Why The Euro Was Always Destined To Fail

Ill admit when the Euro was introduced in the late 90s, it seemed like a noble idea. Hypothetically with one currency, countries that were so close together could more easily transact with each other and tourists would be able to just buy one currency if they were travelling through Europe. However, if you read articles at the time, many very smart economists were warning of future problems with the currency that have now come to fruition. The basic fact of the matter is, grouping governments with entirely different ideals, ways of life and people under one currency and one Central bank is an idea that is doomed from the start.

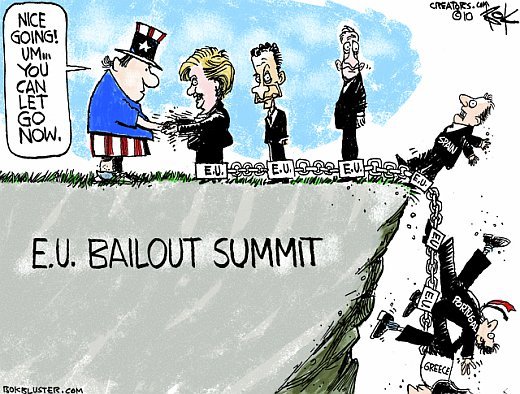

We have seen in the past five years multiple Euro based countries that have either needed to be bailed out or required stimulus. However because one government does not control the central bank, they must rely on their peers to okay the help. I hate Central Banks and the Federal Reserve as much as the next person, but the way our current fiat based economy works, without complete control of a central bank, you cant fully take actions to help control your economy. Governments have two main options they can take when it comes to using a central bank to help economic growth, one would be lowing or raising interest rates and another would be printing money. A government that can print endless amounts of money will almost never default but they will all faith from foreign investors or piss off their own people and leaders will be unelected. If Greece had the power to print currency during its crises, they would have never defaulted. Taking away essential tools that modern governments use to influence their economies will eventually lead to countries switching back because of pressure.

Next , probably the most important part is grouping together multiple countries that have different people, beliefs and ways of life under a single currency. I recently wrote an article about smaller countries and how they can be more effective and there is a reason for that. Greek people have totally different monetary ideas and beliefs than German people, yet they are grouped under the same currency. It doesn’t matter if Greece’s system is worse, Germany will then need to pick up the slack. If Germany had any real pull on Greece’s government, things might be different , but as it stands they can only make recommendations and scold bad behavior. Other countries have no real way to force a bad actor to abide by the rules, other than kicking them out, which is near impossible with how things are put together. This was one of the major skepticisms in the 90s when the Euro was proposed, but people were blinded by the possibility of economic prosperity that they ignored fundamental problems with a system that was going to largely change an entire continent.

There are ways to fix the Euro to make it work, especially in the digital age, but it would require every country to go back to their own currencies, while still accepting the euro as well. If we were using completely digital money and could easily make the transfer between, say the Sterling and the Euro, this could be easily done, but today that is not the case. If we wanted to group a group of countries into one economic union, in my opinion, we would need a reserve currency controlled by no central bank or influenced by any institution, with a capped amount, that countries could transact with eachother in and freely move between their own currency and this reserve currency. Because countries will still have the power of their own central banks, they can use their tools to influence the economy in how they see fit, while still having a reserve currency that would reflect the change.

This is where I originally saw the possible use case for bitcoin, or a cryptocurrency like it, which is what made me excited. Rather than a Euro which is influenced by a private bank, a decentralized global currency that countries would transact in and everyone around the world would accept because it would instantly go into their own currency is the end game in my opinion. Many countries settle deals in currencies that can be just as volatile as their own, but if we have a global currency, it would act as a way to pit all existing currencies against each other to reflect the purchasing power of each one.

The Euro was destined to fail by design from the beginning because of the fundamental differences that human beings have. Even if they are just a few hundred miles away, their beliefs and ideas about money and how government and economies should work can be entirely different. Putting these people under the same currency was a foolish idea. In my opinion, I completely expect the Euro to not exist in another 20-30 years, if not earlier. Already countries are threatening to back out and its only a matter of time before the prosperous countries with good monetary policy, that are picking up the slack of others are going to say they have had enough. Let me know what you guys personally think below.

-Calaber24p

great article - this was inevitable. Britain wanted to stay away from the crisis so they left and wanted to have nothing more to do with it, and now we'll see what will happen next!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

no one is going to back out. At this point, it's really not POSSIBLE. For the 1st time ever, we are seeing a new form of federal union and it will need time to establish and consolidate its position. Euro progress is slowed down because of the double recession (mind you, the financial collapse started in USA). Anyway, most of the countries "lied" about their economic growth, there were criteria to join the EURO zone, thus we are seeing the economic crisis in Italy, Spain, Greece etc.

Have you checked lately what's happening in UK? ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its never too late to back out, just look at the Soviet Union, they were one of the most stable collectives in the world, up until they weren't. The UK never used the Euro though, the EU can be successful with trade partnerships and strengthening relationships, but all those countries under a single currency, I dont see lasting. It works if every country acts fiscally responsible, but when has that ever happened?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

oh yes. their economy is doing well, you know (sarcasm). You can't compare Soviet Union with EU. totally different political and economic systems.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Truth~

However Every fiat currency ever implemented fails. Its part of the design of the global elite bankers. They raise and collapse economies with their control over fiat currencies to allocate and transfer wealth from the people.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think there can be a successful fiat currency if it is tightly controlled, which is a risk since people inherently act in their own interests. However there needs to be outlets for people to take their money out of fiat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes~

Of course anything is possible. The problem is not with currency just as the problem is not with guns. It is with people. People who use power to get more power and control people, and people who follow without thinking.

The real solution to ALL problems is people learning to be empowered.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Remember the "convergence trade" where all the govie rates "converged" - until they did not anymore? I felt so stupid at the time because I could not understand how a 10 year bond from Portugal could be the same risk as Germany....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The concept of the euro, might seem a failure, but in reality it succeeded in enslaving many european countries by converting their debt (in national currency) to ...externally issued currency/external debt. This chained these countries into slavery*.

Any country that does not have serious trade surpluses to achieve bigger euro inflows than outflows (debt repayments+interests) is practically doomed.

** I've analyzed this in an older article of mine: https://steemit.com/money/@alexgr/why-the-euro-is-a-scamcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ye it succeeded in enslaving countries, because it took away the government's ability to control fiscal policy with the own currency it used.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.4. Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise.

Built by @ontofractal

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

time zu mine bitcoins :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Euro will fail because it's a scam!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit