Cryptocurrency has always been inundated with sources of income gain (and ultimately ,income loss).Day traders, investors, miners etc. Avenues, in myriads, exist by which one can make profits and earn a good amount of money. And the best thing is that one can choose the best way that works for him/her and can accordingly adjust to the measure of return in terms of risk for a specific time period. This is known universally as the reward/risk ratio and was first defined and popularized by Dr. Richard Johnsson in July 25, 2010, on a financial write up.

We may have to deviate monumentally to define some terms here. Let us talk about the numerous income sources.

Day Trading

First off, Day trading, or just simply, crypto trading.

Trading is the buy and sale of assets(security, stock, precious metal, or cryptocurrency), for the ultimate profit.The entire name of the game can be summed up as buy low, sell high. The “day” aspect of day trading is its short-term nature.The ultimate aim of day trading is to get into the market, take a position, keep a close eye on that position, and then exit at a profit. We’re talking time spans here as short as a few minutes. It should also be noted that some so-called day traders maintain some positions for weeks or even months, depending on certain security goals. This is in direct contrast to the popular crypto HODL, an intentional miss-spelling of “Hold” in which you decide to buy a given crypto and then keep it safe for potential long-term, long-range, and long-odds growth.

Day trading can be manual or automated. Manual trading requires actual physical presence. In Automated trading, there is an ever faster turnover, with automated computer programs that do your trading for you, can produce a flurry of trades in just a few seconds.

Trading Categories

The two broadest categories into which one can divide day traders are speculators and technical analysts. This is based on the several different means of approaching that goal.

This can be either the Speculators, also known as newshound traders that scour the internet for outside market influences that seem to indicate a cryptocurrency will either suddenly gain or suddenly lose value, like news about corporate takeovers or mergers, interviews with notable political or financial figures hacks, big coin tech milestones and developments, major adoptions, and other potential market movers.

Technical Analysts

The second category is concerned with the internal workings of the market rather than outside pressures. This kind of day trader relies on financial charts to get a feel for where the price was in the recent past and where it might be heading next. Learning to identify a few simple, market-tested patterns can give you a pretty good idea of where any given coin’s price will be headed next.

Investing

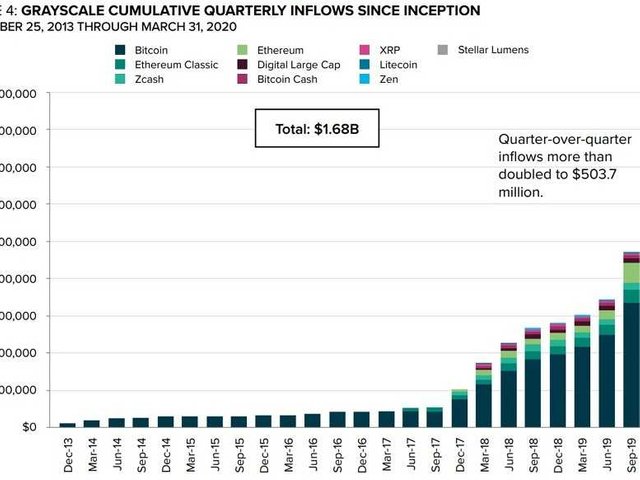

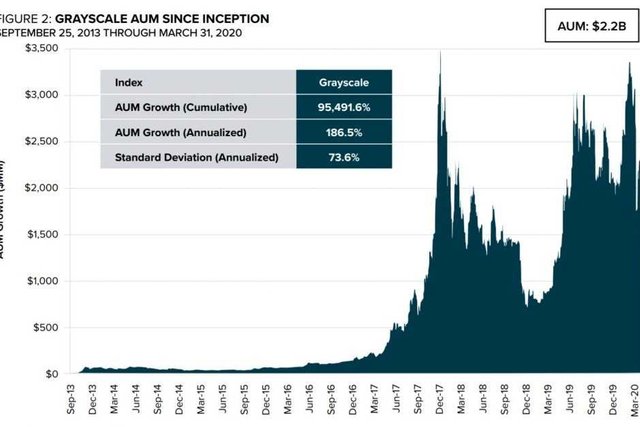

This is usually a long term version of (day) trading. Investing in crypto has been at an All Time High. For example ,Grayscale Investments announced its quarterly results as the worldwide economic crisis escalates.

“Despite the risk asset drawdown this quarter, Grayscale’s assets under management (‘AUM’) continues towards all-time highs, as does our share of the digital asset market,”

Specifically, the total investment into Grayscale crypto products in Q1 2020 amounted to $503.7 million, compared to $1.07 billion for the trailing 12 months. At the end of March, the company’s total assets under management since inception (Sept. 25, 2013) totaled approximately $2.2 billion.

There is also a projected increase in the interest in crypto investment. The covid-19 pandemic has led to total economic meltdown, with companies missing their estimated earning and projections, and many traditional investments have taken a hit across the board.Thus, the IMF has made a statement that it is the worst recession since the Great Depression of the thirties. The crisis has investors scratching their collective head to find safe haven assets, and more people are now asking whether cryptocurrencies, are a good investment.

Tetsuyuki Oishi of Bitcoin Lab, a guest crypto analyst at Japanese financial company Fisco, shared three reasons earlier this week why he sees considerable demand from institutional investors for cryptocurrencies post the pandemic.

Firstly, he said that the stock market may lose its attractiveness after the coronavirus crisis due to decreased demand for many companies’ products, resulting in long-term declines in corporate profits.

Why Invest

People invest for many reasons

First,because they support the rationale behind cryptocurrencies – that of unbridled freedom from the government for the whole world. Also because they want to hedge their net-worth against the fall of the Dollar , which is assumed by many people to inevitably happen at some time, and also because they understand the technology behind it.

However, there are also very bad reasons to invest in cryptocurrencies. Many people fall victim to the hype surrounding every cryptocurrency-bubble. There is always somebody captured by FOMO (fear of missing out), buying massively in at the peak of a bubble, just in the hope to make quick money, while not understanding cryptocurrencies at all.

Cryptocurrency Mining

Transactions are made and recorded in the blockchain, which is run by miners, who use powerful computers that tally the transactions. Their function is to update the Blockchain's ledger each time a transaction is made and also ensure the authenticity of information, thereby ascertaining that each transaction is secure and is processed properly and safely.As remuneration for their services, miners are paid physically minted cryptocurrency as fees for each transaction cleared. Since there is no middle-man like the bank or government involved in the transaction, as it is a peer-to-peer transaction, the transaction fee that is associated with credit cards is eliminated. The identity of the buyer and seller are not revealed, and only wallet addresses are seen. However, each and every transaction is made public to all the people in the blockchain network.

Cryptocurrency mining involves verifying previous bitcoin transactions on the blockchain .This process prevents "double-spending(users are kept honest), hacker attacks and dysfunctional Blockchains. The reward that miners accrue incentivizes and motivates more miners to assist in supporting the blockchain. cryptocurrency networks, mining is a validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes has been increased by the use of specialized machines such as FPGAs (Field-Programmable Gate Array) and ASICs(Application-Specific Integrated Circuit) which are specialized computers specifically for cryptocurrency mining and each running hashing algorithms. Algorithms are computational patterns for each Cryptocurrency. Bitcoin utilizes the SHA-256,Ethereum the Ethash algorithms. With more people venturing into the world of virtual currency, mining for this validation has become far more complex over the years, with miners having to invest large sums of money on employing multiple high performance ASICs. Thus the value of the currency obtained for finding a hash often does not justify the amount of money spent on setting up the miners, the cooling processes to overcome the heat they produce, and the wattage required to run them. A hash is produced by a non-random complex math equation that reduces any amount of text or data to 64-character string, otherwise known as a "hash function". This is a very effective way to tell if something has been changed, and is how the blockchain can confirm that a transaction has not been tampered with.

Now using bitcoin as a prime example, at the time of writing, the reward is 6.25 bitcoin per block, from 12.5 bitcoins. Although it’s not nearly as cushy a deal as it sounds. There are a lot of mining nodes competing for that reward, and it is a question of luck and computing power (the more guessing calculations you can perform, the luckier you are). Thus mining difficulty(for bitcoin at least) has skyrocketed, going with the reduced mining rewards.

There are 3 main types of cryptocurrency mining. Solo mining, pool mining and cloud mining.

Solo mining is the little guy in the lot, it is least effective and lucrative. And plain useless. It involves use of personal computers. However some personal miners utilize hardwares like GPUs (Graphic Processing Unit) like AMD RX 480s and nVidia RX Titans. These give a bump in income, but may not accrue much which is due to the competition around.

Pool mining involves solo miners forming a group, contributing hashes and computational muscles and splitting the rewards. This is relatively more profitable.

Cloud mining is the process of mining concurrency utilizing a remote datacenter with shared processing power. This type of cloud mining enables users to mine bitcoins or altcoins without managing the hardware. The hardwares are hosted by companies who manage the machines (ASICSs and GPUs basically). The overheads like rent, electricity are deducted from the rewards, and profits shared as per a pre-agreed ratio. They commonly come with a contract of period and ratio to be shared.

Masternode Hosting

A full node is a node that hosts a copy of the coin’s blockchain ledger and helps ensure its integrity and safety by doing so. A masternode is just a full node running specific types of functions that help support the network and is rewarded with coins, and requires a virtual private server and a huge cache of the specific crypto for as long as you the node is run.This is an alternative to mining. The masternode model was integrated by Dash into its protocol, under its proof of service algorithm, a second tier network of masternodes exists alongside a first tier network of miners to achieve distributed consensus on the blockchain.

WHAT ABOUT IQ CASH

Now we have seen the income streams available in crypto, let us intimate on how IQ Cash jumps into the fray.

What is IQ.Cash?

IQ.сash is a universal, large-scale blockchain platform for Investor, Traders, Miners and Masternode hosting, which enables instant anonymous online payments and investing like InstaSend.

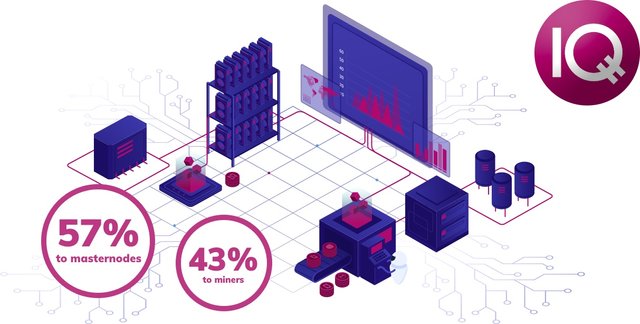

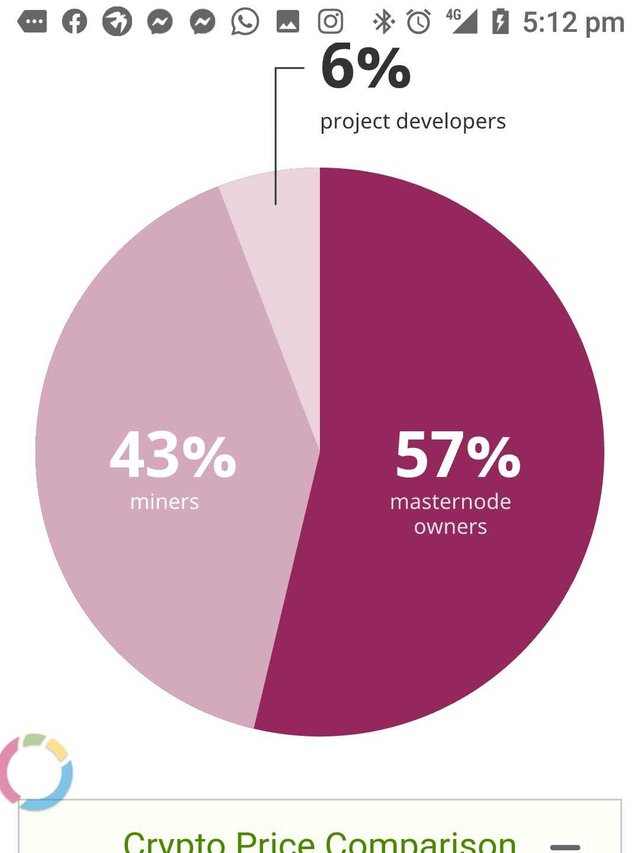

The programming allows sharing of the profit between miners as a reward for the transactions operated by IT specialists and MasterNode owners with 3,000 IQ.cash deposit as a commission for assisting the server system by investing in it. IQ.cash coin was created the way so the profit is split in proportion of 57% and 43% between MasterNode (server with deposit) owners and miners accordingly. Additional 6% DAO is reserved to be either shared with people helping to develop the IQ.cash project or to simply dissolve once a month

The major steps to make more 200% yearly profit

- Purchase 3,001IQ as 1 IQ will be spent on the transaction Commission, remaining the basic 3000 IQ.

IQ Cash can be purchased quickly from the following high end exchanges

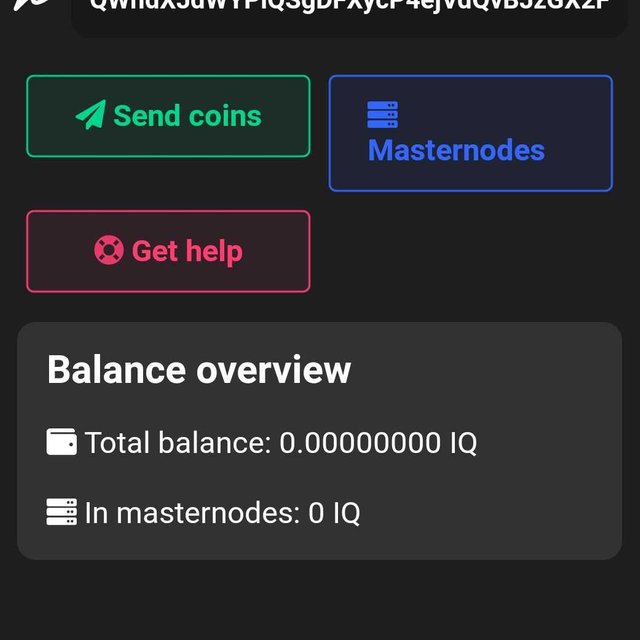

Download and install the Flits App for the mobile device. You can get the Android and iOS versions here.

Copy your IQ Cash wallet address and send the coins to it from any of the above exchanges you made the purchase.

Put 3,001 IQ into the wallet and create a MasterNode server and a deposit. To create such a server, the owner must ‘rent’ it from the hoster. The 3,000 IQ deposit must be ready before the investment works.

Pay Flit about 2 Euro per month for the hosting provider service fee.

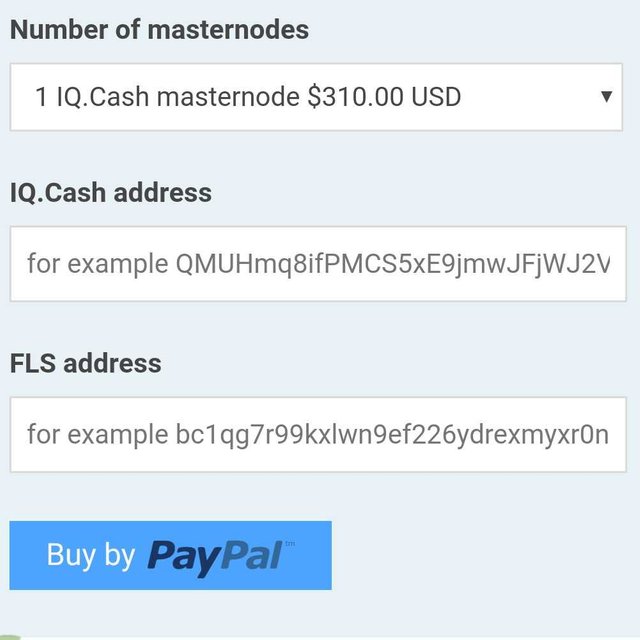

Navigate to this page

Complete the «IQ wallet address» and «FLS wallet address» in the Flits app

Then for the package. One whole package includes both 3000 IQ.cash and Bitcoin for five months of Flits service.

The moment the money transfer is complete, open the window IQ – MasterNode and create them proportionally to coins purchased (3000 IQ for 1 MasterNode)

Switch on the MasterNode and get the profit. You can follow the current rate in the Flits App or at any crypto exchange trading IQ.cash coins.

Easy peasy, if you ask me!

Updates:🔥OTC Market - IQ.cash - Sale ONLY 2 packs of 500k IQ = 12 BTC each🔥

IQ CASH Resources

About the Author

Joseph Johns is a successful Emergency Medicine Physician and an ardent cryptocurrency and Blockchain connoisseur

altcoinstalk Username: Jaephoenix

Altcoinstalk Profile: https://www.altcoinstalks.com/index.php?action=profile;area=summary;u=11461

.png)

.png)