Did you know IRS has a U.S. Tax Code that is

written vaguely

so much so that a change of law may not even be required to change it for the better of humanity?never defined what an "individual" is

so the definition varies upon them being

-single

-married

-widdowed

-head of householddoesn't clearly define individual

-are they a citizen of the U.S.

-under 18 years old

-in a coma

-mentally incompetent

-not a U.S. citizen

None of these issues are ever even debated by those in charge of government.

Why is that do you suppose?

Was this purposely

vague

secretive

income tax law passed by avoiding public deliberation

of decisions

on WHO

was subject to deliberation of the individual income tax law?

Who does this benefit?

Humanity or the Powers that be [those in control of humanity IF humanity Allows their control]?

So who has the power to decide just WHO an individual is?

The U.S. Department of Treasury?

Do THEY decide who pays and how much?

Did you know the U.S. Department of Treasury is the cabinet in charge of

administering the U.S. Tax Code?

Does the individual U.S. Income Tax Law live by REGULATION?

If so, then doesn't this conclude that

it can DIE by regulation?

Can President Trump appoint a new Secretary of Treasury

to draft new regulations?

Did you know that when the U.S. Treasury

makes and rewrites regulations

it must follow the Administrative Procedure Act [APA]

like most other federal agencies.

See further information here,

https://www.justice.gov/sites/default/files/jmd/legacy/2014/05/01/act-pl79-404.pdf

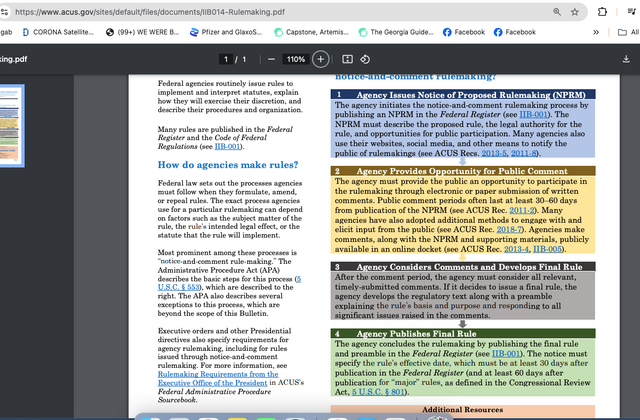

The APA requires that when the U.S. Treasury Department intends to make new regulations

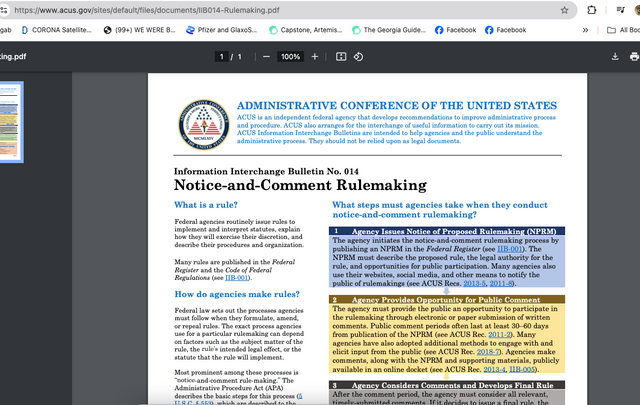

it must engage in what is known as Notice-and-Comment

This rule making process requires three main steps.

See more in this pdf link,

https://www.acus.gov/sites/default/files/documents/IIB014-Rulemaking.pdf

*They must publish a notice of proposed rulemaking

this is in order to INFORM the public of the proposed regulation.

[was this EVER done in the first place initially?]

This is supposed to be a way for people to discuss prior to the proposed regulation.

A requirement is that regulations must be in harmony with the statutes.

In the United States, the individual income tax law

found in title 26 of the U.S. Code

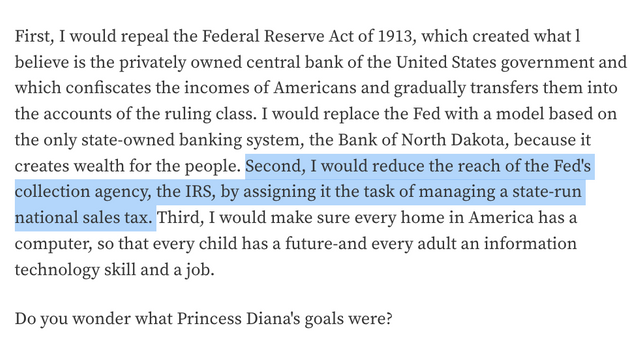

Find out who said they would limit the overbearing power of the IRS [arm of a controlling government] if he were president in an interview on PBS decades ago here,

From one of my articles years ago with research I have been archiving for many years,

https://steemit.com/news/@artistiquejewels/hear-president-trump-refer-to-a-letter-from-jfkjr-dated-after-the-plane-crash-and-larry-king-appears-to-fumble-the-date-with-2

Find more info here,

https://www.irs.gov/privacy-disclosure/tax-code-regulations-and-official-guidance#:~:text=Congress%20typically%20enacts%20Federal%20tax,States%20Code%20(26%20USC).

#IRS, #TaxCode, #irstaxcode, #taxes, #dollarcrisis, #USA, #economy, #USAeconomy