What will happen this weekend will determine the course of the financial markets for 2019

Next Saturday there is a very important meeting on the agenda. President Donald Trump and President Xi Jingping will meet at the G20 summit in Osaka, Japan. According to market experts, the meeting will determine the course of the markets for the remainder of 2019.

A further worsening of the trade war may, according to various economists, bring the world economy into recession. Arend Kapteyn, economist at investment bank UBS said:

"If the trade war gets out of hand, we estimate that global growth will turn out to be 0.75 percent lower for the next six months, leading to a mild global recession. Similar to the crisis in the euro zone, the oil crisis in the mid-80s and the "Tequila" crisis in the 90s."

How does the market assess the opportunities?

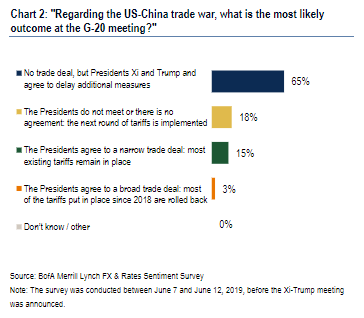

- The market does not expect a solution to be found in the conflict between the United States and China. However, a majority expects a ceasefire in the trade war. According to a survey by the American bank Bank of America Merrill Lynch.

65 percent of those interviewed expect presidents Trump and Xi to agree not to impose additional rates or other measures for the time being. But that won't lead to a deal.

And that is the same thing that different economists expect. Despite the recession scenario that exists, when the trade war gets out of hand, it is most likely that there will be a ceasefire. Cesar Rojas, economist at Citigroup, said:

"[I expect] a ceasefire with a symbolic handshake."

Ceasefire positive for stocks

A ceasefire could also have a positive effect on the financial markets. According to Peter Boockvar, top strategist at Bleakley Advisory Group, the stock market will do well if such a deal is made. But in moderation, the strategist said:

"The fact that the rates still exist will limit the size of a rally."

Source: CNBC