We have all hard the saying "everything in moderation". It certainly applies to Greed and Envy, two of the "deadly sins", which, in the right amount can be powerful motivators to improve ones station in life. In the iconic words of Gordon Gecko, "greed is good." A true enough statement, but only up to a point.

In the right amounts greed and envy can be healthy. You see someone else doing well for themselves, you will be motivated to do better yourself. But when greed and envy become the the dominant aspect of ones thinking it becomes an unhealthy spiral to the bottom. Life ceases to be about excelling in life and moving forward as much as it is an unstoppable arms race to the bottom.

Yes, your next door neighbor might have a better car than you. He might have a big tv and be able to take his wife out to expensive dinners on a regular basis etc. He might have an easier time earning steem on this website than you, in spite of all the work that you put in. There is nothing wrong in wanting that. There is something wrong in going down a destructive path for the sake of keeping up appearances for the sake of your ego.

People get into huge amounts of debt so they can pull up to their driveway in a flashy car or afford a bigger house, not because they want or need it, but because they want to keep up in the game. Taking on huge amounts of stress to be able to service debts, then watch it all crumble away when something goes wrong.

This is not just a personal issue, but something that has become systemic in society. Consumerist culture has encouraged this, to sell more trinkets, gimmick gadgets and brand names, and financial institutions have encouraged this behavior to increase their loan generation. Whole neighborhoods are purchasing unnecessary rubbish for no reason other than their mate is buying unnecessary rubbish and they don't want to be left behind.

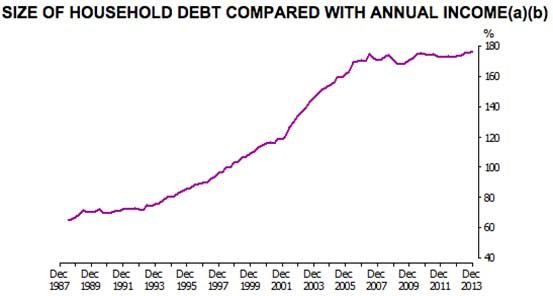

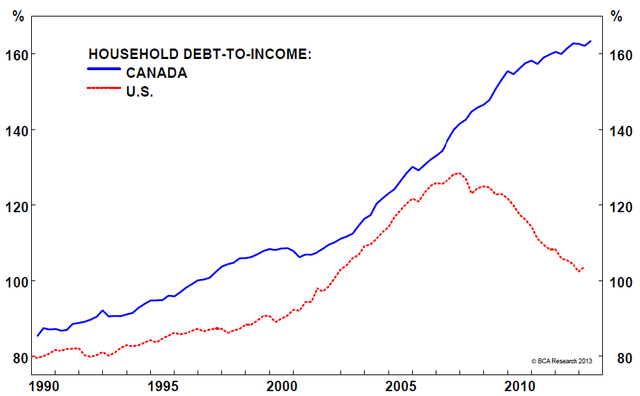

The result? Since 1990, the ratio of household debt in Australia has risen from ~56% to nearly 180%. Canada and the United States have experienced similar increases in debt levels.

This can only lead to greater dependence on the wider economy, namely the machinations of large financial institutions, Central Banks and government fiscal policy, which all impact the interest rate, and wider economic climate. People buried under such mountains of debt are so sensitive to the movements of their interest rates, that their whole lives hinges on the movements of politicians and bankers, a recipe for disaster if there ever was one. Would so many people have had to default on their home loan or declare bankruptcy in the GFC if the level of private debt was lower?

The saddest part of all this, is that after all the debt, all the stress, people who play this game are doomed to lose regardless, and have nothing of real value to show for their efforts. Its an unhealthy lifestyle to constantly be looking over your neighbors fence, freaking out because the barbecue he just wheeled out onto his patio is better than yours, which apparently makes you less of a man. Its nothing more than a prisoners dilemma, where each person stands to gain more if they both stop playing, but neither will out of fear that the other will out do them.

The reality is, unless your name is Warren Buffett, there is always going to be someone with a nicer car and a bigger bank account, so don't bother playing. Keep things that make you happy. Don't bother looking over your next door neighbors fence, because chances are, he is looking over someone else's anyway.

Other Posts I Have Made:

8 Reasons The Government Sucks

Free Speech in Politically Correct World.

Destroying central planning with a Banana

Greetings! This article has been featured in Lost Content Digest, Issue #2. The author will receive a share of all SBD proceeds from the LCD issue.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sweet! Thankyou!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article. Actually, I believe Warren Buffett drives a modest car and lives in the same modest house he has lived in for 40 or 50 years.

Do what makes you happy and don't worry about image. One interesting thing is that often people with all the latest gadgets actually have lower net worth than those without because of all the debt they used to buy them. The truly rich have learned the power of delayed gratification.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep.

At the end of the day, run your own race. The only person you should compare yourself to is your past self.

Reminds me of a property developer that I know. He drives a 25 year old jaguar worth mayybe 20 grand. Everyone in his friendship circle, my uncles included drive brand new porsches, beamers mercs etc. I asked him once why he didn't by a better car. His response, "why? I like this car. I don't need to prove to anyone how much money i have. "

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Jaguars are cool. I mean, a lot of old cars are much more esthetically pleasing than what they are doing today. Most cars look like they were designed by the same guy, with those predatory curves and slit eyes. Not really friendly, especially not if you are going through the car park in the late evening while really deep on acid. :-D

I am glad that a lot of car companies are into giving old designs a new life. Hopefully it will become a trend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm a fan of the aggressive look, but you're right, it would be nice if every manufacturer didn't make identical cars.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is agressive and there is agressive. I mean, there is friendly agressive, and there is downright menacing. Thing is that not many manufacturers go down that route. I mean I like cars that look like the 2015 ZiL Punisher. But this is a military car, and the common look for the cars is mildly predatory, just enough to go into the uncanny valley.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As far as I know Warren Buffet is pretty modest with his stuff.

But I remember there was quite a collapse for a lot of people here in Russia, because they took mortages to buy homes in USD, and once this debacle with Crimea & sanctions against Russia happened, suddenly they had twice as much debt in economicly uncertain situation. A lot of them ended up owing more then what they have already payed out, as well as doubled monthly payments in roubles.

If there is a moral in this story, it is never borrow significant sums with payments in foreign currencies.

Anyhow, found this post in the digest that featured my post also. Great article!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I only used warren buffet as the example because of how much he is worth.

But you're right, he is a good example of the right way to do things. With all the resources that the man has at his disposal, he still only surrounds himself with things that improve his life.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit