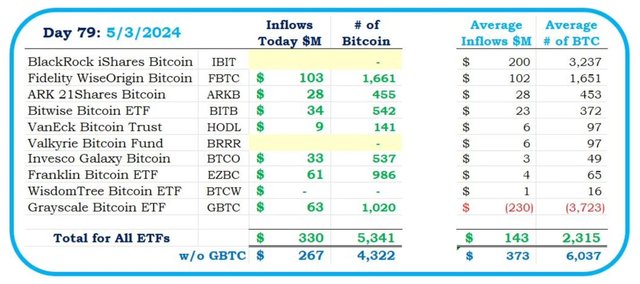

The overall U.S. Bitcoin spot ETF saw a net inflow of US$330 million yesterday (3rd), of which Fidelity's FBTC topped the list with an inflow of US$103 million, while Grayscale GBTC saw a net inflow for the first time after transforming into a spot ETF. . In addition, Bitcoin surged this morning to a maximum of $63,000, and Bitfinex whales’ BTC long positions increased by 6% in the past few days.

The capital inflows of U.S.-listed Bitcoin spot ETFs rebounded sharply yesterday (3rd). According to data compiled by HODL15Capital, the overall spot ETFs recorded a net inflow of US$330 million on May 3, of which Fidelity FBTC ranks first with $103 million in inflows.

In addition, this is the first time that the overall spot ETF has resumed net inflows after maintaining net outflows for seven days since April 24.

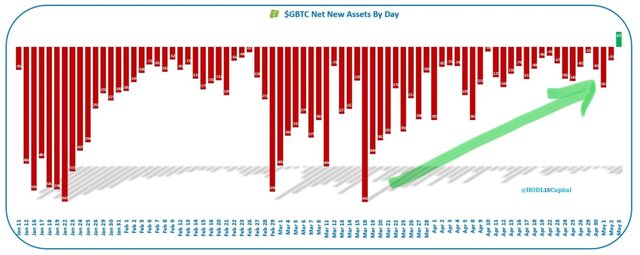

Grayscale GBTC experienced net inflow for the first time

What is even more striking is that since the Bitcoin Trust Fund was converted into a spot ETF, yesterday Grayscale GBTC saw a net inflow of US$63 million for the first time after 78 days of net outflows.

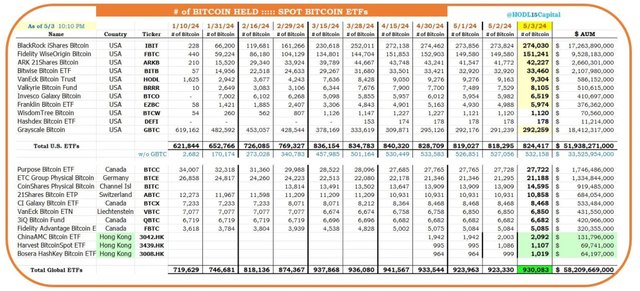

In addition, according to HODL15Capital statistics, as of the 3rd, global Bitcoin spot ETFs held a total of 930,083 BTC, worth more than 58.2 billion US dollars, of which US spot ETFs held 824,417 BTC, accounting for nearly 89%.

Bitcoin surges 8%, breaking through $63,000

In addition, in terms of Bitcoin price, after falling below US$57,000 on the 1st, BTC once again reached the US$60,000 mark on the evening of the 3rd, rising by more than 8% from US$58,849, to a maximum of US$63,595 this morning. The author is reporting 62,758 US dollars, an increase of 5% in the past 24 hours.

Bitfinex whale bulls surge 6%

Just as the price of Bitcoin has rebounded in the past two days, according to Cryptoslate, the long BTC positions held by Bitfinex whales have increased significantly by 6% in the past few days, reaching a total of 48,615 BTC.

Analysis of Bitfinex whale activity in 2024 found: These whales held more than 76,000 BTC on February 10 (when Bitcoin was around $43,000), but by the time it hit an all-time high of $73,000 in March, whale holdings Has been reduced to 42,000 BTC.

However, since Bitcoin dropped to $60,000 on April 13, Bitfinex whales have been steadily increasing their holdings and continued to expand their holdings as BTC surged from $56,500 to $63,500 over the past two days.

Historical trends show that Bitfinex whale activity can often serve as a reliable indicator of price direction. When Bitcoin prices hit highs, whale long positions tend to bottom out, and these whales take advantage of market declines to add to their positions. Instead, whales gradually sell off positions as Bitcoin prices rise.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit