This week was an eventful week if you are a cryptocurrency trader or Bitcoin enthusiast. My thoughts and ideas that I have gathered in the past few days on the stock market, the climate in Washington DC, and Blockchain.

Government Shutdown: The VIX and the stock market have no fear, barely moving to a possible shutdown on Friday VIX is still elevated, but will completely deflate when Washington agrees to a budget deal soon. As of late Friday night, Congress did not reach an agreement to fund the government, and as of this writing are both sides of the aisle are digging into their positions.

I expect the Stock Markets to rocket up after any agreement, and I think it will happen either late Sunday night or sometime on Monday. The market always responds to news to the upside only, as in the last year, the Dow shot up after Fed meetings, unemployment jobs reports(good or bad), and Congressional Events such as December’s “Kick the Budget Deal to January” Bill and the landmark Tax Reform bill.

Both sides will declare victory in the deal, and the market will continue to drive to Dow 30,000.

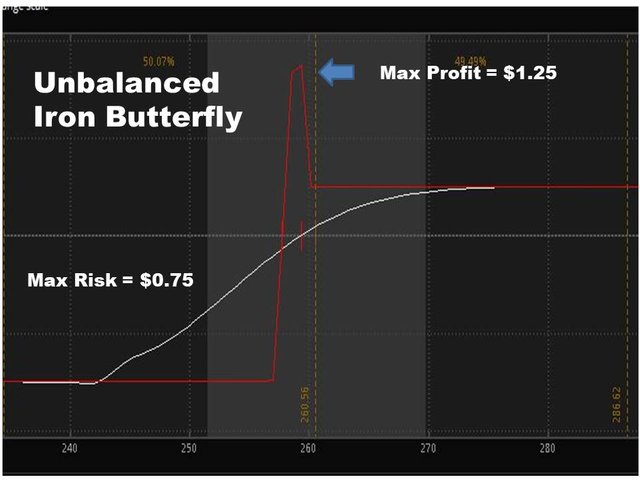

Unbalanced Iron Butterfly Trade

Since my prognosis is a quick resolution with the Dow Jones soaring soon after the news breaks, I will take a shot with a low risk bullish trade using the DIA ETF as my options instrument. The options strategy that I will deploy will be the Unbalanced Iron Butterfly. While the regular Iron Butterfly has two equal call and put credit spreads on each side, the Unbalanced Iron Butterfly has one side that has more risk than the other, skewing the bias to be bullish or bearish instead of a delta neutral trade. If setup correctly, the risk is only to the one side of the options trade(vs the regular Iron Butterfly, where the risk is to both sides if the stock goes wild).

Here is my Unbalanced Iron Butterfly Trade opened on 1/19/2018:

Call Credit Spread

Sell 1 FEB 2018 259 Call

Buy 1 FEB 2018 260 Call

Put Credit Spread

Sell 1 FEB 2018 259 Put

Buy 1 FEB 2018 257 Put

Total Credit of Spread: $1.25

Max Risk: $0.75

Days to Expiration: 28

The DIA has to close at the common strike of 259 on expiration(February 18th), to receive the maximum profit of $1.25.

Some Notes on this trade:

To Reduce the risk to one side, the credit of the spread must be greater than the width of the shorter spread. What’s that? For example, the Call side width is $1.00(260 minus 259), and the credit is $1.25. So, if Dow Jones takes off, I can still make $.25 on this trade. I will lose on this trade if the DIA closes below the 257 Strike.

Trade in small lots, only risk what you are willing to lose.

Trade Plan

Loss Exit: If the trade, closes below the 257 strike, close the trade immediately and take the loss.

Profit Exit: Look to take about 30% of the credit for profit, which is $1.25 x .30 = $.38.

The Return would be the Profit/Max Risk, which calculates to be a 50%($.38/.75) return on max risk.

I expect the Congress to finish their drama by Sunday night or Monday morning. However, in case of a prolonged fight, the options are good until the February 18th expiration day. Since I am a net seller of option premium, I benefit from Theta decay, as opposed to option buyers, who have decaying assets as it approaches expiration. Also, if the Dow Jones trades sideways(which is ideal), then my position is still good.