According to The Block, JP Morgan analysts have expressed doubts about the sustainability of strong cryptocurrency inflows so far this year, citing the current high price of Bitcoin.

Net inflows of $12 billion in crypto funds so far this year

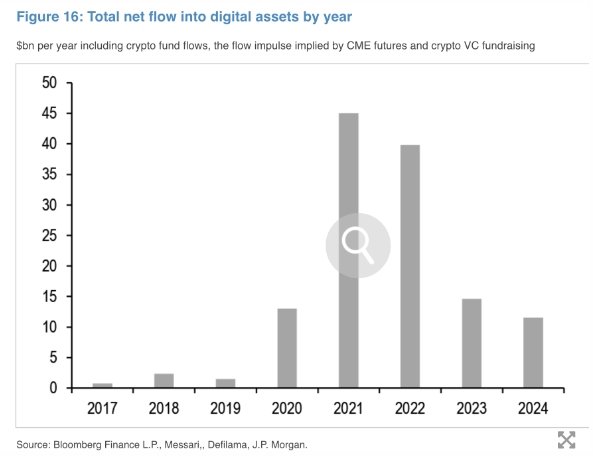

JP Morgan pointed out in its latest report that so far this year, the cryptocurrency market has seen a large inflow of funds driven by Bitcoin spot exchange-traded funds, which has now reached $16 billion. If the inflows from CME futures and crypto venture capital fund financing are added, the total inflow of cryptocurrencies so far this year has reached $25 billion. However, JP Morgan believes that not all of this represents new funds entering the market.

Due to cost-effectiveness, liquidity and regulatory advantages, many investors may have turned from crypto wallets on exchanges to Bitcoin spot ETFs. Analysts cited data from CryptoQuant, saying that since the launch of the ETF in January, the exchange's Bitcoin reserves have decreased by 220,000 Bitcoins, or $13 billion, and this shift is obvious. If this data is adjusted, the net inflow of crypto assets so far this year is about $12 billion.

ETF 16 billion + CME futures and crypto venture capital 9 billion - exchange 13 billion = 12 billion US dollars

Bitcoin prices are high, and capital inflows may be difficult to sustain

Although this rate is estimated to result in $26 billion in net inflows by the end of the year, JPMorgan Chase is skeptical about whether this growth rate can be maintained: Given that Bitcoin prices are high relative to its production costs or relative to gold prices, we are skeptical about whether the $12 billion growth rate from the beginning of the year can continue until the end of the year.

Last month, JPMorgan Chase raised its estimate of Bitcoin production costs from $42,000 to $45,000. At the time of writing, the price of Bitcoin was $66,500.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit