The content of this article is really special. I think it is one of the best articles that I will ever write because of its far reaching effects and the magnitude of positive difference it is going to make in people's lives.

One of the reasons why I am so sure is that this topic is never taught at school and most us have to figure it out ourselves. Many fail to do that have hard time in their financial dealings and planning.

Image Credits: Me and Canva.

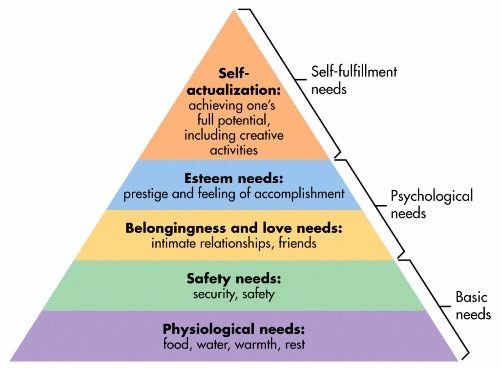

Over 2 billion people in the world will simply die without ever getting out of poverty. If you view them in terms of Maslow's Hierarchy of Needs, you'd find them at the bottom of the pyramid; trapped in hardly fulfilling basic human needs like food.

Source: Simply Psychology

Why are so many people destined to die poor? They not only die poor but leave poor children to do the same as they did. There may be infinite reasons but the lack of financial knowledge and intelligence is one common factor.

Source: Pixabay

Let's look at the categories of people in this world according to their financial status.

- There's a common belief, and there's solid evidence to ascertain its truth, that top 3 % people of the world own major share of world's wealth. They are the super rich, multimillionaires with empires of their own.

- Then there are billions of people who're living a life that we call middle-class life. They're not poor but not rich either.

- And then there are billions of poor people who have a miserable life and have a tough time surviving and attaining even the basic needs.

How to become rich? It's a very common question. This article not only covers the secret of becoming rich but also is a fundamental source of financial intelligence that everyone needs in life. To learn how to become rich, you have to understand why people are rich, middle-class or poor.

Note: - All the images below this point are taken from Pixabay; mentioned or not.

Let's begin!

How To Become Poor?

Why are poor people poor? There's a strong and logical reason behind their poverty. While you're reading this sentence, I want you to think of your understanding of poverty and the reason behind it. Done? Great.

Now let's look at the fundamental principle which all the poor people follow. It may sound counter-intuitive to you but there are people who have lots of income, own big houses, drive good cars and enjoy great positions in government or private organizations but still can become poor in a matter of days.

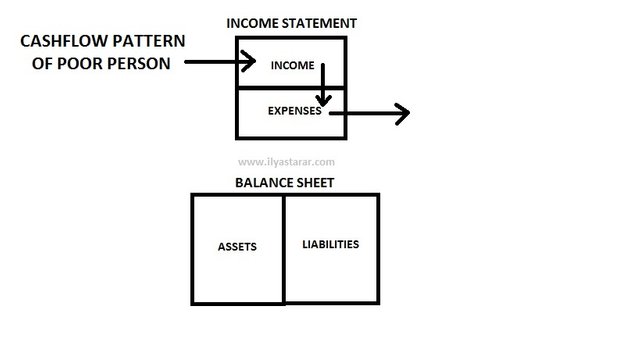

Confused? You should be, because we have a very different opinion about poverty, right? But you'll agree once you understand what the following picture says.

Image Credits: Me

This pictorial thing will be explained later when we arrive at the secret of becoming rich (or poor). But keep this in mind. It's the secret to becoming poor. If you want to avoid becoming poor and wish to become rich, you should know and understand the secret to becoming poor; which you're going to know in this article.

The Secret to Becoming Middle-class

Middle class is one step above the poor. But, as you might have believed, it's not because they're financially strong. The middle-class is better equipped with basic facilities of life as compared to the poor.

They too were probably poor some time ago. With better income, promotion or hard work, they have access to more money and escape the borders of poverty. But many people living a newly attained middle-class life carry the poverty mindset into their improved environment.

- They're trapped between poor and rich mindset.

- They spend like poor people do and try to live like rich.

- The middle-class families fulfill the dreams that they couldn't fulfill in their poverty.

Source: Pixabay

Standard practices include: -

- Buying a car

- Building or buying a new house.

- Chasing and having better facilities at home.

- Paying regular money for the upgraded lifestyle.

Speaking in terms of mindset, it is no different or just a tad better than being poor. As mentioned in poverty segment above, people can have a lot of wealth and a luxurious lifestyle but may also be like middle-class.

Why do I say this?

Because it's not money or the lifestyle that determines who's poor, middle-class or rich. It's what you do with your money.

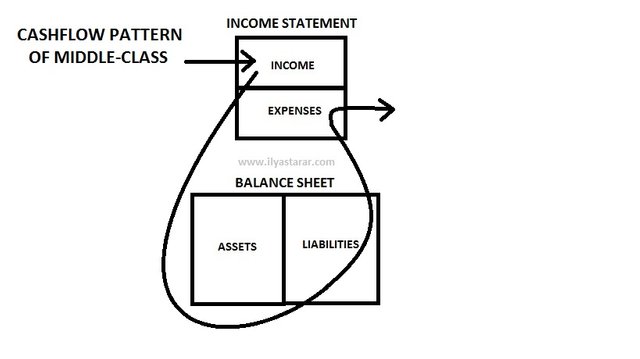

Why are middle-class where they are financially? Here's why; look at the picture.

Image Credits: Me

Read on. It will be explained in the crux of this article (which is just a little scroll away).

How To Become Rich?

We're here finally. Is there a reason why rich are rich? There must be and you're about to find it out. It's the fundamental knowledge towards financial independence. It's the starting point of becoming a millionaire. It's the answer to your 'how to become rich' question.

Like a wealthy person can be a superlative form of poor or middle-class (due to mindset), similarly, and as counter-intuitive as it can sound, a poor or middle-class person can be a rich millionaire in the making.

Why do I say that? Because, as I said earlier.

Being poor or rich is not about the amount of money you have. It's what you do with that money which makes him or her rich or poor.

Source: Pixabay

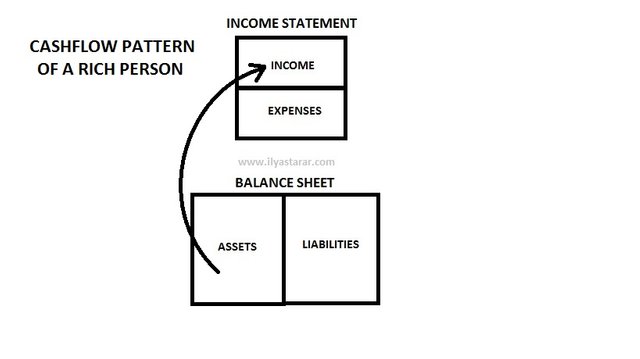

I'm repeating things so that you understand them and remember them. Here again, I'll share the diagram which presumably is the biggest and the only secret to becoming rich. Look at the picture below.

Image Credits: Me

And we are finally moving to the secret part. You're going in!

The Secret to Becoming Rich Explained

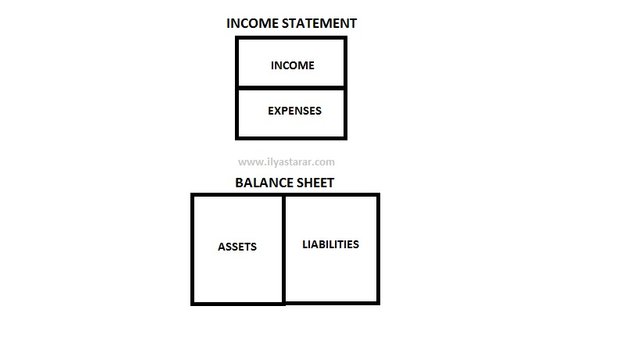

First of all, let's solve the mystery of the three diagrams that you see above. I'll take the basic approach of explaining everything such that even a nine year old can easily understand it. Let me post a generic diagram you can relate to while reading explanations.

Image Credits: Me

Let's see what the heck these terms mean and what role do they play in becoming rich. Read and understand.

Arrows

Arrows point the direction on money. It comes in the form of income and goes out as expenditure; as visible in diagrams.

Income

The money that you get from your job, service or business.

Expenditure

The money that you spend on your needs, bills, groceries and everything you buy to survive or live a month.

Assets

Understanding assets is tricky. It's the focal point of becoming rich so it must be understood well. What we generally think of as assets are not assets. For now, remember that assets make money or they increase in value. I'll explain it further when we reach the crux of whole discussion.

Liabilities

Liabilities are opposite of assets. They consume money. Our understanding of liabilities is as confusing as that of assets. We'll discuss them in detail.

The Diagrams

The three diagrams given above represent the cashflow of poor, middle-class and rich respectively. Cashflow is fundamental accounting knowledge. In simple words, it's the direction of money.

The money revolves around the four boxes in our entire financial life. To become rich, we need to understand and control the direction of money; the cashflow.

Now let's move to the most important and decisive part of the article. Remember what you've read this far? Now just focus your attention on what you're going to read. Warning! It's life changing!

