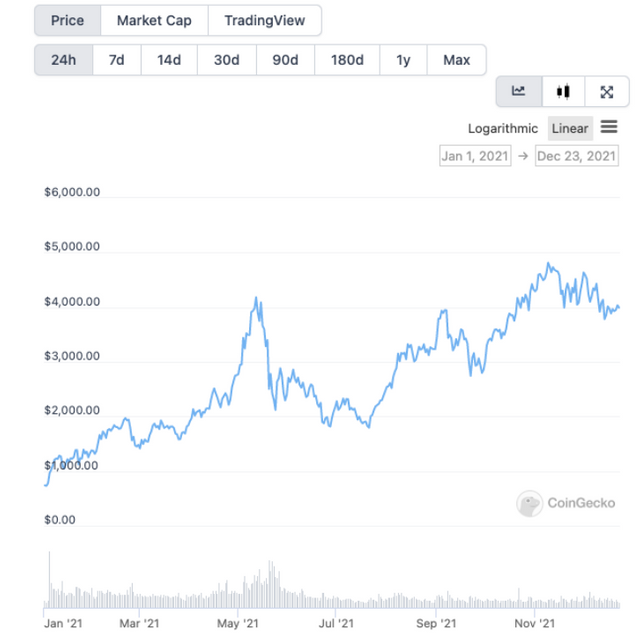

1.Ethereum embraces a 438% price increase in 2021

By 18th December, Ethereum price has multiplied 4.38 times since the beginning of 2021, from the $736 to $3960. While Bitcoin price only went up 63%. As three Ethereum ETF were approved for listing at the end of April (1. Purpose Ether ETF launched by Purpose Investment; 2. CI Galaxy Ethereum ETF launched by CI Global Asset Management; 3. Evolve Ether ETF launched by Evolve Capital), Ethereum is gradually turning from an alt coin to valid coin in the eyes of crypto conservatives.

- Steep fell following China’s total ban

Miners’ income was boosted as Ethereum price surged. On 15th May, miners’ single-day income hit a record high (130 million US dollars), and then fell to a minimum of 32 million US dollars following the market plunge and of China’s cryptocurrency ban. Due to the Ethereum’s burning mechanism, the income of miners never returned to the its highest level on May (as you can see from the figure below, the block rewards are gradually increasing, but the handling fee income is severely reduced)

- Ethereum ecosystem scaled to over 150 billion USD

Although cryptocurrency market had a great leap in 2021, Ethereum price only multiplied 2.6 times compared to its last highest record of $1448 in 2017.

Though its price hasn’t went up crazily, Ethereum’s ecosystem is now worth a total of 150 billion USD, while 130 billion was accumulated this year. DeFi’s TVL has 7 folded compared to the beginning of 2021. However, Ethereum’s dominance in DeFi also lowered from 97% to 63%.

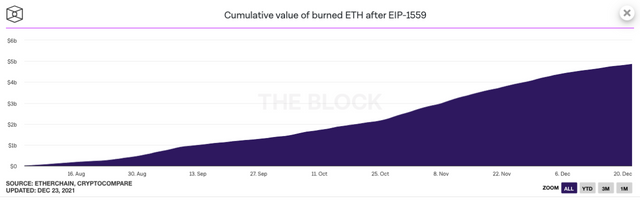

- EIP-1559 burning mechanism has great contribution towards Ethereum price recovery

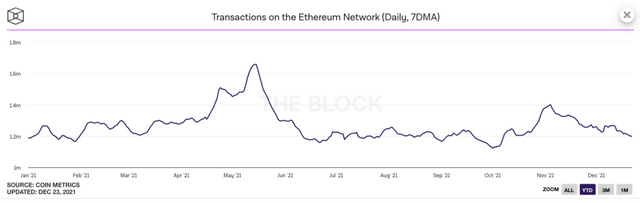

Due to the high usage rate, Ethereum continues to see gas price peaks in 2021. Before the market crash in May, the gas used median remained above 100 gwei for most of the time, and dropped to less than 30 gwei during the recession, but it rose again as the market rebounded. However, the volatility of gas used in the second half of 2021 is much smaller than that in the first half, which is mainly due to EIP-1559 burning mechanism. EIP-1559 impacts on the network in a way that perhaps will not reduce gas fee, but can reduce its volatility and increase predictability.

4.Astonishing number of Ethereum are burned everyday due to London upgrade

On 5th August, Ethereum launched London upgrade at a height of 12,965,000. Nearly 9,000 Ethereum are burned on a daily basis. Until now, the number of Ethereum burned had exceeded 1.2 million, valued at approximately 4.9 billion USD. (It’s estimated that 2 million Ethereum will be burned annually in a bear market. If it’s been bull market for a whole year, then annual burned volume will exceed 3 million).

At present, the average daily output of Ethereum is about 13,000, and a total of 119 million have been produced. Its annual inflation rate is about 4.1%. Ethereum's burning mechanism can reduce its inflation rate to about 1.4%, lower than that of Bitcoin (1.7%). When Ethereum officially enters 2.0, the inflation rate may be further reduced to a negative number, achieving deflation.

According to Ethereum's economic model, the annual issuance of Ethereum 2.0 goes up with the increase in the number of pledges. When the quantity of pledge exceeds 100 million, the annual issuance rate will stabilize at 1.71%, that is, the average daily output is about 5600. By then if Ethereum 2.0 can maintain the current burn volume, it can achieve 1% deflation every year.

6、By December 19, the Ethereum 2.0 beacon chain address has pledged 8.71 million Ethereum, worth about 34.4 billion U.S. dollars, accounting for only 7.3% of the total issuance, and the actual staking rate is about 5.4%. It can be seen from the figure that the growth rate of the staking amount of Ethereum 2.0 has slowed down significantly this year. In 2020, it only took 2 months to accumulate 2.18 million Ethereum. But the number has only increased by another 653 since the beginning of 2021. This is related to the slowness of the Ethereum upgrade.