My fellow Steemians,

Most gold mining stocks have risen sharply in recent weeks. The rising gold price caused more and more investors to become interested in the yellow precious metal. Does the gold market still have sufficient growth potential?

Many investors have a hard time selecting the right stocks. An index is a true outcome for those investors. After all, if you invest in an index, you invest indirectly in many listed companies.

Gold mining stocks may appreciate even further!

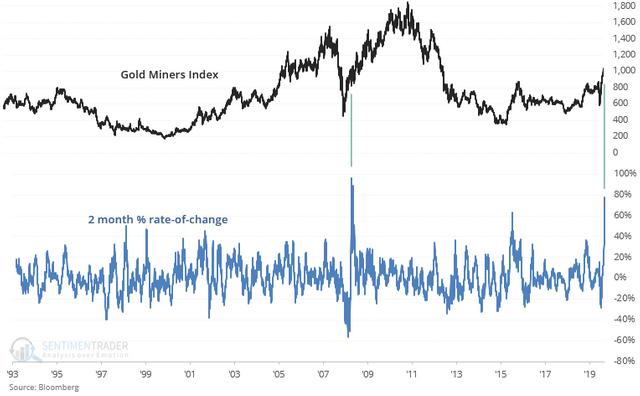

For example, investors interested in gold mining stocks can opt for the Gold Miners Index. This index consists of the main listed gold mining companies. Over the past two months, this index has risen by 77%.

Research by SentimenTrader shows that such an increase has occurred only once before in such a short period. That was in December 2008. As a result, the Gold Miners Index rose another 54% the following year. And only in the year 2011 this gigantic Gold Run came to an end.

Thank you for reading!

https://slimbeleggen.com/trends/beschikt-de-goudmarkt-nog-over-potentieel/

The Stable Melt Value of Gold will reach $3,500 per ounce... That's if it's Measured with Fiat Dollars... Gold will become Stable at $35 per ounce, In terms of "Sound Money"...

May 24, 2020... 18.6 Hollywood Time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In 1933, Executive Order 6102 was signed by U.S. President Franklin D. Roosevelt, requiring US citizens to turn in their gold for $20.67 per ounce. Afterwards, the price of gold was set at $35.00 per ounce.

That was a long time ago. With the abolishment of the gold standard in 1971 and the excessive printing of money, it very unlikely that gold will go back to $35!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have the entire U.S. Monetary Reset figured out... If an Executive Order was used to remove our Gold, how much easier will it be to remove all Federal Reserve Notes from Circulation, with an Executive Order...??? Gold at $35 per ounce and Silver at $3.50 per ounce will back the Entire U.S. Monetary Reset, all the way down to a Decimal Cent...

May 25, 2020... 7.3 Hollywood Time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The US government is going to try to create inflation and to debase the usd imho... If they are going back to a gold standard, they will have to increase the price of gold and silver immensely. Whatever scenario its going to be, its going to be a massive theft...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People who don't prepare, will not be harmed Financially by the U.S. Monetary Reset to "Sound Money"... In Terms of Sound Money, the Melt Value of Gold will be $35 per ounce and the Melt Value of Silver will be $3.50 per ounce... It terms of Fiat Money, Gold will become stable at $3,500 and Silver will become stable at $350 per ounce...

We're not taking the Hyper-Inflation Path, and the Transition will be very Smooth, due to the Redemption Period... All Federal Reserve Notes will be Removed and Replaced by Sound Money... None of the Financial Guru's see what I see coming...

May 25, 2020... 14.8 Hollywood Time...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You might be right, let's see what the future holds. Thanks for expressing your opinion.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit