https://siepr.stanford.edu/publications/measuring-and-mitigating-racial-disparities-tax-audits

According to the study's estimates, Black taxpayers are audited at 2.9 to 4.7 times the rate of non-Black taxpayers. This disparity was primarily among taxpayers that claimed the Earned Income Tax Credit. There was a smaller disparity among taxpayers that didn't claim the EITC.

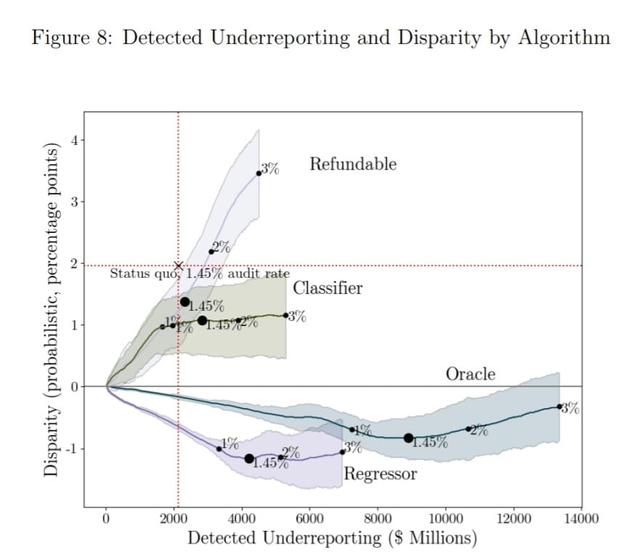

IRS audits are race blind as a rule. The IRS isn't intentionally trying to audit Black taxpayers more. But what the study indicates is that the design of the audit selection algorithms can still produce racial disparities. This chart is the key part of the study. As it shows different counterfactual audit algorithms would produce different racial disparities. Most importantly the status quo isn't maximizing detection of underreporting- one could reduce the racial disparities while increasing detection of underreporting.

Part of the racial disparity is because Black taxpayers are more likely to claim the EITC, which has a higher audit rate because EITC audits are generally low cost automatic correspondence audits by mail. Likewise some of the racial disparity is driven by racial differences in income, demographics, family composition, and tax undereporting. But racial disparities still remain after accounting for those differences.

The remaining drivers might be from audit selection algorithm design. An audit algorithm that prioritizes finding non-compliant taxpayers rather than prioritizing finding the most underreporting will have a higher racial disparity. In addition audit algorithms that prioritize targeting abuse of refundable credits will have a higher racial disparity as Black taxpayers are more likely to claim them. Lastly, the paper shows that algorithms that prioritize EITC returns without business income have higher racial disparity as Black taxpayers are more likely to be non-business income EITC returns. Business income returns are more complex and costly to audit, so IRS underfunding is likely shaping audit distribution.

As the study notes operational constraints limit the IRS here. Congress determines what information is reported to the IRS by third parties, which in turn constrains the IRS' ability to identify non-compliant taxpayers. Congress as well sets the credit eligibility rules, which have different racial incidence. And finally Congress sets IRS funding levels, which constrains how much the IRS is able to audit more complex returns among non-Black taxpayers. So Congress will likely have to act to allow the IRS to improve its audit processes on both racial disparities and on undereporting. This will require more IRS funding and resources.