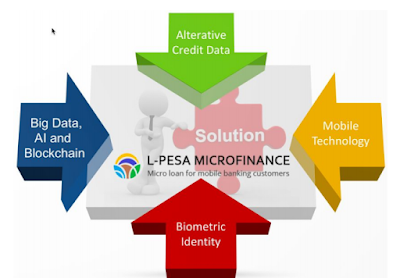

For most people is in need of capital loans. With a capital loan they can advance their business. If the loan is used appropriately then, their business will be fast, to grow. Seeing that L-Pesa created a smart blocker-based loan, which could make people all over the internet to advance their business and become successful entrepreneurs. A reliable visionary can take a loan in Ether or bitcoin and can then join the L-Pesa market that facilitates peer-to-peer loans that are the first crypto loan service in Africa. L- Pesa is a company that has validated its operation model over the last 18 months and has built advanced technology, automating most operations. about 25%. There are four important market forces gathered for scaling. Among them are Big Data, Artificial Intelligence and Blockchain, alternative credit data, mobile technology, biometric identity. However, traditional microfinance has limited reach, and the solution is targeted to poor farmers and small business owners. The middle class consumers and business owners in developing countries can not apply for credit, but the current financial infrastructure in these countries

does not support underwriting credit. The current marketplace presents a number of issues including:

-Underwriting. Traditional consumer and business credit reports used for underwriting loans in developed countries are generally unavailable, and loans without underwriting rights will result in high loss ratios.

-Lack of bank credit. Traditional bank loans are not widely available in developing country residents.

-microfinance only targets agriculture only on traditional microfinance institutions that typically provide loans to poor farmers in rural areas. Middle class consumers

do not have access to microfinance

-Outdated Operating models of banks as well as microfinance institutions are already high overhead costs, struggles with lack of data for underwriting loans, and generally fail to be taken

advantages of new technology

-Microfinance is targeting the poor only to consumers, farmers and small business owners in Indonesia. Developing countries above the lowest poverty levels have little chance of getting credit.

-Most consumers are un-banked. Many consumers, farmers and small business owners in developing countries do not have bank accounts.

Solution

The solution of the barriers presented above is described as barikut:

-Large Data, Artificial Intelligence, and Blockchain The new tool enables the storage of large amounts of data and extensive data analysis at a fraction of the cost some years ago.

Advances in Artificial Intelligence provide a new opportunity for automated loan underwriting. Blockchain technology allows for faster, more secure, and exchange rate is cheaper. Blockchain technology has just begun to revolutionize financial services and will result in enormous efficiencies over the next ten years - the blockchain has been described as internet money and will do for internet financial services for information and trading.

-Alternative Data Credits. Just a decade ago, there was little data available in most people in the world. This has changed with the emergence of social media and related trends of new tools that have been developed to make this data useful for decision making in underwriting loans. L-Pesa has developed a unique exclusive credit with a model based on user behavior combined with traditional and alternative credit data. L-Pesa competitors have developed their own proprietary models. The experience over the next decade will lead to revise best practices, which ultimately become the industry standard.

-Mobile technology. The rise of mobile phones over the past two years has been one of the most profound, technological and market changes in human history. Most humans now have mobile phones, and many own-owned smartphones. Mobile financial services such as M-Pesa have been available in many countries and support both banked and unencumbered populations. Based on market penetration of mobile phones (smartphones and feature phones), mobile money services like M-Pesa, Tigo Pesa and Paytm have very fast growth and have enabled L-Pesa.

-Biometric identity. Traditional microfinance relies heavily on large branch networks since identity verification, online and directly. India's Aadhaar biometric ID system leads world and has registered 99% of India's 1.2 billion people. Other countries that are expected to successfully follow India for the implementation of biometric ID will be generated dramatically reducing the cost and ability to provide financial services without a physical branch of the network.

Why Blockchain

The blockchain is an immutable public ledger that records digital transactions. This technology was first introduced by an anonymous individual under the pseudonym Satoshi Nakamoto in 2008 and has since revolutionized the way we conduct currency transactions worldwide. Blockchain enables trust to be distributed throughout a network, without the need for a central authority to track, verify and approve the digital exchange of value. It operates as a decentralized distributed database, maintaining a continuously growing list of records divided up into blocks. Legacy will take advantage of this technology to be decentralized and place its trust in its users. The blockchain is a fairly new technology and it is still in active development, improvements are happening continuously, and it has become more efficient and secure than the traditional antiquated systems, which is why banks, government, and other institutions are adopting the technology. Blockchains combine concepts of peer-to-peer networks, asymmetric cryptography, decentralized computing and smart contracts into a new technology platform. In short, blockchains are distributed peer-to-peer systems which implement a trustless shared public append-only transaction ledger.

Target market

The L-Pesa market target is a market of 40% of the population in the continent of Africa, India and southeast Asia. Its population is 3 billion and the population is growing very fast. India is at 92% penetration and many African countries are above 70%. L-Pesa work on smartphones and feature phones. L-Pesa relies on mobile money service providers for liquefaction and collection, making the process quick and efficient. Many countries were initially targeted by L-Pesa to have a high proportion of un-banked service populations on mobile money like M-Pesa is a good choice. India has a higher level percentage of population with bank account, and Aadhaar biometric ID

The database is now connected to the bank account, making the disbursement and Collections in India are potentially very efficient in the near future. Dependency on African money service users restricts L-Pesa users basis for users with mobile money service wallet. Until mid-2017, there about 170 million wallets are used in Africa. In India, more than 1 billion Aadhaar users have connected their bank account. The available L-Pesa market will far exceed L-Pesa's loan capacity and all its competitors in the future. Limiting factor for Growth is not expected to users will want to try L-Pesa but vice versa availability of capital for loans.

In Conclusion

L-PESA believes that with a solid and reliable team and system, it can provide Users with a secure and transparent financial and payment services, and provide users with a variety of benefits and conveniences in every financial activity they undertake. The L-PESA team also believes that with a systematic and professional development, Team L-PESA can build a better platform than similar platforms.

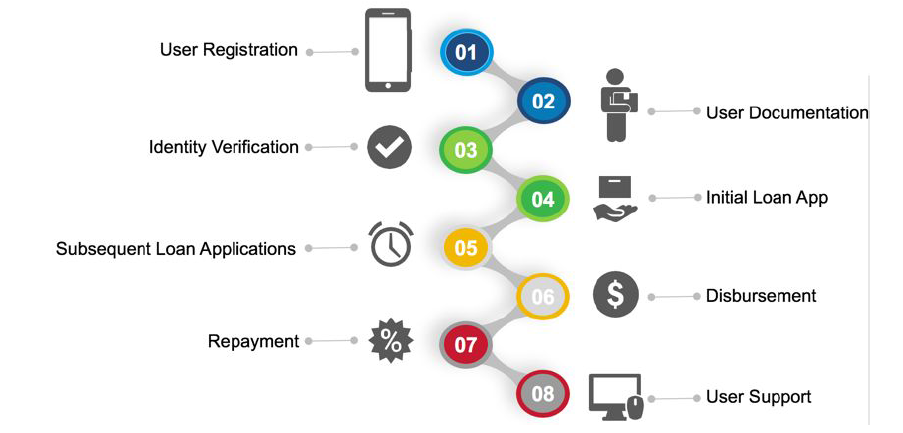

The key business model of L-Pesa is:

● A highly automated back office system that allows virtually complete task automation tasks

● Integration with mobile money providers to obtain efficient loans disbursement and collection of payments.

● The process of loan origination is very efficient - fully online and almost fully automatic

● Model of customized credit rating that has been adjusted

The first 35,000 loans issued by L-Pesa resulted in a loss ratio below 10%.

