The stock market is seen by many people in the public as an indicator of overall economic health – a veritable prophecy of what will come. Thus, huge drops in the market foretell economic troubles in most people’s eyes. However, that is not always true – it is more often a cause of correlation and not causation. Stock market crashes can indeed impact real people’s income, wealth, and standard livings, but the overall market needs a particularly bad mixture of negative catalysts, all forming at the same time, to turn into a recession. Thus, not all market downturns result in recession, but unfortunately for the people living in 1929, the negative catalysts were there, and those catalysts, combined with the stock market crash, resulted in one of the worse economic downturns in history. In contrast, a similar stock market crash happened in 1987 – just 58 years after the Great Depression – and it did not produce a depression, or even a recession, in at least the following two years. But this is as expected: the underlying economic conditions were different from the 1929 downturn in a few key ways. This paper will look back at the economic conditions of 1929 and 1987, the arguable catalysts for a crash, the follow up from political officials, and the potential similarities to present day economic conditions.

1929 Stock Market Crash and the Great Depression

The stock market crash of 1929 was not the reason for the Great Depression, but it was a contributing factor. There were other underlying economic factors in the economy that had a larger impact, but the loss of wealth and an increase in fear can always negatively impact the economy. The real underlying economic factors which contributed to the Great Depression are: inequality, trade balances, economic ignorance, and a decrease in money supply. These factors contributed in significant, and often overlooked ways, due perhaps, in large part that “less than 2.5 percent of the population had brokerage accounts.”iii There is no doubt however that fear was in the air, and that fear likely spooked the rich (which can have a large impact on the economy when combined with great inequality, as existed in 1929).

In the years leading up to 1929, inequality between rich and poor was increasing.i This increasing gap allowed the rich to have a despotically large impact on the economy with the result that the American economy was, as John Kenneth Galbraith states in The Great Crash: 1929, extremely “dependent on high investment or luxury spending of the rich.” i High investment and luxury spending are much more dependent upon the current landscape of the economy than necessity spending like food, rent, or clothing. Clearly then, if something shakes the rich’s confidence, they may, almost by definition, reduce their luxury spending and investment. Since this spending was the foundation of much of the economy, as Galbraith suggests, it is no wonder then that the economy faltered.

World War I had a huge impact on not only the people of the time but also the economic conditions of the world. WWI turned America into a creditor nation rather than a debtor.i The United States was owned far more money than it owed to foreign nations – in part due to the treaty of Versailles and reparation payments.ii In addition, the world was on a typical gold standard and America demanded payments be made in gold. Gold was flowing into the United States literally by the boat load, but it was flowing out rather slowly. Further, the political administration decided to impose tariffs and protectionist policies, which kept American exports low. Foreigners had no money to purchase American goods – it was all going into America, but little was coming out.ii

As alluded to above, with protectionist policies in place and worldwide gold standards, economists and political leaders were showing large levels of economic ignorance. In 1929 laissez-faire principles, theories about self-regulation, and the classical theory of economics were still very influential in American politics.ii For example the political party in charge loved a balanced budget “For Re-;Jublicans [sic][Republicans] the balanced budget was, as ever, high doctrine.”i A balanced budget meant that the Republican government could not expand spending and stop the suffering. This policy helped to prolong the Great Depression and suffering until FDR gained office, and even then, he had trouble turning the economy around.

Further, it wasn’t just politically elected officials mucking the economy up – some fault lies with the appointed officials at the Federal Reserve. The Federal Reserve decided upon an open market operation to reduce the money supply.ii The decline in money supply, produced by the Federal Reserve, led to increases in interest rates and decreased spending and investment, which resulted then in even more unemployment and economic contraction.

These issues together each exasperated an already bleak situation and were the economic causes of the 1929 Great Depression. However, most of the true causes of these economic issues can be traced back to poor policy implementation, poor or little regulation, and ignorance on the government’s end. The government not only contributed to the 1929 Depression but exacerbated both it and the countries slow recovery from it. This stands in contrast to the 1987 market crash which produced few, if any, of the same results as the 1929 crash, even though it had many of the same economic inputs.

1987 Stock Market Crash versus 1929 Stock Market Crash

As there was no recession or depression after the 1987 stock market crash, looking at the reasons for the 1987 crash compared to the 1929 crash and considering why the 1987 crash did not result in a recession or depression is vital to avoiding future crises. Some of the theorized reasons for the 1987 stock market crash are: computerized trading, illiquid, trade deficits, and overvaluation.

Computer trading and derivative invesments were becoming very popular in major financial firms.ii However, after some analysis it looks as though that may not be the major cause of the crash. This is because other stock markets crashed nearly as precipitously as the United States stock market crash, even when computerized trading was not as popular on overseas stock markets as it was in the United States.ii

Another cited reason for the 1987 stock market crash was trade and budget deficits.ii At the time, there was a large trade deficit between the US and other countries. This could have investors to think that foreign stocks were a better deal than US stocks, which could have led to massive sell offs to exchange stocks for foreign options.ii

The last, and final potential cause was merely overvaluation in stocks. Stocks were extremely high for the time leading up to the 1987 crash. But similarly high price to earnings ratios and price to dividend ratios existed during most of the 60-70s and there was no crash then.ii It’s unlikely that these were the direct causes of the 1987 stock market crash. Although there is some speculation that overvaluation was a cause of the 1929 crash, this theory can likely be dismissed – for if this were a widespread belief at that time, why had “many… resisted the panic and still owned their shares”? Financial markets are far more complicated than some might like to think. Assigning any single, or even multiple causes, to a stock market crash is a fool’s errand.

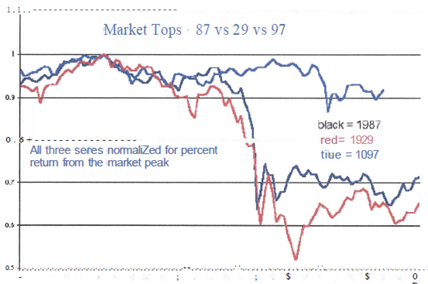

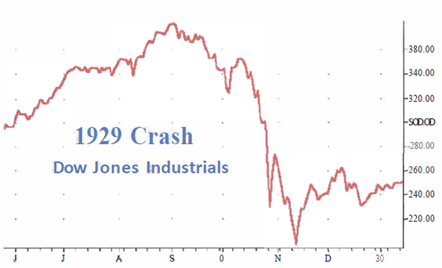

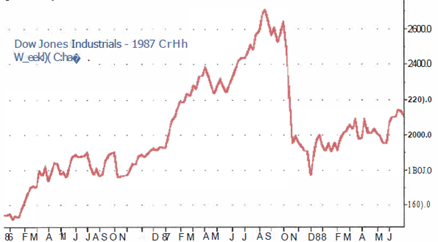

While the potentially contributing factors between the two crashses so far have no correlated well, there was one striking similarity between them: the amount of decline in the stock market. Both stock market crashes were among the worst America has ever seen. Below are several figures showing the loses experienced in both of these crashes. Looking at both Figure 1 and Figure 2, it is obvious that both crashes saw massive drops in the value of the stock market. And while looking at Figure 3, which normalizes for percent from the peak, it is apparent that the1929 crash was a worse market crash than the 1987 crash, the difference is not as great as some may assume: both crashes had drawdowns of 30% or more.ii There is no doubt that these kinds of declines in stocks would put fear into any investor.

So, while the two stock market crashes did have some similarities – like overvaluation, they also had many differences. In 1987, markets were computerized, and less protectionism than in 1929. But most importantly the political response was vastly different in 1987 than in 1929.

Political Response to Each Crash

One of the major political and monetary blunders of the last century was Hoover passing the Smoot-Hawley Tariff Act. The Tariff Act imposed extremely high tariffs on foreign goods coming into America – a particularly bad move during a recessionary period. The act was passed in 1930, towards the beginning of the Depression. John Steele Gordon said it well in his book An Empire of Wealth: The Epic History of American Economic Power: “This was economic folly. Tariffs are taxes, and taxes, inescapably, are always a drag on the economy. But, far worse, high tariffs breed retaliatory tariffs in foreign countries.”iii These tariffs put further strain on domestic producers through higher input prices, which in turn crushed consumer purchasing power with higher prices. As a result, world trade began to collapse: before the tariffs, in 1929, world trade amounted to 36 billion USD, but as the trade wars grew and retaliatory tariffs were put into place, world trade dropped by a factor of three, to nearly 12 billion USD.iii A literally collapse in global trade was the result of the Smoot-Hawley Tariff Act. This was because Hoover saught to appease his struggling farmer voter base and stifle the protests over “foreign competitors” taking people’s jobs.iii The fiscal response to the Great Depression is laughable at best – unfortunately the response of the Federal Reserve wasn’t much better.

The Federal Reserve began decreasing the money supply from 1929 to 1933 – that happens to coincide with the worst period of the Great Depression. The monetarist’s view on the recession preceding the Great Depression is that if the Federal Reserve had increased the money supply and decreased the interest rates, the recession would not have turned into a Great Depression. However, not all of the Federal Reserve governors had the same contractionary ideas. George Harrison, the governor of the New York Federal Reserve, was quite outspoken against the contractionary approach and lowered the New York Federal Reserve’s discount rate to 3.5%, purchased securities from banks, and increased the banks’ liquidity. Try as he might, his efforts were for naught: “George Harrison did not have anything like the influence Strong (his predecessor) had with the other Federal Reserve Banks…. The Federal Reserve as a whole did not move decisively to add liquidity to the banking system nationally, a serious mistake.”iii Sadly, these monetary policies were insufficient to help the country – even though he had the now leading Federal Reserve Bank in the country in his control. It is important to keep in mind though that this was only a single bank: it is still an open question as to whether greater adoption of monetary policy approaches among the Reserves could have led to better outcomes at that time. In contrast, the response to the 1987 stock market crash was much more sophisticated and suggested a greater level of economical literacy among the policymakers involved than was seen in the1929 crash.

One significant development before the 1987 crash was the increasing prominence of Keynesian economics. Keynes was in favor of government intervention during crises as a source of liquidity, jobs, and security. He theorized that GDP was a function of many things, but one of them was government expenditure. This gave governments a justification to intervene even more in the economy. Fortunately for the United States, these policies seem to have been moderately effective in the 1987 crash, at least in comparison to the 1929 crash.

Keynesian policies heavily influenced the outcome of the 1987 crash. Alan Greenspan was the chairman of the Federal Reserve Board at the time of the crash. He pursued policies much like George Harrison did back in 1929. He purchased large amounts of securities from banks, provided liquidity to bankers, and “reassured the public that the Federal Reserve would serve as a source of liquidity to support the economic and financial system.”ii Indeed, by increasing the money supply, providing banks liquidity, and purchasing securities, Greenspan made sure that the “stock price recovery period was much shorter than the 1929 crash.”ii While the monetary policy was on target with preventing a recession, fiscal policy followed suit too.

Rather than pursing ridiculous protectionist policies during the time following the market crash, the political class decided to remain largely hands-off. There was more support for free trade during the 1987 stock market crash and with “recent evidence of improvement in our foreign trade performance, suggest the overwhelming desirability of avoiding protectionist legislation… particularly if it would provoke retaliation from trading partners,”iv there was greater support for an economic environment in favor of free trade. Fortunately, both monetary policy and fiscal policy (or rather fiscal inaction) stopped the stock market crash from further compounding the problems created by the crash and damaging the greater economic environment in the country.

Comparisons to Today

Unfortunately, there are several stark similarities between our modern economic and political landscape and the landscape leading up to the 1929 Great Depression era. The first and most prominent is America’s sudden and abrupt turn from free trade towards protectionism. Trump seems duty-bound to impose tariffs on any country he possibly can; even if foreigners have as much as even a 1% tariff on US goods. This strategy might pay off if Trump is bluffing and other countries cut their tariffs, but that has so far not been the case: The President recently imposed a large tariff on Chinese imports to America. Much like the Smoot-Harvey tariffs, Trump is trying to appease his anti-trade base of supporters. These policies are notably damaging to the American economy. Indeed, monetary policy is following in the contractionary footsteps of fiscal policy: The Federal Reserve is currently raising interest rates and restricting the monetary base. Presumably this is to curb inflation and give room to adjust interest rates when the next recession hits, but these actions greatly increase the likelihood of a recession in the near future.

Further, there’s an increasing amount of inequality in the country, thus making Americans rely more and more upon the rich for luxury spending and investment to support the economy, rather than the more reliable necessity spending. As noted earlier, these are the same conditions leading up to the 1929 crash: anti-trade, tightening monetary policy, and inequality. These are worrying developments and could possibly signal an imminent recession due to particularly foolish fiscal policy, compounded by a cautionary Federal Reserve. Fortunately, history provides an antidote – hopefully policymakers will take note.

Sources:

i The Great Crash: 1929 by John Kenneth Galbraith, first published in 1955.

ii An Empire of Wealth: The Epic History of American Economic Power by John Steele Gordon, 2004

iii Achieving Economic Stability: Lessons From the Crash of 1929 by Gary H. Stern, President, Federal Reserve Bank of Minneapolis, 1987 Annual Report

Figure 1:

Figure 2:

Figure 3: