Bitcoin extended its losing streak Friday, as prices fell to fresh two-week lows in the wake of an unprecedented run that sent the cryptocurrency toward $20,000.

BTC/USD Price Levels

The value of bitcoin fell for a fifth consecutive day Friday, as the market resumed its downward correction. BTC/USD plunged 8.5%, or $1,320, to $14,284 through the early morning. That’s the lowest level since Dec. 7 when prices were trekking sharply higher.

With the latest drop, bitcoin has shed $3,000 over the past five days, bringing its total market cap back down to $243 billion. Bitcoin’s total market cap blew past $300 billion earlier this month.

Trade volumes in the cryptocurrency remained elevated Friday, with the total value of transactions exceeding $17.3 billion over the past 24 hours. Brokers that saw the highest turnover include Bitfinex, Coinbase’s GDAX and Poloniex. South Korea’s Bithumb was also among the highest in terms of daily turnover.

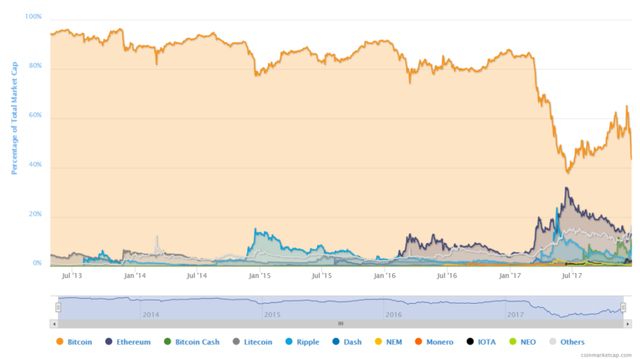

At current price levels, bitcoin owns roughly 47% of the cryptocurrency market by capitalization. This figure has deteriorated sharply throughout the year as altcoins continued to advance. The value of all cryptocurrencies in circulation was around $551 billion on Friday, which is about $100 billion short of record highs.

Bitcoin wasn’t the only crypto to report declines. All but two of the top-26 cryptocurrencies were trading in negative territory on Friday. Ripple and List continued to defy the odds.

Bitcoin Billionaires and the Future of Institutional Investment

The arrival of bitcoin futures has been heralded as a major achievement for the digital asset class, and one that could take prices to new highs on the strength of institutional demand. Of course, the reality is not that simple. A key cog in the equation is how the so-called ‘bitcoin billionaires’ react to the new investment vehicle.

Bitcoin’s market is highly concentrated, with roughly 1,000 people holding an estimated 40% of all tokens. That’s an average of $350 million per head. The key question is whether institutional vehicles, such as futures, will compel these investors to reduce their holdings in exchange for cash. If this were to happen, a certain percentage of bitcoin would be taken off the market and held as option collateral. This could provide the market with much-needed stability and ensure that current prices represent actual quantities of bitcoin.

More bitcoin taken off the market likely means greater custodial ownership among financial institutions, thereby broadening the digital currency’s ownership base. However, this isn’t as easy as it sounds. As Aaron Brown of Bloomberg notes, “There are few entities with institutional access to bitcoin derivatives trading and expertise with trading and holding physical bitcoin. That has to change for bitcoin to join the global financial system.”

At the same time, there’s no guarantee that bitcoin holders will liquidate their positions anytime soon. Bitcoin’s huge valuation is expected to go even higher in the medium term, with some credible voices predicting $50,000 a coin in the not-too-distant future. Brown notes “institutional investment in bitcoin will remain problematic” should the market remain concentrated.

Source: Hacked

I think it will continue to go down a little more. after that it might increase its value or be stable at around $ 10000 . I don't think it will plunge down as it did before. This loss in value might be mainly due Emil Oldenburg selling his coins and investing in BCH.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Support at $13000 is holding for now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/bitcoin-drops-to-two-week-lows-as-institutional-investment-presents-conundrum/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The bitcoin currency will be flucating daily

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit