(Bloomberg Gadfly) -- Hedge fund managers have been lying awake at night for years worrying about poor performance, weak volatility and whether it might be time to just move on and do something else -- like get into bitcoin maybe.

The allure of 1,000 percent returns in a market of unsophisticated punters who behave in herd-like ways is undeniable. But how long before crypto fund managers start having their own bedtime terrors?

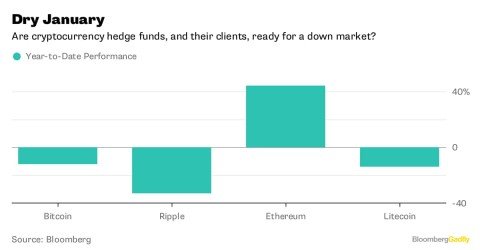

Beating the stock market with a bitcoin in your pocket wasn't very difficult in 2017, but it's been getting much harder since. The price of bitcoin has fallen from about $14,300 to $11,900, a drop of 17 percent, even if that's well above the $10,000 level that seemed so ludicrous barely a month ago.

The array of alternatives to bitcoin out there doesn't make it much easier to find the next big hit, either. Frenzied speculation has seen Ripple tumble 60 percent in 10 days and Litecoin by 35 percent. A 2 percent increase for the boring old S&P 500 doesn't seem so bad.

While hedge funds should be better placed versus the retail crowd dominating the crypto markets -- given they're supposed to hedge, after all -- there aren't too many ways to profit from an indiscriminate selloff across crypto-land.

This is not a mature market that can easily accommodate short-selling or derivatives. Bitcoin is the exception, with futures contracts allowing traders to profit from recent falls. But the bullish side of the trade has lost money. And most of the crypto-focused hedge funds surveyed by Bloomberg News traded more than just bitcoin. They got into this market because it was booming.

Then there's the question of client sentiment. Managers of the Altana Digital Currency Fund last year warned customers that they should invest only a "fraction" of their net worth. So maybe these clients have deep enough pockets to ride the rough with the smooth.

But at what point do investors start to wonder if their fund's 1,496-percent gain last year is as good as it ever gets? If the offer on the table is for clients to redeem their holdings every quarter, or every month, how long before they decide to take it up? Just because you've invested what you can afford to lose, it doesn't mean you'd want to lose it.

The hedge fund industry has had an awkward few years trying to justify rich fees and weak performance. Bitcoin and cryptocurrencies seem to offer an escape to managers and clients alike: Mind-boggling profit, a market full of amateurs and arbitrage opportunities galore.

Maybe the smart money is sharp enough to navigate 1,000 volatile currencies. But there's a chance that the returns on offer won't justify the risks being taken, which in some cases include leverage. Mike Novogratz, who delayed his planned crypto hedge fund last month, might be the one sleeping soundest.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Gadfly columnist covering finance and markets. He previously worked at Reuters and Forbes.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.cetusnews.com/news/The-Siren-Call-of-1-000-Percent-Returns.B1jDgds4f.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit