Sourcea7

Crypto Depository Receipts (CryDR)

CryDRs are tethered tokens that represent ownership of

an underlying traditional asset held by jibrel. In this

paper, they are denoted as jAsset (e.g. jUSD, jEUR,

jGBP). On release, jibrel will support six fiat currencies

and two money market instruments, with plans to add

additional financial instruments in the future.

JIBREL NETWORK

It is a worldwide network.It provides us with the best rates for the currency available around.

The Jibrel Network provides currencies, equities, commodities and other financial assets and instruments as standard ERC-20 tokens on the Ethereum blockchain.

Jibrel Network provides the traditional financial assets,which are like currencies, bonds, commodities and securities, as standard ERC-20 tokens on the ethereum blockchain.

It has the best network which is available around.

In the longer-term,the Jibrel Network aims to fully automate and decentralize consumer banking.

JIBREL NETWORK AIMS AT SOLVING THE PROBLEMS

The network of Jibrel provides with the best services and commodities around.And the Team is fixing the problems available around.

The Team is bringing traditional financial assets to the blockchain, problems plaguing traditional banking such as high fees and slow transfer times which can be eliminated.

The team is using crypto-fiat tokens, users can store, send and receive value in their local currency with near-zero fees.

In addition to the,decentralized organizations and funds can diversify into traditional assets, using asset backed CryptoDepository Receipts (CryDRs).

The jibrel network main aim is to facilitate the digitization,listing and trading of traditional assets,

such as currencies, bonds and other financial instruments, on the blockchain.

The jibrel decentral bank will allow platform users to deposit cash, money market instruments or create

their own Crypto Depository Receipts (CryDRs) and benefit from onchain / offchain arbitrage.

Decentralized organizations and funds that are overexposed in digital currencies can hedge

their positions and protect their funding with stable assets.After all the jibrel will provide

developers with a complete platform to build tools and applications for transacting, investing

and hedging, through leveraging traditional asset backed tokens.

ABOUT THE Jibrel ‘Decentral’ Bank (JDB)

The JDB will work on to receive and hold traditional assets on the place of their owners and issue their respective CryDRs.

And the bank will send it to the owner’s wallet.

After the redemption of

a token, the token is destroyed and the underlying asset

is transferred to the token holder.

Also the JDB aims to be fully decentralized, until full

onchain integration of traditional financial institutions,

large components of the system will need to be offchain.

Offchain activity will require the input and oversight of

local and international regulators.

For this reason the stakeholder interaction must be

properly managed to ensure full regulatory compliance

without sacrificing transparency and reliability.The whole process

will be achieved through asset portals, dedicated entities

operating with full compliance in their respective geographies.

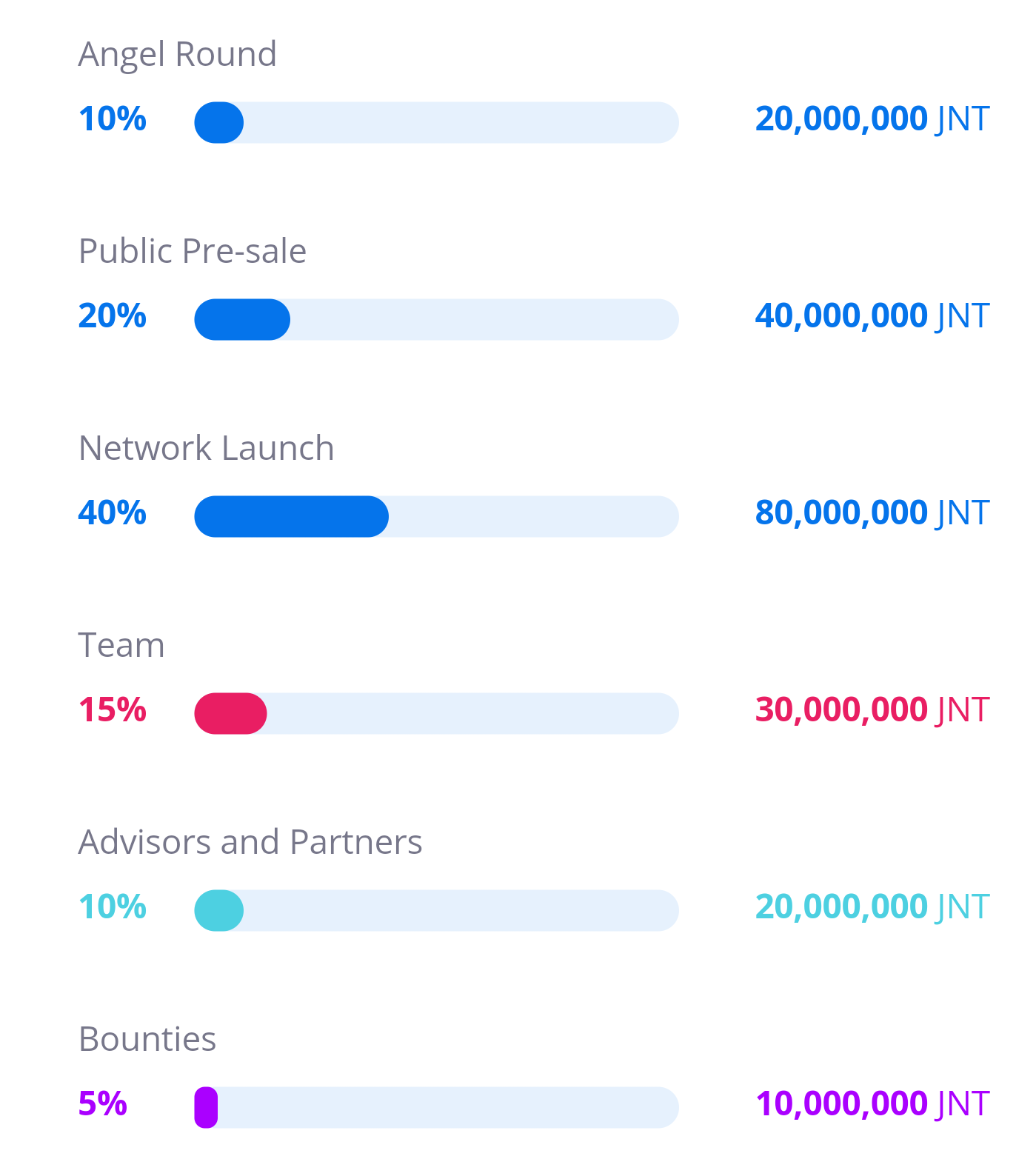

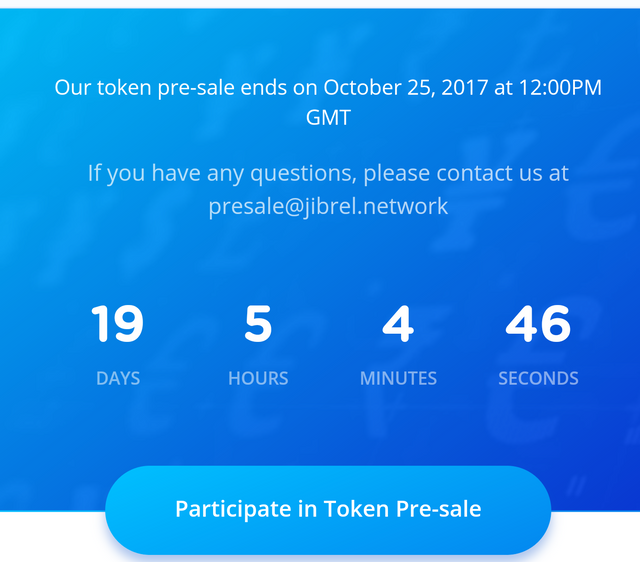

ALL ABOUT THE ICO

The ICO is live now.Investors should invest there money to earn a huge profit now.The ICO will end on 25th of october 2017 at 12 pm.Hurry up and join your hands ti earn huge profit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptocurrencytalk.com/links/category/22-vc-investors-funds/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm looking into this token also. Do you think that this would be accepted by mainstream?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit