Hey guys! how are you doing today? This week, I want to present a review of an invoice Financing platform called Invox Finance to you.

Are you a business owner, seller, buyer or an investor. do you have a general interest in Finance or are you experiencing periodic cash-flow problems? this review will help you gain a better perspective about the current innovation called Invox Platform powered by Blockchain Technology.

What is Invox Finance? It's a decentralised peer to peer invoice lending platform that enables businesses to stay afloat by expediting and regularize their cash flows.

It is a decentralised p2p platform that connects sellers, buyers, and investors.

First, let's look at the major problems/setback posed by the Traditional Invoice Financing, then we will see how Invox Finance Platform profer remedies to these problems.

MAJOR PROBLEMS/SETBACK POSED BY THE TRADITIONAL INVOICE FINANCING

-The costs involved in preparing and executing legal documents are not just exorbitant but typically stripe you of your privacy by exposing you to a third party.

-The financier tends to face more risk as they usually do not have a direct contact with the buyer.

-There is a high level of possibility to defrauds the financier, especially in a case where the seller and the buyer decide to conspire against the financier.

-Incessant lost are usually recorded especially in a situation where the buyer becomes broke and incapable of making the payment.

-Using the traditional model of invoicing, it is a common practice for sellers to issue an invoice for a sub-standard product. This and other points listed above usually leads to dispute between all the parties involved in the Invoicing financing.

Here are the methods adopted by us in solving the above-listed problems:

(1)We enabled permissioned access and confirmations between all parties so as to encourage Trust and Transparency.

(2) We offer financing to Sellers at a very reduced interest rate than what is obtainable from a traditional financer

(3)We enable direct access contact between individual investors and Sellers.

(4) There are Dynamic invoices which enable all parties to update invoice data in a continuous manner, ensure immutability and manage sensitive information access.

(5) Investors will be conceded access to an investment product that is generally only available to banks and finance organizations.

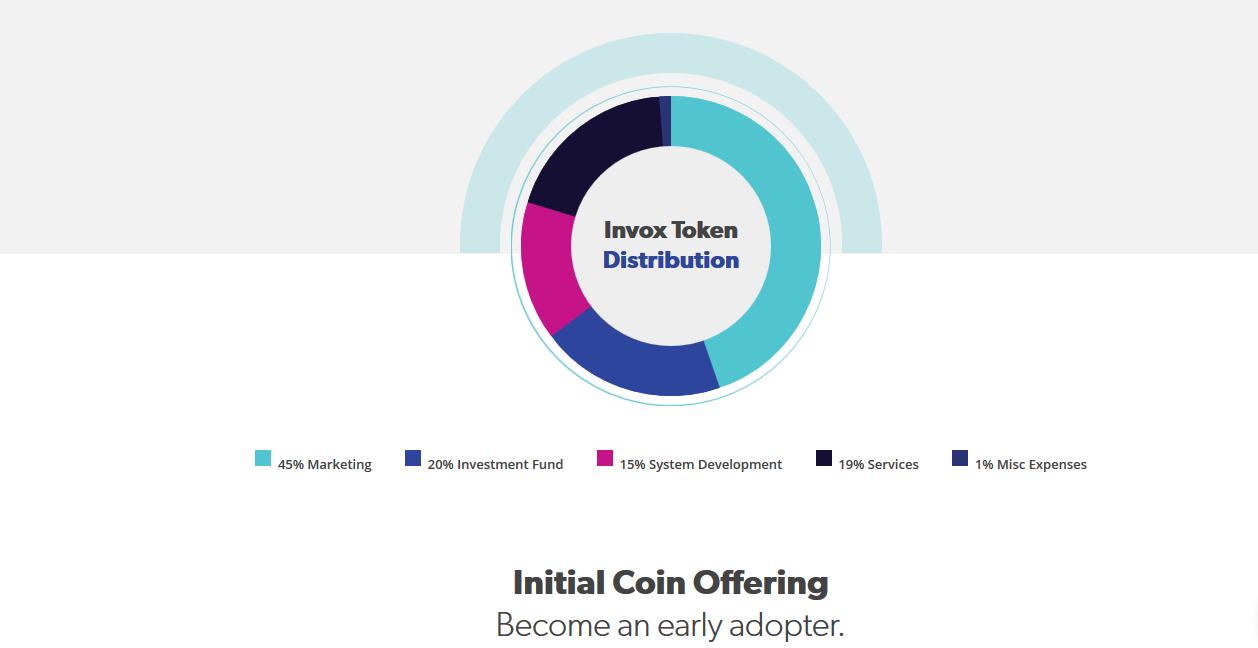

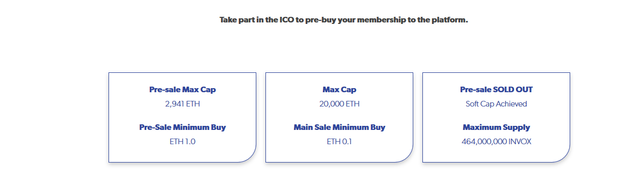

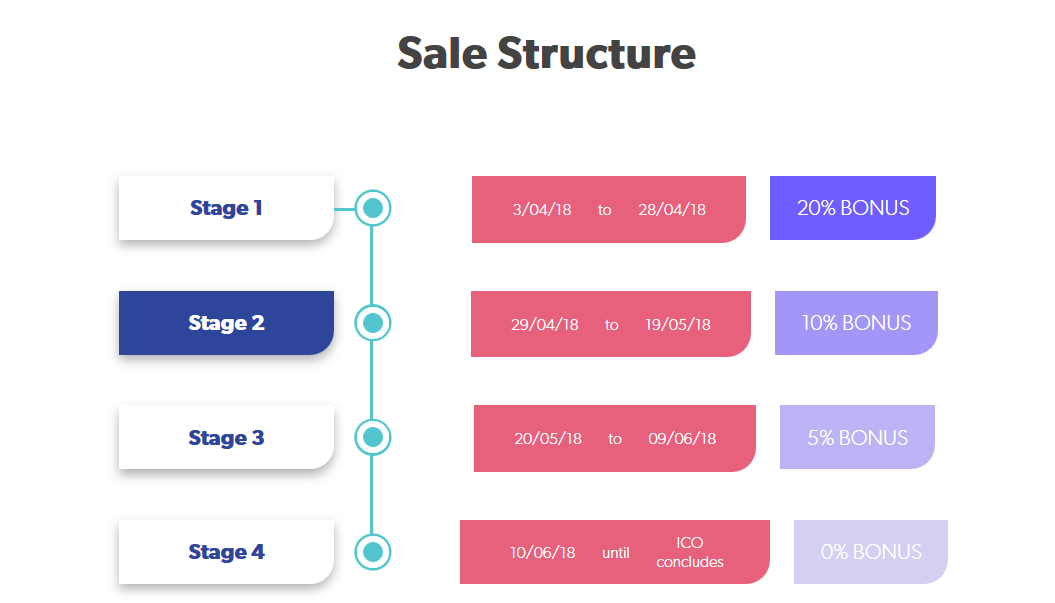

TOKEN

FOR MORE INFORMATION PLEASE CONNECT WITH THE COMPANY BELOW:

WEBSITE | WHITEPAPER | TELEGRAM |

A review done by HOBISH |