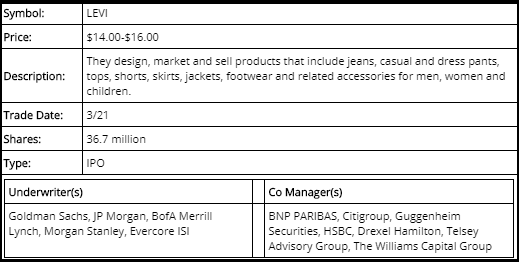

On March 20, there will be the IPO of Levi Strauss&Co, the company which received the first patent for blue Jeans. The company will offer 36.7 million shares in the price range of $14- $ 16. The offering volume will be $ 550 million.

The mature giant has aimed at new markets and niches: China, India and Brazil, along with entering the female segment growing by more than 20%. The company was already public in 1971-1985 and is coming back to the market.

Levi’s products are sold in more than 50,000 retail stores in 110 countries. The company intends to seriously increase its shares in China, India and Brazil. For example, revenue in China is only 3% with a 20% share of the country in the world. Over the past 2 years, the women's line is growing at 25-29% per year, moreover, since 2015 income from female tops grew at CAGR of 46%. Sales of jeans grow faster than the apparel industry as a whole: 5% against 1%. Sales of denim in general are ahead of the apparel industry (according to the NPD Group, the growth of the denim industry was 5%, and the apparel industry was 1%).

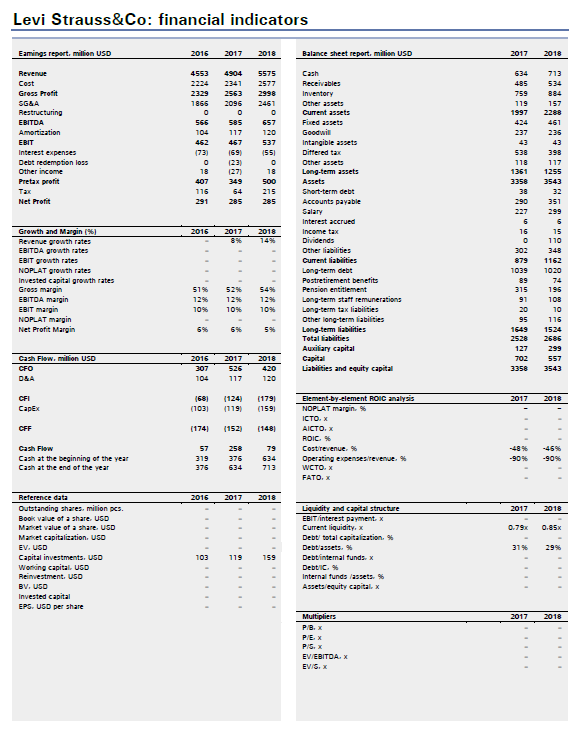

Revenue growth from 1% to 14% in 2018 with a stable margin is an excellent sign for a mature business. After reduction in revenue in 2015, the company is confidently increasing its revenue from year to year from -5% to + 14% in 2018. EBIT margin in 2015 shows growth. In 2014, this indicator was equal to 6.6%, but since 2015 EBIT margin has been showing indicators in the range of 9.5% and 10.2%. For the last 3 years, the company has demonstrated positive cash flow.

Potential of 49% on DCF and on P/S to the upper boundary of the IPO. By multipliers based on industry dependence of EBIT margin and P/S, we see a valuation of 1.65x annual revenues of $ 9.198 billion or $ 23.9 (upside potential 49%). At the same time, even the DCF-model gives a slightly high valuation at the level of $ 9.162 billion with a target price of $ 23.8 (upside potential 49%)!

(

@usstockmarket, interesting information. Thank you for letting us know about this IPO.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @usstockmarket! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit