So I first got interested in LIFE coins in early January this year when I bought about 130k for about GBP500. I knew very little about cryptocurrencies and tokens and liked (a) the charitable angle of LIFE tokens and (b) they had a cool logo and name. I mean ‘life’ is so used in everyday life (excuse the pun) it could become one of those ground-breaking branded products like ‘apple’ or ‘google’. [Have a life! Get a life! Don’t let Life pass you by!]

Anyway I then watched disappointed as my ‘investment’ then dwindled by over 80% as the LIFE coin fell from 30 sats down to around 3-6 sats as it is currently. However, I did start doing my homework and analysis which I now share for those who are interested. As a disclaimer I am not a financial advisor and accept no liability for any investment decisions you choose to make which are your own and also never invest more into cryptocurrencies than you can afford to lose.

So the original LIFE Token had a fairly decent white paper and sort of outlined how despite block chain technology having all these benefits around decentralised databases, enhanced security, democratic smart contracts etc. the general public still had an inherent fear of and misunderstanding of crypto’s and there was no decent real life applications to use it. So their idea is to have some key adopters in prime areas (e.g. retail, real estate etc.) that would be given LIFE tokens as rewards for their customers. So instead of airdropping tokens they could be drip-fed into the system in a controlled manner. The second leg of their approach was that 30% of all tokens would be earmarked for charities (I think perhaps a first in crypto coins that I had come across?). In tandem with this they hoped to create an environment where the everyday public could more easily access crypto’s and so would develop a user friendly LIFEwallet and LIFEapp and a LIFEcard (contactless debitcard).

All good so far and I believe that if they do actually manage to get the objectives met above this would be ‘the holy grail’ of adoption and possibly even better than bitcoin as people could spend their LIFE coins in real life. But I believe there were a few problems with the above plan and how it evolved in the first few months:

(a) They published an extremely aggressive roadmap hoping to have the wallet and card by the end of Q1 2018! (This was naive given the huge complexities of getting Visa / MasterCard to issue a contactless card and gives rise to security requirements for the card company, how quickly the customers Life can be sold for fiat to pay the merchant etc. The only card I have seen successfully used is GLINT which has a MasterCard and cool phone app but where the underlying currency is in gold. (Refer https://glintpay.com) I actually believe GLINT and LIFE should be talking as they are both UK companies and one has the card and the other the token so some form of alliance here would be great!

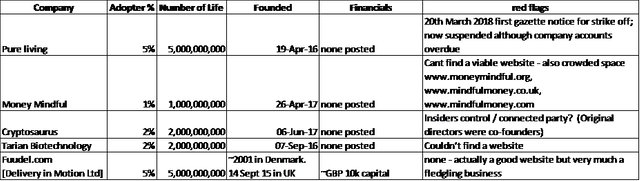

(b) The whole plan for LIFE adoption depends on the adopters chosen who were (in my humble opinion) not the key partners that LIFE needed. I dug around on Companies House to see what I could find and it was dismal reading with companies all that were very newly created and highly unlikely to be able to quickly grow and get wide spread interest and to whom nevertheless significant tokens had been allocated! (I mean we are talking about 15bln tokens!).

I don’t want to demean these companies and to be fair LIFE had the problem of being a new tech starter company so was unlikely to be able to get say Starbucks on as an adopter and also as a new rising tech star company wanted to align itself with progressive growing companies.

(c) I believe the founders / founders circle were a little greedy taking 12%. Traditionally I would have thought this would be around 5%. Also having taken a step back and leaving implementation of the plan to a new team I would hope there was some sharing of these tokens (albeit still with lock up clauses)

(d) Unfortunately LIFE is only on a handful of exchanges (Tidex, Coinexchange) and I believe only on one credible liquid exchange (HitBTC) which is still very small.

So with all of the above and of course missed deadlines on delivering on the roadmap, it is no surprise that LIFE coins have tanked over the last few months to where they are now. But I don’t believe this is all doom and gloom and have used the last few months averaging down my buying price as I have purchased more of these tokens. So what has changed my opinion you might ask?

(a) The LIFE team went through a Hard Reset and changed the management team by appointing Luke Chittock as Managing Director. This was a very good move by the founders, as they were the visionaries of the concept and certainly should be applauded for starting the token and getting listed on exchanges but I doubt it is their specific skillset to actually run a tech company and project manage the delivery of what has been promised. I believe one can already see a number of initiatives from Luke and his team that are very positive for development of this coin.

(b) Marketing and communication has improved significantly bringing on people like David Pugh Jones (who was Microsoft Global creative strategy director for 10 years) and Anwar Ali (who moderates the telegram chat (https://t.me/joinchat/HFVijQ3hyhyQZa6LQCE-NQ) which now sports ~3700 members and growing. They have sent out stickers (which I now display on my car) and I know it’s a little thing but it gives that little taste of possibility! And more recently they have started creating you tube video’s:

(c) The LIFE community is extremely engaged and enthusiastic about the project and fairly international across the US, Asia and EU. [I am a member of a number of other token chat groups in telegram with over 4 times the number of members and yet less daily commentary!]

(d) The team has re-published a new website that is much clearer on their concept (https://www.lifelabs.io)

(e) The new team has created a new and more realistic roadmap that suggests the mobile app wallets will be available in August/September, an adopter loyalty rewards analytical dashboard in November and back office / exchange development through Nov and December for a possible card releases in January 2019. Far better to have a ‘delayed’ but properly scoped roadmap that can be achieved than some ‘pie in the sky’ stab.

(f) The team seem to be making progress on the adopters. Some of the earlier ones have dropped off the website (?) Pure Living, Mindful and Tarian, whilst Cryptosaurus is only mentioned now as a collaborator. I’m not sure whether this means they are totally gone or just an oversight but on the website it is much better to see adopters are now Senditoo (mobile apps), Lemonstorm (commercialise ecommerce licences) and Fuudel (food online) which is still there.

I’m still not sure whether these are really the ‘big hitting’ adopters LIFE needs, but they do seem more credible:

• Fuudel has been around since 2001 in Denmark and trades in the UK through ‘Delivery in Motion’ since 2015. Nevertheless its micro accounts from 2016 would suggest it is still a very small venture, although a nice concept and good website (https://www.fuudel.com)

• Senditoo started life as Soumcorp Limited in 2013, then Ozaremit Ltd in 2016 before rebranding as senditoo in 2016. They could have big reach trying to break into sending mobile credit globally and have a pleasant website (https://senditoo.com). That said their balance sheet would also suggest at this stage a small start-up company.

• Lemonstorm operates in Germany (so I wasn’t able to see their accounts) but seems to have a number of high profile clients including Discovery Channel Online and Bear Gryllis Stores in Germany. Refer: http://lemonstorm.com

(g) The LIFE team have apparently applied for a number of new Exchange listings including Binance (which if it happens will open up its availability to a much wider range of investors in the US and Asia). This will also improve liquidity and hopefully their withdrawal fee will be less than the current 57k that HitBTC charges.

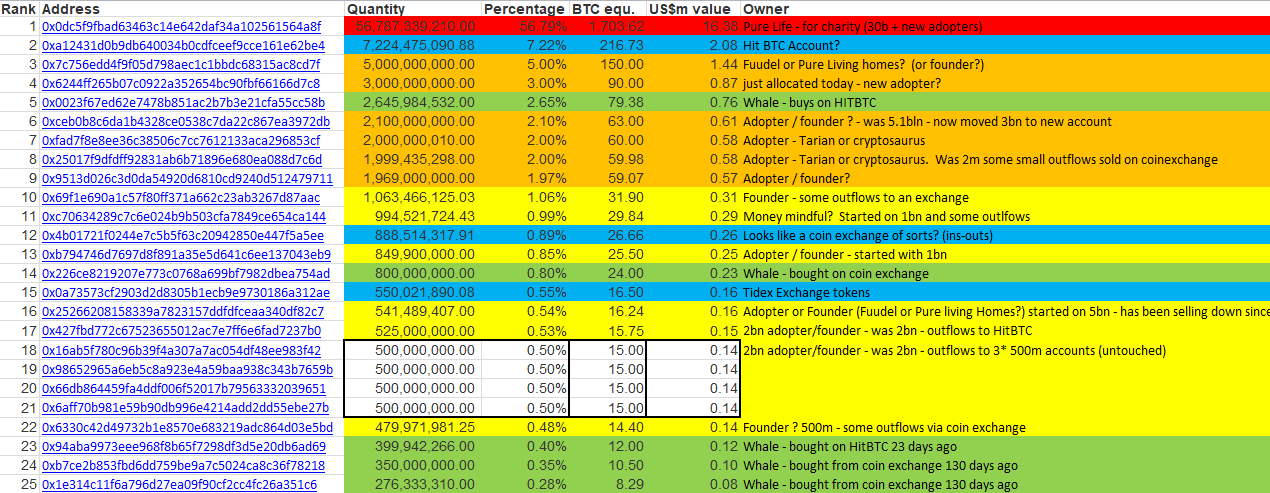

Analysis a few days ago of LIFE wallets shows that 57% of supply is still held in one wallet for charity/unallocated adopters. Exchanges look like they have around 3% of total supply and obviously adopters / founder circle (which are difficult to analysis without better transparency and something I believe the team is hoping to improve) have a large amount but these are supposedly locked up and limited. The number of large whales (in green) are actually quite small (although there will be more within the exchanges). I believe there are around 3,200 wallets so you would be an early adopter on this!

So I believe LIFE is like a diamond in the rough. LIFEcoin is currently trading on HitBTC at 4/5 sats which at current Bitcoin prices means you can pick up about 2,000 of these per US dollar. As perspective consider some other tokens with total eventual supply of 100bln coins include Tronix TRX (1051 sats); Ripple XRP (8505 sats) or even Dentacoin with 80x the supply is trading at 170sats.

I have no idea whether LIFE will succeed. I do know I have more faith in their management and what they are currently doing and believe that if they succeed on meeting their roadmap targets (wallet, card, adopter visibility) AND get some nice high profile adopters on board (Tesco’s, Costa, Harris & Hoole, Glint??) then this coin could really fly. Even without any significant new adopter, the way I see this progressing is a slow increase between now 4/5 sats to around 10 sats come August as more people become aware of this coin and its possibilities. If a listing on Binance it could jump quickly by 50 sats and for each successful release of wallet, app and card we could see another ~20-40 sats so come January next year I don’t see why this wouldn’t be valued at 120 sats. But then this is crypto currencies and anything is possible? Even a big donut.

Again as legal disclaimer I am just a blogger and not a financial advisor nor is any content in this article presented as financial advice. It is for informational and recreational purposes only. Investing in crypto currencies and tokens is high risk and you should only invest what you can afford to lose.

This post has received a 3.11 % upvote from @drotto thanks to: @genxlifelessons.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post was upvoted and resteemed by @resteemr!

Thank you for using @resteemr.

@resteemr is a low price resteem service.

Check what @resteemr can do for you. Introduction of resteemr.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit