INTRODUCTION

Mergers and acquisitions (M&A) can be defined as consolidation of companies. The two word are often used in place of another but they aren't precisely the same. Differentiating the two terms, Mergers is a kind of business strategy where two companies combine to form one, while acquisition is a kind of business model where a more booming company takes over another company. M&A is one of the major aspects of corporate finance world. The general idea behind M&A is that when two separate companies join together the result is more attractive and valuable compared to being on an individual stand. With the aim of wealth maximization and business expansion companies always evaluate different opportunities through the route of merger or acquisition.

Mergers and acquisitions (M&A) provide organizations, businesses both large and small, with an opportunity to accelerate strategic growth, through purchasing of other asset which grants the aquirer access to intellectual property, human capital and host of other assets effortlessly and at faster rate.

However, the current traditional M&A business and finance process is highly centralized, outdated and fragmented to the extent that it takes years for a successful M&A consensus and transactions are concluded and also buyers or seller's in the industry has to pay a very huge sum to intermediaries to either asses the products they are buying or to locate a buyer for their products, this has been the bane of this great industry. To date, there has not been an efficient way for

sellers to find buyers who can carry the torch of a faltering business. In turn, buyers

usually do not have a consistent source of deal-flow outside of their inner circle, even when a buyer and seller do manage to find each other, the process itself which is the main challenge here is unjustly complex, involving many intermediaries such as corporate lawyers, investment banks, financial advisors and assessor's, calling the service of such intermediaries comes at a very high cost, this process inhibit many start ups with low funds which might have been an attractive acquisition target if only it had access to the right buyers and expertise. Other M&A challenges include

Pricing difficulties, arriving at an acceptable valuations is very difficult in the present M&A process.

High cost of transactions, due to numerous commissions paid to intermediaries.

Intellectual property challenges.

THE LEXIT PLATFORM

LEXIT believe that it's high time M&A transaction process is transformed and brought to the era of smart contract and digitalization to enable an efficient process and in the sector which allow more entries of both large and small businesses. Just as eBay revolutionized peer-to-peer commerce and Airbnb brought aggregation

platforms to the forefront, LEXIT will bring increased efficiency and liquidity to M&A

transactions, all these will be done within one secure platform.

HOW LEXIT AIMS TO REVOLUTIONIZE M&A BUSINESS MODEL

Through building a marketplace that brings both buyers and sellers together, giving them

global access to assets and opportunityThrough the addition of assessors and field experts who help to assess and confirm reliability of an ASSET.

LEXIT platform has a secure, digital deal room where transactions are finalized quickly

Lexit platform utilized blockchain technology, for its security and transparency

Through token economics: lexit introduced it's native currency to be used in the platform for easy and efficient transactions.

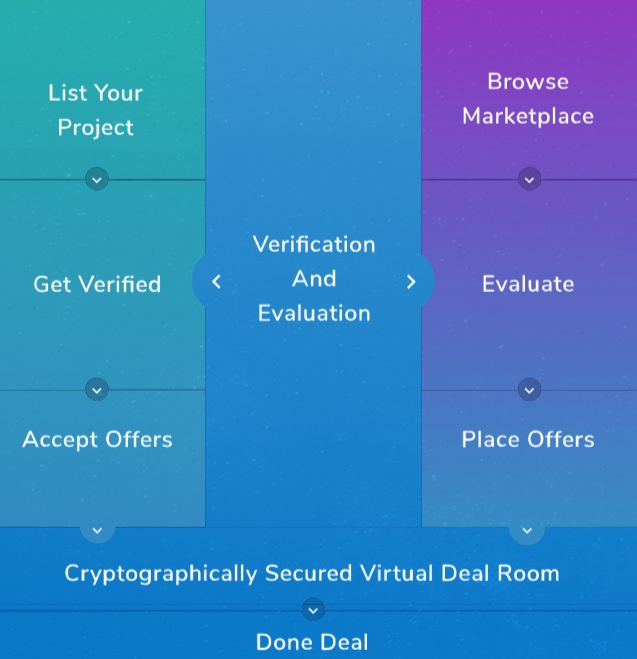

Graphical example of how lexit works

LEXIT believes by taking away the bottlenecks of the current M&A process, M&A transactions will close in a very short time, lexit platform will empower entrepreneurs, businesses to know the true value if their assets in a highly liquid marketplace at almost zero cost.

CONCLUSION

Lexit platform aims to make today’s mergers and acquisitions as simple,

seamless, and lucrative as ever by revolutionizing how M&A transaction processes are conducted, The increased liquidity and market-efficiency of lexit platform will promote innovation and growth of the industry, and at the same time reduce costs and risk for all parties involved.

Lexit token

Lexit token (LXT) is the platform's native currency, built on stable ethereum blockchain (ERC20) to curb price fluctuations, it will be used in the platform to perform an efficient, secure and transparent M&A transactions at low cost

MORE INFORMATION, VISIT THE LINKS BELOW

AUTHORS EMAIL: [email protected]