About IX Swap

A decentralized exchange (DEX) is a peer-to-peer (P2P) marketplace that connects advanced cash buyers and sellers. Instead of a concentrated exchange (CEX), the decentralized stage is non-custodial, which means the customer is still in charge of their private keys while using the DEX stage.

IX Swap is a decentralized exchange for security tokens and tokenized stock. It has set September 8th as the delivery date for basic decentralized exchange (IDO) offerings at Occam and Poolz, the two leading DeFi delivery organizations. The KuCoin Spotlight, which begins on September 3rd and runs until the IEO coincides with the IDO, will also be incorporated into the multi-platform delivery of IXS tokens.

IX Swap Missions:

Defeat any conflict between DeFi and CeFi. Increase liquidity in the STO market. The security token industry is on the mend, but businesses are facing a major conflict, namely a lack of trading liquidity due to a lack of licensees and market makers in the market. business.

The primary goal of IX Swap is to use blockchain development to create a liquidity plan and system for a security token climate, allowing for overall trading and induction of this invisible asset class.

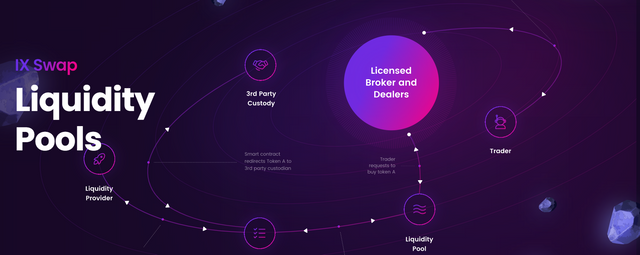

How IX Swap works:

The IX Swap plan works as follows: it addresses the issue of low liquidity in security token commitments (STO) and security token commitments (TSO) by establishing liquidity pools and robotic market makers (AMM) for security tokens and tokenized assets. This token holder assistant is even more efficient when it comes to trading, staking, earning, and crediting assets, as well as participating in liquidity mining.

IX Swap helps clear the way for the private marketplace and the blockchain space in general by addressing the switching, joining, and onboarding issues that the DeFi space faces. It has been estimated that more than $7.5 trillion is held in private assets, and that these assets could benefit from breaking the liquidity bottleneck that has prevented various large monetary hedges from re-entering and exploring the illiquid part of the market for an extended period of time. Personal, for example, business, personal values, shared assets, and trade in goods like wood, to name a few.

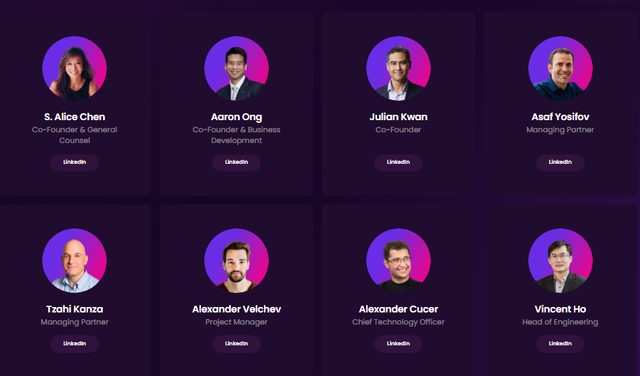

Team membes

IX Swap's team has worked with over 15 associations between partners and has extensive experience in all areas of the capital business and blockchain chain space. The team has come together to address a critical infrastructure issue, namely liquidity within the natural security token framework, using their vast data and experience.

Conclusion

IX Swap effectively bridges the gap between centralized finance and DeFi by doing so. It also provides numerous STO benefits for all types of projects, including the launch of IPOs and compliance. STOs also aid in the raising of funds, the reduction of reliance on illiquid assets such as venture capital and private equity, and the entry into new markets.

For more information please follow the link below:

- Website : https://ixswap.io/

- Litepaper : http://ixs.loc/app/uploads/2021/08/IX-Swap-Litepaper.pdf

- Medium : https://ixswap.medium.com/

- Twitter : https://twitter.com/IxSwap

- Facebook : https://www.facebook.com/IXSwap/

- Telegram : https://t.me/ixswapofficial

- Linkedin : https://www.linkedin.com/company/ixswap

- YouTube : https://www.youtube.com/channel/UCaYPNR-eLs9iuB5ZVKRx-fw

Username : pijayplow93

Profile : https://bitcointalk.org/index.php?action=profile;u=2750501

Wallet Address : 0xE42555f44ff0d1f38C56540b3FFA4428734dD775