With the growth, spread, and expansion of technology to all facets of human life and endeavors, the financial sector has benefited immensely. Ultra-fast transactions, cross-border or continental banking, has become a reality etc. However many people have not benefited anywhere from these financial firms, thus basically creating an unbanked population. To further worsen the scenario, many do not care about the rising spread of digital crypto assets or regard it as legal tender, thus cutting off another section of the community.

The traditional banking system seems out of touch with 21st-century issues and problems either in higher commissions charged by these financial firms or their crazy interest rates. in fact, accessing credit services comes with lots of hurdles even for salaried earners especially in third world developing nations. Also KYC - know your customer is a basic prerequisite condition for most of these finance houses thus getting many who are desirous of accessing banking facilities but having little or incomplete identification caught in the middle. Libra credit thus steps forth to bring hope by keeping to its vision of credit for the world…Thus aiming to bridge the gap of the unbanked and to achieve credit service for all. Irrespective of nationality, race or even location.

Libra Credit

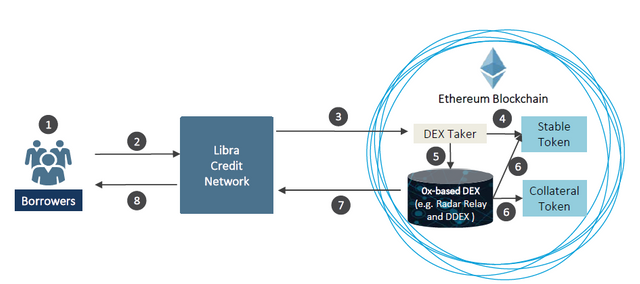

Libra Credit is a decentralized lending platform that leverages on the power of the blockchain technology to create open and unrestricted access to lending services, irrespective of your location and at any time of the day. Basically, the aim is to serve the unbanked population worldwide, especially those with digital assets, using its extensive and broad partnership networks plus an artificial intelligence based proprietary credit assessment system. Hence, participants, i.e borrowers can put in their digital assets (crypto) as collateral in exchange for loans in fiat. With Libra credit sitting on the blockchain, it has smart contracts running and patented collateral valuation and liquidity mechanism in place.

Thus Libra credit aims to blaze the trail as the first lending ecosystem of its kind by spreading its tentacles to bring in partnership from across the board and these covers

- An In-house Proprietary AI-based Credit assessment model

- Customer acquisition and E-wallet partnership network

- Smart Contract Suites developed on the Ethereum blockchain

- Lenders & Stablecoin Partnership Network

- Exchange & Custodian Partnership Network

- Identity Verification Partnership Network to solve KYC & verification issues.

Token Details

Token to be referred to as LBA

Type : Erc20

Ico price : 1 LBA = 0.1 USD

Total Supply - 1,000,000,000

Payment method: Ethereum

Conclusion

it is worthy of note that presently, both lenders and borrowers in the present banking system face difficulties and to make issues worst, some countries have terrible banking regulations that are choking not only to borrowers but even investors. Thus Libra Credit steps in with a platform that is decentralized to take control away from these traditional credit operators, basically sidelining them and giving the unbanked service(s) that they need. The Libra credit ecosystem will benefit all parties involved and the transactions will be safe, secure since it's on the blockchain network.

To have an in-depth understanding of Libra credit innovative lending ecosystem, please you can visit any or all of the links below.

Website - https://www.libracredit.io

Whitepaper - https://www.libracredit.io/page/Libra_Credit_Whitepaper.pdf

Telegram - https://t.me/libraofficial

Twitter - https://twitter.com/LibraCredit

LinkedIn - https://www.linkedin.com/company/18560125/

Writer - OtunbaGhadafi

Bitcointalk profile- https://bitcointalk.org/index.php?action=profile;u=1209874;

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed 🙂

P.S.: My Recent Post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How do I know this will not end like other lending platforms that ended as scams?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Is the issue of. Collateral also involved here?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ofcourse but with libra credit, your collateral can be a crypto asset and libra will give you a loan based on that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed a new face of lending. Any information on tokensale??

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes its in the article, you must have missed it. 1 LBA = 0.1 usd

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With the collapse of previous lending platforms and the clampdown by sec , what measures have you put in place to surmount hurdles from any quaters

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Every modalities have been put in place. Having studied other lending platforms and seen the pitfalls, libra credit works on its platform to disrupt the financial sector and bring hope (credit/financial lines) to the unbanked even in third world nations

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've taken a keen interesting on writing about banking the unbanked. Maybe you and I could collaborate on something similar? You can read more about my post on https://steemit.com/introduceyourself/@tanhongjie/hello-steemit-i-m-hong-jie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit