***Read the original article by Kerala Blockchain Academy at https://medium.com/@kbaiiitmk

Almost all cryptocurrencies fluctuate wildly, making them attractive for investors but at the same time riskier for people who want to use them for one of their intended purposes, say, pay for goods and services. There exists a robust feel that cryptocurrencies cannot be chosen as a safe medium of exchange if the purchasing power keeps changing, apparently calling a much more stabilized option that lessens the risk. This very thought gave rise to “stable” digital currency that can make payments as fiat currencies like the US Dollar.

Let’s get the term clearer.

Stablecoin

Stablecoins are crypto-assets designed for price stability. Stablecoins retain a stable price relative to a target currency. A DeFi system built on a stablecoin is successfully seen to solve the issues raised out of the volatile nature of the cryptocurrency.

How can stablecoins be implemented?

One can design a smart contract to produce a token whose price is equal to the value of a fiat currency. For example, if a token’s price is fixed as $1, it can interface fiat currency and cryptocurrency.

Do remember cryptocurrencies and tokens are two different enttities. Cryptocurrencies have their blockchains, while tokens are built on an existing blockchain.

Tether token is a stablecoin hosted on the Ethereum blockchain. Tether token is pegged against USD.

Stablecoins combines the benefits of cryptocurrency like privacy and security alongside keeping tight the price stability of a fiat currency.

Types of Stablecoins

Assuming that you got an idea about stablecoins, let’s take a look at the different categories of stablecoins. The categorization is based on their backup asset and mode of operation.

Custodial stablecoins are centralized stablecoins where the custodians use fiat currencies or any high-quality liquid assets as a reserve. Digital tokens to represent an on-chain version of the reserve asset are then offered to users. Holders of the digital token have some form of claim against the custodial assets. Custodial stablecoins are not truly DeFi since a third party is involved. But they can be incorporated into other DeFi services. An example of custodial stablecoin is USDC which is fully backed by cash and equivalents.

Collateralized stablecoins use on-chain collateral (security) to derive economic value and ensure price stability. They use smart contracts to create and liquidate collateral in the form of assets like cryptocurrency. They are also known as asset-backed stablecoins. The widely used collateralized stablecoin is DAI. You can read on DAI as you go on.

Algorithmic stablecoins work based on a protocol/algorithm implemented as a smart contract (programs running on a blockchain). The algorithm implements the rules for balancing the supply and demand of stablecoin. They are not collateralized. The tokens in circulation will be reduced if the market price falls below the price of the fiat currency associated with it, and token production will be increased if the token price exceeds the fiat currency’s price. Terra USD is an example of an algorithmic stablecoin.

Asset-backed and algorithmic stablecoins are themselves considered as DeFi services for their decentralized and non-custodial properties.

MakerDAO

Launched in 2017, MakerDAO is a Decentralized Autonomous Organization (DAO), which was one of the earliest DeFi protocols. It issues the DAI stablecoin and the first Ethereum project that facilitates collateral-based loans. Let’s get in-depth on DAI and MakerDAO.

DAI is an asset-backed stable coin on the Ethereum blockchain. DAI is a popular stablecoin mainly used in DeFi as a medium for lending and borrowing crypto assets without an intermediary. It is based on the Maker protocol that its MKR token holders govern.

Lending and Borrowing in MakerDAO system

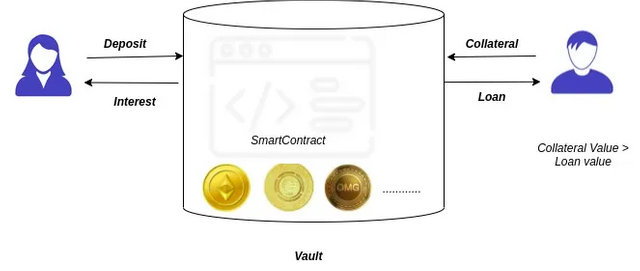

A user can open a maker vault, deposit any Ethereum-based assets as collateral and get a loan in DAI. These vaults are smart contracts that keep the collateral until the loan is returned. The value of the collateral deposited must be more than the value of the DAI borrowed. If the collateral value falls below the value of the borrowed DAI tokens, the collateral will be liquidated. You might wonder how the user can benefit if the collateral value is more than the loan amount ?. It allows locking up collateral whose value is unstable and receiving a stable asset as a return. So users can convert a “risky” investment to a stable asset. Lenders can deposit DAI and receive interest as per the DAI savings rate (DSR).

Stablecoins provide an excellent solution for bridging the gap between cryptocurrency and fiat currency. Apart from achieving price stability, stablecoins offer several benefits over fiat currency. They are quicker to issue than paper-based or physical assets. The electronic format and smart contract implementation help in faster transaction processing.

References

[1] Werner, Sam & Perez, Daniel & Gudgeon, Lewis & Klages-Mundt, Ariah & Harz, Dominik & Knottenbelt, William. (2021). “SoK: Decentralized Finance (DeFi)”.

[2] A. Klages-Mundt, D. Harz, L. Gudgeon, J.-Y. Liu, and A. Minca,

“Stablecoins 2.0: Economic foundations and risk-based models,” in

Proceedings of the 2nd ACM Conference on Advances in Financial

Technologies, 2020, pp. 59–79.