Introduction

Identifying the issues affecting a system does not count if you do not suggest or implement a solution to rectify the problems. Kragx network has observed several challenges affecting the traditional financial institutions due to the centralized system it operates on. The existing system majorly affects the investors and the services obtained from the financial institutions. Some of the issues noticed by the Kragx network in the financial industry due to the centralized system include human error, corruption, expensive third parties, the huge gap between the rich and the poor, and slow transaction processing time. With such issues limiting the operations and processes of a financial institution, which translates to inadequate services provided to clients, the Kragx network introduces its platform to address the issues affecting the structure of financial institutions.

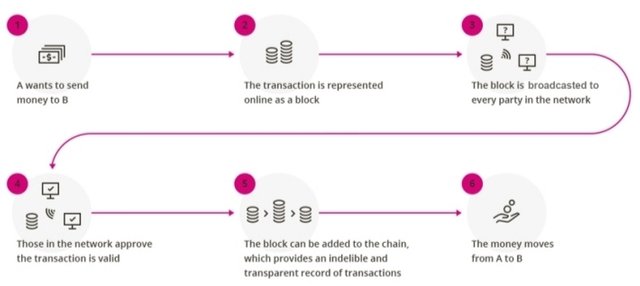

The approach of the Kragx network to tackle the centralized system issues focuses on utilizing its decentralized finance platform. Through its platform, Kragx can deliver improved processes and operations of handling financial transactions and payment systems. The decentralized finance platform of Kragx is powered by blockchain technology and it is based on this that it offers varied features and applications that facilitate better and improved financial alternatives. On this platform, clients and investors have a complete right and control over all their stored assets and investments. They also benefit from a high level of transparency and security available during transactions of their tokens and investments.

Kragx network is adopting blockchain technology features to eliminate the centralized system and institute a decentralized system. Some key solutions proffered by Kragx to deliver sustainable solutions to the existing financial structure issues through decentralized finance include the following:

Use of Smart Contracts

We can refer to smart contracts as the digital equivalent of legal contracts. It is drawn up when two or more parties are agreeing on a business or project. Unlike a legal contract that requires human supervision and execution, smart contracts operate as a self-enforcing software tool managed by a peer-to-peer network of computers that initiate, authorize, and execute the negotiations and agreement of a contract.

Smart contracts are enabled by blockchain technology and it is usually not effective and the transactions between the parties are not functional until all the conditions and agreements are met, which is validated electronically by a collection of independent computers configured with programs and codes, and without human interference. The use of smart contracts helps the involved parties avoid the interference of intermediaries, and this is because the blockchain technology that supports operates a decentralized system. This helps to eliminate the common issues of human error in enacting contracts and the chances of corruption. Smart contracts remove the high cost of intermediaries, enable a faster and affordable transaction or procedure, and improves security compared to regular contracts.

Kragx network integrated the use of smart contracts to develop their decentralized finance platform. Using smart contracts enable basic features such as seamless payments and transfers, as well as other credit financial instruments. Likewise, there are advanced applications delivered via the Kragx platform such as crypto-asset trading and derivatives, and they achieve these without any third parties. Additional solutions offered by the Kragx network based on the application of smart contracts include wealth management, insurance, trading, DeFi payments, derivatives, lending and borrowing, and many other prospective applications in the future.

The decentralized finance platform introduced by the Kragx network enables an automatic process across the entire financial system by integrating smart contracts. This improves the level of security and privacy and ensures proper and effective recordkeeping. Smart contracts remain the sustainable tool capable of resolving the majority of the issues in the financial sector caused by a centralized system.

Tokenization of Assets

Kragx platform uses its decentralized finance system to provide a digital representation of all the assets of its users, this is called tokenization. The process involves the addition of a value to the distributed ledger of the blockchain network, which gives access to all members of the DeFi framework of the blockchain to use the tokens. Clients can use the tokens to perform varied financial transactions such as exchanges, selling, borrowing, and investing. The tokenization of assets increases the speed of processing transactions and investments, as well as eliminates the occurrence of hideous data, market manipulation, and other kinds of financial corruption. It also enables an all-inclusive network by ensuring all investments and assets are available to everyone, regardless of financial status.

Faster and Cheaper Transactions

When any financial activity involves an intermediary or a third party, the cost of performing such a transaction increases, and the customer bears all the cost. However, the Kragx network, powered by blockchain technology, removes all intermediaries from the system; thereby making the processes involved – transactions, authorization, loan application, and other different applications requiring consultants – less expensive and at no cost. Oftentimes, there may be other costs different from the actual monetary cost in transactions, but these should be related to consulting financial services and professional advice on investments and technology use.

Open Lending Protocols

Kragx network uses blockchain technology to improve the loan and lending process on its decentralized finance platform. The entire process is similar to that of traditional banks, whereby users can deposit their assets or tokens and receive interests when the digital assets are borrowed by another customer. Despite the similarity of the processes, the management and validation of the terms of the lending protocols, linking the borrower to the lender, and interest allocation are all performed automatically on the Kragx network, whereas a central body oversees that of traditional banks. This helps to ensure that all lenders earn the total percentage of their profits from any investment, and enables a proper and vivid understanding of the risks and benefits involved.

Kragx network can deliver this sustainable lending solution because it is built on the Ethereum blockchain, which is the only blockchain network that enables open lending protocols. Lesser time is taken to process and execute these transactions, and users can use their digital assets as collateral instead of physical assets. Credit checks are not required to access these loans; hence, anyone can apply.

Projects Info

Website: https://kragx.io/

Whitepaper: https://kragx.io/whitepaper.pdf

Telegram: https://t.me/kragx_chat

Twitter: https://twitter.com/kragxk

Instagram: https://www.instagram.com/kragx_/

Reddit: https://www.reddit.com/user/Kragx_

YouTube: https://www.youtube.com/channel/UCQXzubCYqUb6dNMp3NEoW9w

Writers Info

Bitcointalk Username: Gadile

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2848249

Proof of Authentication: https://bitcointalk.org/index.php?topic=5313790.msg56516330#msg56516330

Eth Address: 0xCAf60e350847842Edaec7fFb9c11B6E51F0B6306