Advantages

L-Pesa customers have access to affordable financing options helping them improve their lives Provider of third party capital L-Pesa may use its capital get interesting results Shareholders and employees of L-Pesa can obtain reasonable returns on their investment and workforce

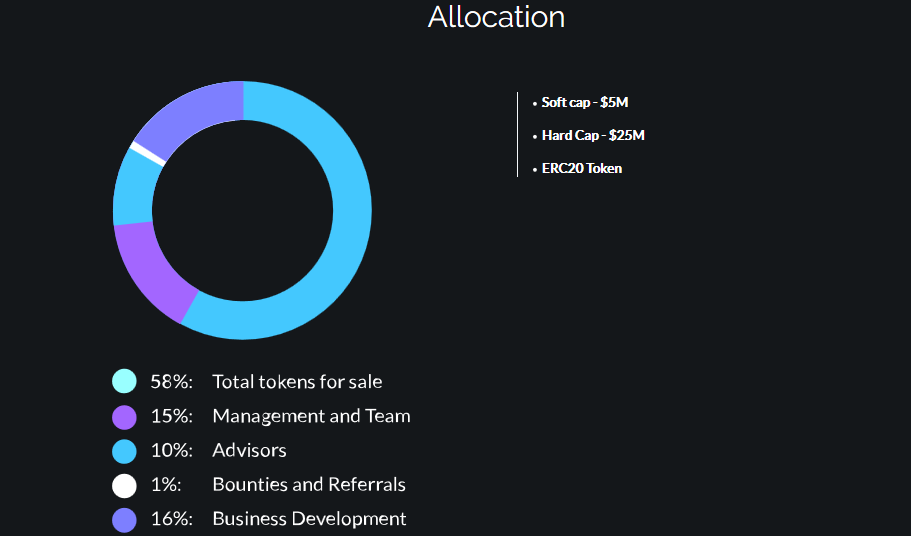

Token L-Pesa

Token name: KRIPTON

Token ticker: LPK

Owner Token: L-Pesa International Business ltd., Gibraltar.

Token type: Ethereum ERC20

Total Token issued: a maximum of 3,200,000,000. The final amount

the token created will be calculated according to the final contribution amount.

The final number will be issued at the end of ICO.

Token distribution

57% Public (out of all created tokens),

Team and Advisory 20%,

Bounties Program 1%

22% Reserve (airdrop)

Locking period: L-Pesa underwent 12 months of confinement.

Transfer Token: Token will be transferred to buyer upon payment of ICO confirmation / settlement. Token will be activated only after ICO completion. Furthermore, token transfers will only exist probably after successfully completing ICO.

ROADMAP

Pre - sale starting March 10, 2018

Pre-sale ends on April 9, 2018

ICO starts on 10 April 10 2018

ICO expires on 10 June 10 2018

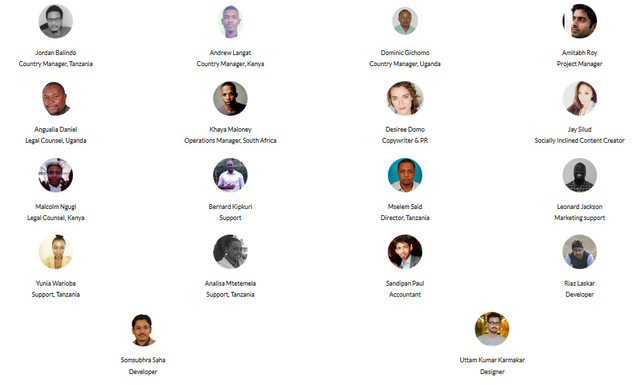

TEAM

More info:

Wedsite: https://kriptonofafrica.com/

whitepaper: https://kriptonofafrica.com/static/pdfs/L-Pesa_ICO_white_paper_Jan_7_2018.pdf

ANN: https://bitcointalk.org/index.php?topic=2873068.0

facebook: https://www.facebook.com/kriptonlpk/

telegram: https://t.me/joinchat/HbNNkBLQJkw7765Ri7tg7w

twitter: https://twitter.com/LPesaMicrofin

bounty: https://bitcointalk.org/index.php?topic=2910183.0

author: Blaizer

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=1805036