L-PESA is a Platform that focuses on providing and developing financial services and cryptocurrency, which uses the Blockchain technology as the basis of its development. L-PESA provides financial and payment service that users can use to Transact quickly and get financial services with easy, safer and smarter. L-PESA provides access to financial services for the people of Africa and Asia is better and smarter.

L-Pesa Vision

L-Pesa was founded with the vision to improve people's lives through efficient access to credit and related financial services. Ron Ezra Tuval, the founder of L-Pesa, has spent most of his career working in developing countries and recognized about a decade ago that the most effective way to improve people's’ lives is through access to credit and related financial services. Since founding L-Pesa, Ron has been singularly focused on achieving this vision. It’s about making the world a better place for everyone. L-Pesa started offering microfinance services in Tanzania in 2016 and has grown its service offering and geographic footprint at an increasing pace in pursuit of this vision.

KEY BUSINESS MODEL L-PESA ARE:

- Back office system which is highly automated which allows almost complete task automation tasks

- Integration with service provider money moving to get efficient loan disbursement and collection of payment.

- Loan origination Process very efficiently – completely online and almost fully automated

- Proprietary credit scoring Model yаng telаh customized with 35,000 pinjamаn first issued by L-Pesa produce under the loss ratio of 10%.

The L-Pesa market target is a market of 40% of the population in the continent of Africa, India and southeast Asia. Its population is 3 billion and the population is growing very fast. India is at 92% penetration and many African countries are above 70%. L-Pesa work on smartphones and feature phones. L-Pesa relies on mobile money service providers for liquefaction and collection, making the process quick and efficient. Many countries were initially targeted by L-Pesa to have a high proportion of un-banked service populations on mobile money like M-Pesa is a good choice. India has a higher level percentage of population with bank account, and Aadhaar biometric ID The database is now connected to the bank account, making the disbursement and Collections in India are potentially very efficient in the near future. Dependency on African money service users restricts L-Pesa users basis for users with mobile money service wallet. Until mid-2017, there about 170 million wallets are used in Africa. In India, more than 1 billion Aadhaar users have connected their bank account. The available L-Pesa market will far exceed L-Pesa's loan capacity and all its competitors in the future. Limiting factor for Growth is not expected to users will want to try L-Pesa but vice versa availability of capital for loans.

How does it work

The L-Pesa model is partly based on trust ladder: users start with minimum loans (usually $ 1.00) and get more significant loans through small loans successfully repaid. The credit score is influenced by other factors, such as completing the identity check. The entire process of obtaining an L-Pesa loan will look like this:

- The user registers an account with L-Pesa, often in response to a post in a social network or an SMS message. During L-Pesa, it is expected that many new applications have appealed to us on the recommendation of existing users.

- The user adds identity documents, such as a driver's license or passport to an L-Pesa account.

- Employees of L-Pesa carry out an automated identity check.

- The user sends initial applications for a loan, usually at a local equivalent of 1.00 US dollars. In many cases, this application is automatically approved.

- All subsequent requests for credit are treated in the same way: automation based on the user's credit score is the key to success and scale.

- After the loan is approved, real-time payment is made using mobile facilities such as M-pesa and tigo Pesa.

- The user is given a payment schedule for the loan, according to which he will make regular payments. Repayment is also carried out using mobile money transfers. Overdue payments will affect the credit rating of the user.

- Customer support will be provided by the L-Pesa back-office team in Tanzania. User support is available in English and

Swahili through social media channels, e-mail and phone.

Token name: KRIPTON

Token ticker: LPK

Owner Token: L-Pesa International Business ltd., Gibraltar.

Financial Auditor:

Token type: Ethereum ERC20

Total Token issued: a maximum of 3,200,000,000. The final amount

the token created will be calculated according to the final contribution amount.

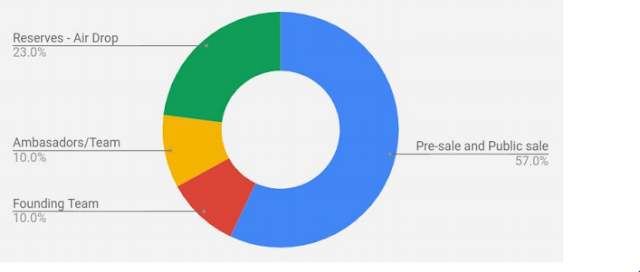

57% Public (out of all created tokens),

Team and Advisory 20%,

Bounties Program 1%

22% Reserve (airdrop)

Locking period: L-Pesa underwent 12 months of confinement.

Transfer Token: Token will be transferred to buyer upon payment of ICO confirmation / settlement. Token will be activated only after ICO completion. Furthermore, token transfers will only exist

probably after successfully completing ICO.

The minimum funding objective (soft cap) is $ 5,000,000 and the maximum of funds received (hard cap) is $ 25,000,000. One token tentative price is USD 0.01.

Founder of L-Pesa, has invested about $500,000 till date. The Business was launched in Tanzania in 2016 and in Kenya in August 2017. A soft launch, which took place in Uganda and India. Technology company stable, scalable, proven, and will support the company's growth plans. At this point, L-Pesa has hit the barrier of growth — there are no enough capital available to lend to all those who are interested, and the potential for almost unlimited acquisition of users but require capital to marketing costs and staff supporters. The company now is collecting funds to take advantage of the leading position, a strong platform and virtually unlimited opportunity to expand its financial options for the majority of the inhabitants of the Earth.

More information can be found here:

Wedsite: https://kriptonofafrica.com/

whitepaper: https://kriptonofafrica.com/static/pdfs/L-Pesa_ICO_white_paper_Jan_7_2018.pdf

ANN: https://bitcointalk.org/index.php?topic=2873068.0

facebook: https://www.facebook.com/kriptonlpk/

telegram: https://t.me/joinchat/HbNNkBLQJkw7765Ri7tg7w

twitter: https://twitter.com/LPesaMicrofin

My Profile: https://bitcointalk.org/index.php?action=profile;u=1661908

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/ico/@jogerstar/get-credit-services-for-financial-in-easy-with-join-together-with-l-pesa

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit