I often say that I wish the IRS would automate tax preparation. Many countries have such "return-free" tax regimes where the tax agency either takes the taxes out as they are earned or does the tax return themselves.

The IRS collects a lot of information about a taxpayer's income from third parties during the year. For W-2 employees, their W-2s are reported by their employers. Likewise by financial institutions for investment incomes. W-2 employees also have taxes withheld during the year.

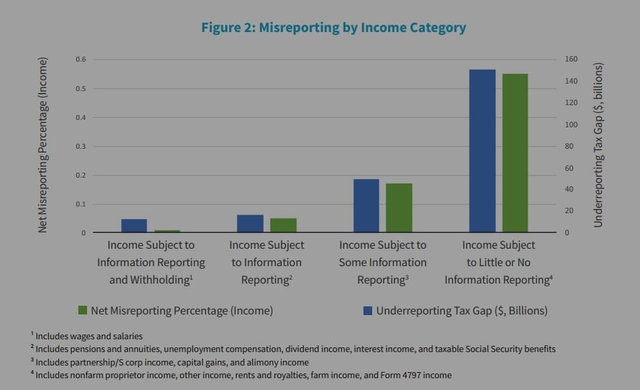

This makes it such that these filers generally don't underreport that much income. There are fewer means available for them to underreport their income. This is why I said earlier that it would be very inefficient of the IRS to use new funding to audit these taxpayers at higher rates. Field audits of these taxpayers wouldn't yield much additional tax revenue.

However for other entities, there is much less mandatory income reporting and much less withholding. The IRS must rely on voluntary compliance for these taxpayers. As such generally the underreporting is much larger. This is why these taxpayers are much more likely to be audited than other taxpayers.