More youthful American specialists are energetic and locked in. As per our most recent DC member study, they're eager and sure about putting something aside for retirement. Be that as it may, they have low scores on exactly how to do it.

Excited, Young, yet Unaware

In our new study of characterized commitment (DC) design members, we discovered three particular personas characterized by their general states of mind toward contributing:

Proficient: sure financial specialists

Enthusiastic: youthful, unconscious members

Preservationist: careful savers

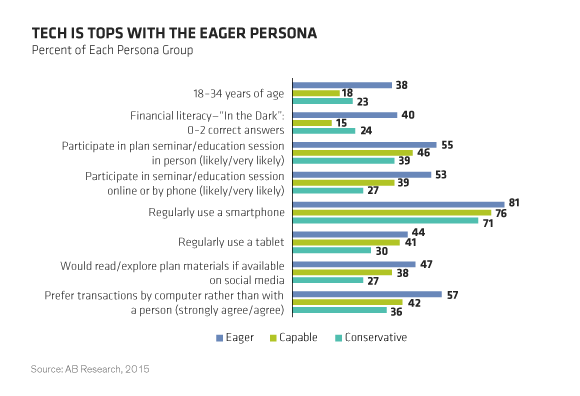

Each gathering holds generally unmistakable money related states of mind, points of view and learning levels. One gathering, Eager members, was remarkably more youthful than the other two—by about 10 years in light of middle age (38, versus 50 for Capables and 46 for Conservatives). What's more, with that relative energy, they're additionally exceptionally energetic and certain.

In any case, that is insufficient to convey the day with regards to sound contributing.

Time to Crack the Books

We solicited an arrangement from eight fundamental money related education inquiries in the overview. The outcomes were another distinct differentiator of Eagers from the other two gatherings—and not positively. An astounding 40% of Eagers found just two solutions or less right (Display 1). In case you're oblivious about contributing fundamentals, energy and certainty can be an obligation.

In the event that You Build It (Online) They Will Come

Be that as it may, one extraordinary resource among Eagers is their eagerness to learn. They're substantially more likely than the other two personas to agree to accept face to face design classes or instruction sessions. Furthermore, they're much more inspired by taking an interest on the web or by telephone.

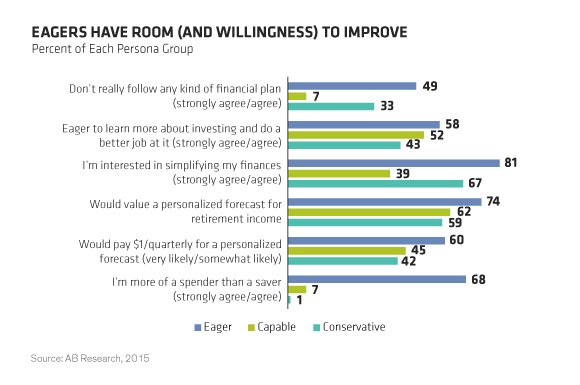

Eagers are likewise online networking smart. These for the most part more youthful laborers welcome whatever their DC designs influence accessible to them to by means of online networking. Almost 50% of them say they would read and investigate design materials on the off chance that they could get to them through cell phones or tablets. They're likewise more intrigued than the other two persona bunches in adapting more about contributing (58%) and disentangling their accounts (81%).

Quarterly conjectures for expected pay in retirement are all the more speaking to Eagers (Display 2). What's more, they're prepared to "put their cash where their mouth is." We inquired as to whether they'd pay $1 quarterly to get a customized estimate; 60% of Eagers said they'd be likely or to some degree prone. That ability was altogether lower for Capables (45%) and Conservatives (42%).

Hello, Big Spender…

Be that as it may, Eagers might be a bit excessively ready, making it impossible to burn through cash all in all. We inquired as to whether he or she was all the more a high-roller than a saver; not very many respondents in the Investor (7%) or Saver (1%) personas concurred or unequivocally concurred that they think about themselves spenders. A conspicuous difference, 68% of Eagers grouped themselves as spenders.

Different reasons may add to that high-roller perspective. In any case, one factor may enormously impact why more youthful specialists don't spare: time.

Anecdotal proof the vast majority discover it almost difficult to envision themselves over 20 years more established than they are today. In case you're a 20-year-old in school, you basically can't imagine being 40. In case you're 65, you can envision being 80 or something like that, however not 90! Regardless of what age you are currently, the perceptible age skyline is never over 20 years. In the event that that is the situation, at that point being 65 years of age—as it were, the very idea of retirement—has no individual significance until the point that individuals are no less than 45 years of age. Until at that point, time, which could be the best advantage for your long haul investment funds, isn't your ally.

The idea that retirement itself is unbelievable to numerous members could have expansive results for the retirement funds challenges that face America and the world.

The perspectives communicated in this don't constitute examine, speculation guidance or exchange proposals and don't really speak to the perspectives of all AB portfolio-administration groups.

"Deadline" in a reserve's name alludes to the surmised year when an arrangement member hopes to resign and start pulling back from his or her record. Deadline finances step by step modify their benefit distribution, bringing down hazard as a member nears retirement. Interests in deadline stores are not ensured against loss of chief whenever, and record esteems can be pretty much than the first sum contributed—including at the season of the reserve's deadline. Likewise, putting resources into deadline reserves does not ensure adequate pay in retirement.