank since 2013, sees two parallel universes: one bank and officials warn about the wonderful position of the Bank and that he managed to get out of the crisis in 2008, to another bank repeatedly issues additional shares and in June 2016 fails the stress test by the Federal Reserve, the IMF calls the bank the biggest threat to the banking system of the world. The result - almost complete impairment of the bank's shares.

Citi Bank with Deutsche Bank issued a statement saying that the bank needed to raise the level of reserves before 2017 to at least 4%, to increase reserves by € 7 billion. After Deutsche reported a € 7 billion in losses for 2015.

And the rest, beautiful marquise, all is well, all is well.

BREXIT?? Buy!Buy!Buy!

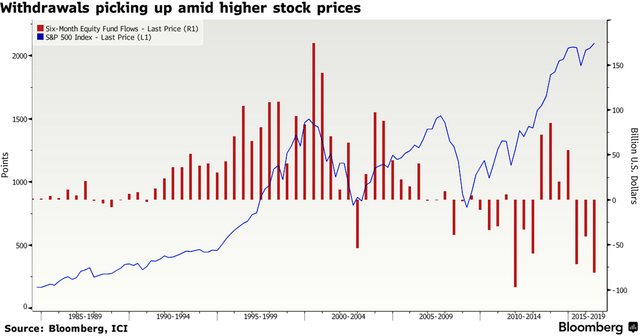

After Brexit markets and banks had to lie on the blades, but this did not happen. Even the investment division of Goldman Sachs, to recommend to customers to go from a stock as soon as possible, we have to right now be explained to those who listened to him. After all, the markets after Brexit not only not fallen, but rose by more than 10%. How can this be, if after 2008 the activity of private investors in the market fell several times and if in 2016 for 17 consecutive weeks investors withdraw money from the market?

The graph clearly visible flow of money funds. Red columns in the negative zone - closing of positions and withdrawal.So, who is pulling the market up, they should have long ago to be at the bottom?

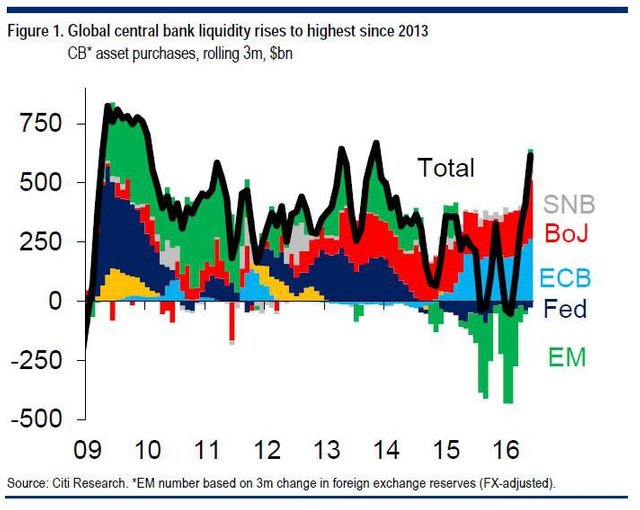

This chart will clarify everything

In the graph we can see the overall asset purchases by central banks (where the BoJ - The Bank of Japan, Fed - Fed, ECB - European Central Bank, EM - banks in developing countries, SNB - Swiss National Bank).

So who are aggressively buying up everything, when everyone else is selling? The ECB and the Bank of Japan (the red and the blue area in the graph).

Why do they need it? Why both banks so aggressively releasing more and more liquidity in the market, by declaring all large programs QE (quantitative easing), rising asset prices all to greater heights?

About Deutsche Bank we already know, it is time to deal with Japan.

On July 26, 2016 Market. As we can see, the market updated height 2015.

Japan tsunami

Imagine for a moment that you just can not get out of the crisis for many years. Prices of goods in your country do not grow, and inflation is at a minimum. In a country with a stable currency, a strong business, a budget surplus and low debt burden, deflation may even be useful, including for consumers and competition.

However, this is not the case record overextended countries like Japan. Due to the fact that your citizens are disciplined like robots and actively invest their savings and pensions are in your state bonds, you release a sea of debt permanently and can theoretically do this forever, blowing more and more credit bubble.

But all this does not work, prices are not rising, inflation is close to zero, and then suddenly, for no apparent reason the country falls into deflation, revealing all the monstrous debt load and increasing the volume of bad debts.

Imagine that, knowing this, you urgently arrives architect "helicopter money", Ben Bernanke, and you start them at home.

Now, any bank, any company must pay you for what you give them the money return on government bonds in 10 years. Yes, that really there, for what keeps the money in your correspondent accounts.

All anything, but there is one problem - the boundless release the money does not create inflation, how would you like it or passing devaluation, and you deeper and deeper lumps deflationary spiral, destroying our economy. And the deeper the spiral, the more you release the money and debt, the lower the value of the assets, the greater the revaluation of collateral creates more and more toxic debt.

At the last meeting of the G7, Japanese Prime Minister Shinzo Abe said that the world is on the verge of financial collapse, a hair's breadth reminiscent of the days before the collapse of Lehman Brothers. Perhaps he still knows he's talking about.

The world is obviously in a state of a large-scale financial crisis, and this is all one can hold back.

Obviously, the market save in all possible ways, all stall instantly pay off, the central banks of all the forces trying to keep the value of the assets afloat, otherwise the major banks, one after another begin to collapse like Lehman Brothers. The ECB and the Bank of Japan in a panic - and use all possible manipulations.

Powder keg

Fed in 2016 stopped the latest quantitative easing program (simply: the release of new money), and the only thing that can keep the markets afloat - it's just corporate profits. But the past two months only bring news about the mass reduction of profits in all top corporations, which kept the indices, the producer price index (Industrial PMI), as well as the industrial production index (US industrial production) has been declining for 9 consecutive months of growth instead.

Now only one sharp shock to powder magazine blew up.

What will it be? The collapse of Europe (Grexit, Italexit, Portoexit), a major terrorist attack, the US military action against China in the South China Sea, the bankruptcy of Deutsche Bank, may, bankruptcy major Japanese banks and generally unpredictable events like "9/11" can conspirological secret srezhessirovannoe world behind the scenes for the writing off of debts. Who knows?

One obvious now: the world is already in deep financial crisis and blow up banks and markets for them can one single event, the shock of which would cause a massive margin call and the subsequent closing of positions that can not kill the ECB and the Bank of Japan.

Now you can you can be sure of only one thing - the oil market leading the Central Bank no effect, in practice, can not render. Oil is living her life.

What to do? How to protect your assets?

Here I will present a vision of where the assets can be invested and which should reduce in its portfolio.

Buy S&P in 2160, I think it's madness.Market greatly swollen, and brewing a strong correction.

Let's look at the composition of the S & P 500. Quite a large part of it are companies with great value P/E (price /earnings). For example the company Facebook has a value of 74, Google - 31. Standard kofitsent 10-15. It is in reducing the market they will fall the fastest.

I believe that it is necessary to sell shares of high-tech companies now, and invest in assets such as production companies and the real economy. So as with a strong decrease in the markets, investors will invest their money in such cryptocurrency Bitcoin or Steemit and its value could increase tenfold.

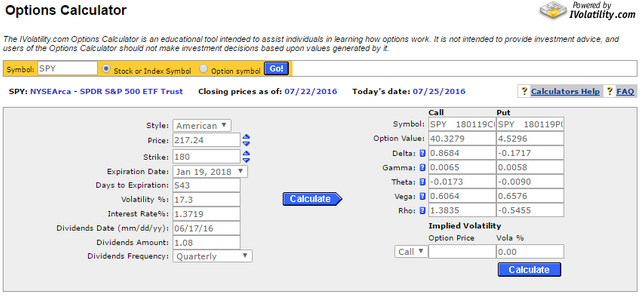

But if for example you want to short the market, but are afraid to short futures on the s & p 500 right now? How to be? You through your broker can buy long-term options on the market (such as Put on SPY).

But if for example you want to short the market, but are afraid to short futures on the s & p 500 right now? How to be?

You through your broker can buy long-term options on the market (such as Put on SPY).

Purchase options - limited risk, unlimited profit. You run the risk of only a certain value of the option purchase.

The site of the Chicago Stock Exchange, you can see all the options of the strikes on the instruments on which they are traded. The maximum non-professional investors can buy options for 2 years in advance.

http://www.cboe.com/framed/IVolframed.aspx?

https://optionalpha.com here's a good resource base, a free course on the basics of trading stock options, basic strategies, etc.

In fact the pricing of an option, it is quite a tricky business, and in one article is not to describe.

This article used information from the works of Ivan Kolykhalov.

P.S. Ask your questions in the comments. By the way, for those who want to understand more in finance, I recommend a free course on Coursera from Yale University in the financial markets by the Nobel Prize Laureate Robert Shiller. https://www.coursera.org/learn/financial-markets

I upvoted You

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit