Good Morning,

Platinum Subscribers

This week we are going to be having the MPC official bank votes, Monetary Policy summary and the official bank rate decision. Firstly, let’s understand what each event is and what It means for traders:

The Bank of England’s Monetary Policy Committee (MPC) meeting is a regular session held by the MPC, in which it sets the UK’s base interest rate (and other monetary policies).

THE OFFICIAL BANK RATE

The committee’s aim is to choose an interest rate that will enable the government’s inflation target to be met. This target is currently 2%. The official bank rate is something many of you know already, this is the rate at which BOE lends to financial institutions and of course will eventually make it down into mortgages and loans etc.

Now, why is this MPC vote an important one, the reason this is an important vote is due to the pressure for the BOE to increase rates? We expect a 7-2 vote, but risks of a 6-3 vote should not be discounted. What this means is that an extra member of the MPC votes to increase rates, this would cause GBP to become very volatile at the time of the announcement if this is made.

If we look closely at the who each MPC member is and what they monetary outlook for BOE, we can see most of the member are Hawkish. Hawkish meaning a positive sentiment to the economy and target inflation figures. With only one member being dovish and the rest with a centrist view to the current economy.

THE USA INCREASED RATES

We have already seen how the US have increased rates systematically over the course of the last 18 months all the way up to 1.75%. We could see a turn for the BOE in the same direction over the course of the next 18 months. The question is how to trade to take advantage of these fundamental moves in the market?

This is where Platinum comes in for you, the trader. We have decided to provide you with a potential trade on the GBP/USD. This is just an example of how to trade and how we work when it comes to providing opportunities for our clients, we do this every day and every week on a regular basis. Today’s blog is a demonstration of the type of Fundamental and Technical analysis you can receive if you were a member.

HOW TO TRADE GBP/USD

TECHNICAL POINT OF VIEW ON THE GBP/USD

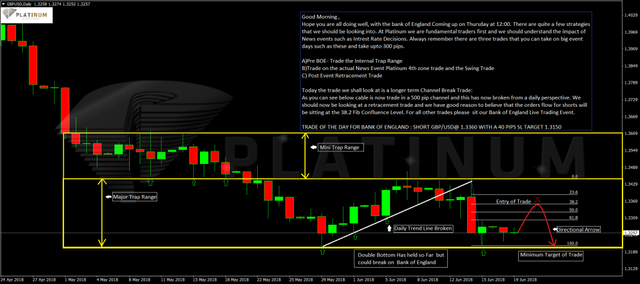

This a typical example of a breakout strategy we use on our major pairs. We can see from the chart, we have a perfect supply level forming. A recent breakout of the demand has allowed this to come into play, the breakout due to the US news last week. Now we will be looking for a short on the confluence 38.2% supply area.

LEARN TO TRADE BANK OF ENGLAND, FOMC & ECB AND MAKE OVER 3000 PIPS!

TRADE ENTRY: A) SHORT GBPUSD @ 1.3370 WITH 40 PIPS STOP LOSS AND TARGET 1.3050

KEY TECHNICAL LEVELS ON THE GBP/USD

3100 – Long term Buying Level

3050 – Long term Buying Level

3500 – Long term Selling Level

3550 – Long term Selling Level

UNDERSTAND BANK OF ENGLAND INTEREST RATE DECISIONS

WHAT IS THE BANK OF ENGLAND’S MPC MEETING?

The Bank of England’s Monetary Policy Committee (MPC) meeting is a regular session held by the MPC, in which it sets the UK’s base interest rate (and other monetary policies). The committee’s aim is to choose an interest rate that will enable the government’s inflation target to be met. This target is currently 2%.

HOW DOES THE BANK OF ENGLAND MEETING AFFECT TRADERS?

MPC meetings are important dates in spread betting and CFD traders’ calendars as they set the official interest rate in the UK.

This UK interest rate is the rate at which the Bank will lend money to commercial banks. However, it also influences the rates set by commercial banks and other lenders, causing ripple effects across the UK economy. These include changes in demand for bonds, stocks, currency, and other securities, as well as consumer spending and inflation.

The committee also decides whether quantitative easing (QE) is required. This is a measure the Bank can use to inject money directly into the economy with the aim of boosting spending.

Traders and investors need to pay close attention to MPC meetings and adapt their investment strategies and portfolios in response to any policy decisions.

WHY IS THE INTEREST RATE IMPORTANT TO TRADERS?

Traders search for any indication of what the UK interest rate and monetary policies will be in the future. If they can get their predictions right, they can change their strategy ahead of the announcement and maximise their profits. An interest rate hike, for example, is likely to increase the value of the pound but reduce the value of stocks, bonds, indices (e.g. FTSE 100) and other securities. Lowering interest rates or implementing quantitative easing, on the other hand, is likely to have the opposite effect.

Traders look at the composition of the MPC and make predictions about the policies each member will vote for, as well as broader economic factors such as Brexit, which could influence the committee.

IN WHAT WAY DOES MPC INFLUENCE INFLATION?

The MPC is responsible for setting monetary policy, with the aim of meeting the government’s inflation targets. The MPC has two policy tools which it can use to influence the rate of inflation. These are the BOEBR and asset purchase facility (APF), both of which allow the Bank to influence the supply of money across the economy.

Setting the UK interest rate

The Bank of England Base Rate (BOEBR), also known as the official bank rate, is the rate of interest charged by the BoE to commercial banks for overnight loans. It is the base rate of interest for the UK economy and has a strong impact on the short and long-term interest rates charged by commercial banks.

When the base rate is lowered, banks are encouraged to borrow more money from the BoE and lower their own interest rates. This reduces the cost of borrowing for businesses and consumers, enabling them to borrow and spend more. Conversely, if the base rate rises, borrowing money from the BoE is discouraged, leading banks to increase their own interest rates. This increases the cost of capital for businesses and consumers, making borrowing more expensive and incentivising saving.

These effects ripple across the global economy, affecting the financial markets, FX rates, and eventually economic factors like unemployment and inflation.

Quantitative easing

Quantitative easing (QE) is the process by which a bank creates new money electronically and uses it to purchase assets. The BoE’s QE programme is called the asset purchase facility (APF) and has mainly been used to buy government bonds from private sector businesses, plus a limited number of high-quality commercial bonds.

This injection of cash into the economy increases the demand for the purchased assets, causing their prices to rise and their yields to fall. Those selling the bonds will, therefore, look to invest the proceeds elsewhere to maximise their return, resulting in a money multiplier effect. The result of this cash injection is therefore wide-ranging, affecting spending and the liquidity of assets across the economy and reducing the cost of borrowing for businesses and consumers.

If inflation rates increase beyond the government’s target, the MPC has the ability to sell a portion or all of its assets to reverse the effect.

Bank of England meeting dates

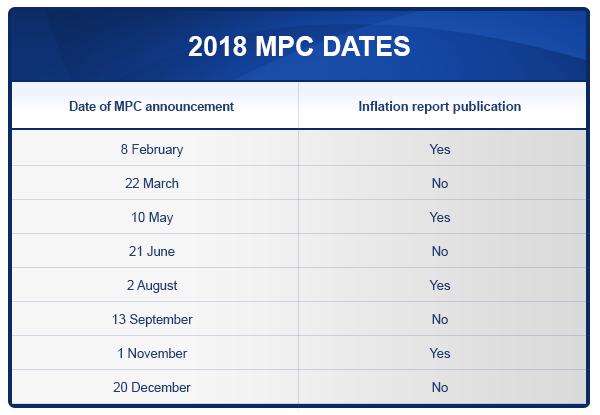

The MPC meets eight times a year, following a briefing by Bank of England staff, with each meeting lasting a total of three days. The meetings involve a discussion of the latest economic data from the Bank of England and what policies should be implemented to help the MPC achieve its aims.

The committee votes on the third day, with the interest rate decision, published the following Thursday at 12 pm (UK time). The committee also publishes an inflation report after every other meeting.

2018 Dates of MPC Announcements

Who are the key people on the MPC?

The MPC is made up of five members of the Bank of England – the governor, three deputy governors and the chief economist – and four economic experts appointed by the chancellor of the exchequer.

Each member has one vote with the governor voting last; this makes their vote decisive in case of a tie. All members serve fixed terms (three years for HM Treasury appointees) before being replaced or reappointed.

Analysts will often try to predict what policies committee members will vote for by classifying them as monetary hawks and doves.

2018 committee members

LEARN TO TRADE BANK OF ENGLAND, FOMC & ECB AND MAKE OVER 3000 PIPS!

How to become a profitable Trader.

If you are a new trader and would like to learn how to trade, then sign up today to our 2-day free Foundation to Forex Trading Course. We have just introduced this as in the last month we have had a lot of inquiries on learning how to trade the financial markets. We can get you on the successful path of becoming a Financial Trader.

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.