Why Poor Are Poor?

The answer is in the following facts about poor people.

- Their income less than or equal to their expenditure.

- Look at their cashflow diagram. Whatever comes in via Income goes out via Expenditure.

- They never have or save enough money to buy liabilities or assets.

When I said wealthy people can be poor too, I meant that their expenses are nearly equal to their income. Even with enough money if they don't do anything (buy assets, precisely) with their money, they're risking their one leg in poverty.

Why Middle-class Are Middle-class?

Almost same case as with poor. You can say even worse. They're middle-class because of what their cashflow shows.

- They get enough money from their jobs (most middle-class families do jobs) to spend each month.

- Whatever is saved or left from their monthly income is spent by them on liabilities. Liabilities consume money. They take money out of your pocket.

- The middle-class commits one criminal mistake in their financial decisions. They think that they are buying or building assets but in actuality, they buy or build liabilities.

[Important] To make the shocking revelation here, the car they buy for their travels is not an asset. The house they buy or build is not an asset. You must be thinking, "But aren't cars and houses big assets?" No, they are not.

Remember the simple difference between an asset and a liability? An asset gives you money. Quite oppositely, a liability takes money out of your pocket. So what does a family car and a house do to your money? You have your answer.

Why Are Rich People Rich?

It's simple. Although it might not be a walk in the park to actually become rich, as it requires multiple factors out of scope of this article, but it is effortlessly simple to understand how to become rich. Once you understand the secret, you can start your journey in the right direction.

- The secret is visible in the cashflow diagram of the rich. See the diagram again. Rich people initially acquire assets like property, stocks, and other investments (which now includes cryptocurrencies as well) from their income or savings.

- The assets put money in our pocket; remember? While they're still getting their income, they starting receiving money from their assets too.

- The cashflow increases and they have more money to spend. They are wise. They don't waste money on liabilities yet. They buy more assets and the assets generate more income for them. This process goes on and on until they can finally, and safely, afford to buy liabilities.

- Their liabilities are called luxuries. They can afford them because their assets never stop filling their pockets with money.

Are Cars and Houses Absolute Liabilities?

I earlier said that car and house are liabilities. They can be assets too. But how? For further understanding of asstes, I would say that a car used by family is a liability (because it takes money out of your pocket in shape of fuel and maintenance costs) but a car registered with an Uber or Careem like ride sharing company or simply rented out is an asset (because it earns you money).

Similarly, a house you live in is a liability whereas a house which is rented on a per month rent is an asset.

Is Money an Asset?

They most stupid assumption that you're going to reject after reading this is about money. Does money, in form of cash or a current account, make you more money? No! So it fails the definition of asset.

Even worse, the money (obviously the fiat currency and bank balances) is devalued with time so it actually becomes less with time; making it almost a liability.

But don't forget that money is necessary to buy assets. It is important. I'm saying this third time in this article that it's not money itself but what we do with it that makes us rich or poor.

What To Do Now?

You've unlocked the secret. You know how to become rich. Now make yourself some promises and fulfill them to change your life and lives of people around you. I call it making a positive difference and that is my mission in life. You can make a positive difference in your life and lives of people connected to you in real life and online. Make and fulfill these promises!

- I promise that I'll think about money in the way explained in this article. I will always know whether I am buying an asset or a liability.

- I promise that I'll read the book named Rich Dad Poor Dad written by Robert Kiyosaki; the inspiration of the wisdom contained in this article.

- I promise that I'll share this knowledgeable and life changing article with the community by resteeming it.

- I promise that I'll become rich! I will make my money work for me by buying assets so that I can escape the rat race!

An Example from Your Steemit Earnings

Suppose you write an article which is useful for the whole community and people are kind enough to upvote, resteem and mention it. The amazing steemit community enables you to earn some steem dollars. What will you do?

Here's what you can do.

- To make that money work for you, you may buy some steem power. Steem Power is an asset because it makes upvotes more valuable monetarily.

- The Steem Dollars you invest in Steem Power will make you more Steem Dollars!

- You buy Steem at $2 and sell it when it's $10. You make 5 times profit!

- Or you can send Steem Dollars from your wallet to Bittrex or Poloniex and trade it for bitcoin. And then buy profitable altcoins with the bitcoin and sell them on huge profit; short term or long term.

These were just a few examples to enhance your imagination and direct your thinking towards the rich mindset. I wrote a post about my plans if you're interested in reading.

Concluding Note

Best of luck as you embark on the journey of becoming rich. I hope you get out of the poor and middle-class mindset soon; if not out of it already.

Please extend your generous support by resteeming and upvoting my effort to educate my fellow Steemians. Thank you!

Thank you for sharing this insightful information. I love it when you guys post things that captivates my attention. It has been really educative and im definitely going to add more of this to my financial intelect. I hope you keep on posting awesomes messages as this to help promote this platform. Poverty is really a sad and bad thing. Lets all work to escape its grips.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for coming here and appreciating the effort. I loved reading your comment and I am happy that you found it useful. The purpose of writing this was of educational nature and reading all the comments, I can feel that fair bit of that purpose has been achieved.

I'll follow you and hope to see great stuff from you. I'll surely keep contributing to this community as much as I can. Please resteem this effort if it deserves that. Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, Awesome post bro, I want to add two books incase you haven't gone through.

1: Think and Grow Rich

.2: Richest Man in The Babylon

2nd book is my favourite and i am sure it will be yours too. I might write a post about it too.

Intense work you have done here.

Just nailed it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have in my to-read list bro. Will surely read. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The 2nd is my favorite too. I also gift it to my friends, and my nephew too. He is 15 years old but I want to change his mind asap.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What a nice & impressive article you have written. This article is eye breaking for me and totally change my mindset about assets and liabilities. Now i have cleared why rich becomes more richer and poor becomes more poorer.

Thanks Mr Ilyas Tarar

You are amazing. I have already up-vote you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much. The schools and degrees teach differently but I'm totally convinced that assets and liabilities should be looked at as explained in Rich Dad Poor Dad by Robert Kiyosaki.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Kudos for the concluding note. ^voted

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the support. You can get my support (not reciprocating) the way you want.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes we don't know even before but after reading your article. Now better understanding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What a lesson. Great to know your strategy. Thank you Pakistani TN ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks to Rich Dad Poor Dad by Robert Kiyosaki. Thanks a lot.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nicely written Ilyas. Yes we are not taught many things at school but the job of school is to get you into a thinking process, which you have excellently displayed here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you and I don't think there's even a hint of thinking in the dimension of personal finance or money in all those schooling years. Financial discipline and intelligence are the most important aspects of adult life and schools don't teach that like they teach English, Math or Science.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is the trick.... You are taught extremely basic stuff so that you can evolve and build in the basics.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post IlyasTarar. There are many valuable lessons to be extracted out of this ''assests and liabilities'' concept. Unfortunately we see people everyday who wish for the newest models of smartphones, luxury cars without caring about the income streams they might have. This can be a great help to those.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The concepts of asset and liability are the real key to financial edge in this world. It's sad that we never had a system to get educated on it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very right, we don't even know the meaning of assets and liabilities unless they get accounting courses. After reading this article, I have started to get my car with Uber or Careem :) upvoted and resteemed!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! That's great. I'm glad this article has already made an impact on you. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for a good article. It has an extensive take on the differences between classes, if you want to call them that. However, I would have to argue that, becoming rich is actually about luck or real determination for most of your life. Becoming wealthy on the other hand is possible the way you explained. Let me explain my point. To me being rich, is being someone who can do almost anything with his money, he or she can buy a ferrari if they feel like it. However, being wealthy, is when you are smart and control the way you use money, as you explained. Eventually build a stable income by saving money, but you still need to think about how you use your money. You can of course become rich also by saving most of your money for 40 years, but by then what is the point? Therefore, becoming wealthy is actually what most should aim for.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All rich people in the world will seem to follow the asset aquisition that I mentioned in the article. Their money works for them and makes more money. They can do anything with that money. There's no point saving for 40 years (and wasting those years) at all. I agree.

My article does not give the extensive strategy but it highlights the fundamental secrets without which, becoming rich or wealthy won't be possible.

And I'm following you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with most, but you can become rich by winning the lotto also ;) Or you can become rich by playing sports at a national level, but you might still not know how to use that money. And by using money wisely you might never be able to reach the same level. BUT you can become wealthy the way you explained :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My whole article is also based on using money wisely and become rich. Lotto is no rich because it all goes in the trash in a few days. We're talking about the same thing with different words I think.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A treasure of very useful information. I m already out of poor and middle-class mindset and the credit goes to you. Thanks a ton :)

Upvoted and resteemed!

Have a good day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@ilyastarar its great article yes of many things few things are new to me i will definitely upvote and resteem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you and do read Rich Dad Poor Dad by Robert Kiyosaki. It will help you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Short version of Rich Dad Poor Dad book 1.

Can I translate your article into my country language and post it on my blog?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Exactly. A summary of the book that changed my finacncial understanding. Subject to credits, I would be glad if people of your country can get the message I wanted to deliver.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit