! Hello Friends Subscribers!In this opportunity before you I want to convey my interest in an excellent and very important project called Invox Finance Pty Ltd, This is a successful invoice financing company based in Indonesia and Australia. Many companies, especially small businesses, involved in the supply of goods and services struggle to stay afloat due to cash flow problems.

They can not cope with daily expenses and commitments since cash is not generated regularly. This refers to the ease of financing the invoice, where the investor advances the seller against the invoice issued as "Invoice Loan" or "Loan of invoice "or" loan "

Creating New Formula Invox Finance

A decentralized p2p form of factoring or invoice financing is being created. If you are not familiar with the financing of invoices, it is when a company allows a third party to buy the rights over the money that is owed (by product or service) with a discount. The benefit to the company is that you get money immediately, which allows you to do things like pay the payroll, buy additional supplies and acquire more jobs.Invoice financing is a big business worldwide because many companies have to wait up to 90 days to receive payment for their products.

Our Invox platform

The Invox platform is a complex ecosystem of buyers, sellers and investors. All these parties carry out business on the Invox platform, which consists of:

Smart Invoices of Dynamic Invoice Converts a paper invoice into an intelligent contract that is recorded in the block chain. The smart contract will allow a diverse set of changing data to be stored within the invoice. Any change will be registered in the chain of blocks and completely visible by all parties.

Smart loan contracts These contracts contain all loan terms and data related to the distribution of funds. These contracts allow the fragmentation of the loans.

User access and processing center It is the user interface and the center where buyers, sellers and investors will carry out the business of creating, verifying and buying loans.

Bank API integration. Integrate the system with Invox banking partners. This will allow the loans to be in Fiat and be reimbursed in Fiat.

Advantages Invox Finance Platform

- It is a decentralized platform.

That's the INVOX Finance platform will allow sellers, buyers, investors and other service providers to directly communicate, interact, share and distribute information. - Reduction of rates for sellers.

Sellers may obtain financing at lower interest rates than those usually received from traditional funders. - Dynamic invoices provide all parties with the possibility of updating account information in real time, ensuring that it is not modified and managing confidential access to information.

- Unification of all parties.

The Invox Finance platform supports trust and transparency among all parties through authorized access, controls and an integrated reward system. - Direct access to investors.

The Invox Finance platform will provide vendors with direct access to investors. This new direct credit environment will benefit both sellers and investors. - A new form of diversification for investors.

The Invox Finance platform will open credit products for investors, consisting of credit fragments, of several companies in various industries. - Risk reduction

The loans to the accounts will be fragmented in smaller increments, which will allow investors to buy credit fragments, this is done in order to reduce the risks and increase their diversification.

Who can use this platform: - Sellers that have invoices that they want to sell.

- Investors who want to increase the profitability and diversification of their investment portfolio

- Buyers who will receive a prolonged period of payment of invoices and will receive a reward for consulting invoices.

Disadvantages of the Current Financial System

No direct contact

The financier has no relationship with the buyer, which places a significant risk on the financier. Invalid bills A seller may issue an invoice for an incomplete service or product that does not meet the requirements.

High legal costs The preparation and execution of legal documents is expensive and generally involves third party suppliers.

Deceptive actions

The seller and the buyer may conspire to deceive the financier. Or the seller can break your agreement and request a direct payment.

Disputes

The buyer can challenge the responsibility for the payment and leave the other parties out of pocket, endangering their reputation.

Insolvency.

The buyer can declare himself insolvent and can not pay the bills, forcing the other parties to tolerate the loss of funds.

Economy Model

Sellers

Invox Finance will charge the sellers a processing and administration fee equivalent to 1.1% of the nominal value of each invoice registered in the platform. This must be paid in Invox Tokens A large proportion (approximately 91%) of this income will be used to reward buyers and sellers for the Verification and payment of invoices. That is, 1% of the nominal value of each invoice will be used for rewards and 0.1% will be used by Invox Finance to recover costs in order to maintain the system. There will be no other charges to the seller, except for legal expenses or third-party services.

Investors

Invox Finance will charge investors a processing and administration fee equivalent to 3.3% of each advance amount. This must be paid in Invox of this income: An amount in Invox Tokens equivalent to 0.5% of each advance amount will be placed in the Invox Finance Self-insurance Fund. The mandate of this fund will be to accumulate and maintain a buffer in Invox Tokens to provide members with self-assurance and for the benefit of users of the system's services by providing funds for debt recovery and execution. Effectively, members will insure each other against uncollectible debts. The size of the buffer to be maintained will be determined in accordance with the industry's best practice. An amount in Invox Tokens equivalent to 0.5% of each anticipated amount will be burned.An amount in Invox Tokens equivalent to 0.3% of each advance amount will be used by Invox Finance for costs in order to maintain the system.An amount in bill tokens equivalent to 2.0% of each advance the amount of money that the platform generates income

Third parties

Third parties that add value to the Invox Finance Platform (for example, credit rating agencies) may be charged to use the Invox Finance platform.However, there may be third parties who wish to access the Invox Finance Platform for the provision of services to their users-these users will be charged as appropriate in Invoice Files.

Important Associations

Invox recently announced two key partnerships and each will play a vital role in the success of this project.

Red Celsius

The first announced partner was the Celsius Network . The Celsius Network is a decentralized P2P lending and borrowing platform. This may look a lot like Invox, but it is less specialized in general. The two platforms will work together in this way:The companies in Invox will offer their invoices to investors.

- The lenders (Investors) of Celsius Network will provide financing for these invoices.

In a nutshell, Celsius Network will provide an integrated lending base for Invox.

ICO details.

The ICO begins its presale on March 15. Pre-sale participants receive a 30% discount and have a minimum purchase of 1 ETH and do not have a maximum. The presale limit is $ 2.5 million.

The crowdsale opens on April 15 and will have a minimum of .1 ETH with no individual limit. Bonuses for this round start at 20% and decrease to zero at the end of the sale.

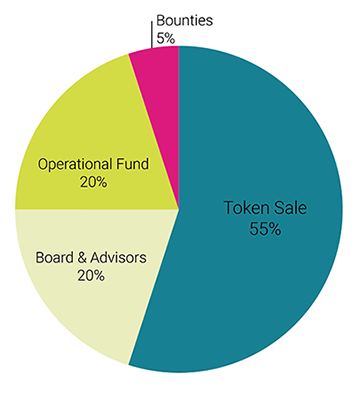

The global maximum limit is 20,000 ETH and the maximum total supply (if maximum bonuses are assigned) is 464 million INVOX.The distribution of the token is the following:

Token

Token Name: INVOX

Price per token: 1 INVOX = 0.0001 ETH

ICO Start date: April 15, 2018

ICO end date: May 15, 2018

Currencies accepted: ETH

Minimum contribution: 0.1 ETH

Invox-Finance route

- Stage 1

The investment of the founders Founded by the ABR Finance team, we already have six years of experience in the invoice financing industry. Through ABR Finance, we have also created customized financing software for traditional invoice financing, which has led the founding team to discover the limitations of centralized systems. The team will have invested more than $ 500,000 AUD in cash at Invox Finance. This investment was used to create an initial community, develop this document, conduct an ICO, establish a system framework

and, most importantly, design the Intelligent Invoice Dynamic Contract. This Ledger facilitates the creation

and the recording of invoices in a dynamic digital format to promote authenticity and transparency

for all parties involved and to protect against manipulation of data by one of the parties. This was the proof of concept and the first step to create Invox Finance Platform. - Stage 2

Completion of ICO and MVP The main objective will be to complete the ICO and finalize the development of the

minimum viable Product (MVP). Once the MVP is complete, Invox Finance will run a test with ABR Finance as its first client to demonstrate a use case and begin rigorous user testing. This will allow multiple sellers and buyers to try the Invox financial platform with ABR Finance as an investor. - Stage 3

Goals for the use of ICO funds The first objective will be to fully develop Invox's financial platform so that it can manage the scale necessary to meet the objectives detailed in this White Paper. Second, the team will launch the

Invox financial platform to the public. After this, it will be the creation of a community around the Investor Platform of Invox, buyers and sellers to guarantee a substantial number of users within the Invox financial platform. This will be achieved through marketing, grassroots commitment, brand ambassadors and partners. The ultimate goal will be to participate and partner with other distributed platforms and other parties that can add extra value to Invox's financial platform.

Team and partners Invox Finace

Team members include:

Alex Mezhvinsky - Co-founder

Adam Mezhvinsky - Co-founder

Daniel Tang - Co-Founder

Victoria Mezhvinsky - Legal Adviser

Jose Luis Ramirez -Lead Software Engineer

Lucas Cullen - Lead Solidity Developer - Contractor

Henry Sit - Business Development Manager

Advisors Include:

Alex Mashinsky - Strategic Advisor

David Lu - Investment Adviser

JP Thor - Crypto Advisor

To access more information about our excellent project, visit these links:

Website: https://www.invoxfinance.io/

White book: https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

Facebook: https://www.facebook.com/Invox-Finance-162381191061327/

Twitter: https://twitter.com/InvoxFinance

Instagram: https://www.instagram.com/invoxfinance/

Telegram: https://t.me/InvoxFinanceCommunity

Linkedin: https://www.linkedin.com/company/invox-finance/

Ann: https://bitcointalk.org/index.php?topic=3048498.0

Author Data

Bitt User: Cripcoin

Bitt User Profile: https://bitcointalk.org/index.php?action=profile;u=1962014

Wallet: 0x446c8411C903E38627777CDa31bae21abe1Af7E1