Great financiers like the rock stars of the financial world. They are the most successful investors who have earned the status, and achieved universal acceptance. Despite this, they are supported by other investors in order to achieve this success.

These investors are very different among themselves their policies and philosophy applied to trade and investment; Some have developed new and innovative methods for the analysis of their investments, others also concluded successful transactions, relying on their intuition. In many things these investors differed from one another, but, despite this, they had the ability to consistently beat the market.

Peter Lynch

There was a fund manager Fidelity Maggelan Fund in the period between 1977-1990 years. During the period of fund management, Lynch was able to increase its assets to $ 20 million, to the incredible amount of $ 14 billion. For 13 years (until retirement Lynch) Fidelity Maggelan Fund has held the top position in the ranking of top mutual funds, which allowed to obtain 29% of annual income.

Often described as a "chameleon," Peter Lynch adapted to any type of investment, which were popular at the time. But at the time when it came to the selection of specific securities, Lynch chose only those that knew and understood.

John Neff

John sat in the Wellington Management Company has in 1964. After that he worked in the company for 30 years. The company Neff led the 3 funds. The main type of investment tactics that he had applied to invest in popular industries are indirect methods. John was considered a good investor, because he always considered in more detail the company with a low P / E ratio and good dividend yield. Neff was managing VanguardWondsorFund Fund for '31 (retired in 1995). During this time he was able to provide an annual yield of the Fund at a rate of 13.7%, compared to the S & P 500 yield of 10.6%. It has provided an increase in the principal amount of 55 times as much as compared to the initial investment made in 1964.

John Templeton

"He went into the list of the most successful people of the last century, which was contrary to stereotypical notions regarding doing business" - a description of the John Templeton. He bought at a low price at the time of the "Great Depression" and sold at the beginning of the Internet boom in the United States at a price much higher than the purchase price. That's helped to make considerable capital Templeton. John founded several very large investment funds have achieved great success. He sold all of its assets company called FranklinGroup, in 1992. After 7 years, a business magazine «Money Magazine» christened John, "one of the world's greatest stock trader century." Being a citizen of the United Kingdom, living entirely on another continent - the Bahamas, John still was knighted. The reason for this has led to numerous successes Templeton, who did not remain without attention and herself Elizabeth II, awarded him the title.

Benjamin Graham

Benjamin Graham stood out among others as an investment manager and financial educator. In particular, he became the founder of two "investment classic" with an unprecedented importance. Graham is also universally recognized as the founder of two major investment exercise - security analysis and value investing.

Ben investment idea is that any attachment should bring you much more money than you give. He believed in the fundamental analysis and looking for companies with good balance sheets, or companies with little debt, whose profits are above average and who also had to be sufficient cash flow.

Thomas Rowe Price, Jr.

Thomas Rowe Price, Jr. is considered the "father of the investment growth." His teenage years were spent in the fight against "the Great Depression", and in those days he brought a lesson - should stay close to the shares, and learn to understand their movements. Price believed financial markets as recurring on a certain cycle. Thomas began to buy shares of the company's worthy for the long term, despite the fact that in the historical period that step regarded as complete madness. The investment philosophy of Thomas was, in principle, - investors should pay more attention to the selection of individual stocks in the long term. Discipline, method, constant, and research fundamentals are the basic principles for the development of world-famous investment career, Thomas Rowe Price, Jr..

William Gross

William Gross, also known under the nickname "Bill", familiar to many investors around the world, as one of the most renowned fund managers bonds. That is why sometimes it is called "King of the bonds." Besides Gross, he was the founder and managing director of the family stock of securities. William, along with his team, at the moment, have a fixed asset yields which has crossed the mark of $ 600 million.

In 1996, "Bond King" opened another important niche in the securities market, the first time the concept of creating a "portfolio manager". This was the reason the adoption of the famous investor in the Hall of Fame FIASI (Society analyst for fixed income instruments). "Bill" bothered this honor for making important contributions to the industry of financial analysis and portfolio management.

Jesse Livermore

Jesse Livermore had no basic education or experience in stock trading. He was a man who made himself in all. A distinctive feature of Jesse was the fact that he took for himself an example to everyone, regardless of whether they have achieved greater success in the world of investments than it is, or not. These successes and failures became the foundation for his trading ideas, which are still to be found in many markets. Livermore discovered the trade even in his youth, and in fifteen years had a profit of $ 1,000 per month. At that time, this amount of profit was considered very high. Over the next few years, Livermore has found a niche that allowed him to get a good income, although it was not legal. He is carrying on the illicit market rates "bucketshop", a kind of bookmakers Bet on changes in the value of shares in one direction or another.

Warren Buffett

Warren Buffett, also referred to as the "Oracle of Omaha", is also included in the leaders of the rating of the most successful investors.

Relying on the principles set out by Benjamin Graham, he earned a multibillion-dollar state, mainly due to the purchase of shares and holding companies through the American BerkshireHathaway. Those lucky ones who invested $ 10,000 in BerkshireHathaway in 1965, currently has the state in the amount of $ 50 million.

Style investing Warren Buffett, which includes discipline, patience, and good value, ahead of many markets for decades.

George Soros

Its main advantage is the mastery of information that allows to find the form not very accurate economic trends and make them highly successful transaction. This applies to both bonds and currency transactions. As an investor, George considered short-term speculators, who made a very big bets on a variety of niche financial markets. Even in 1973, Jorde Soros created a hedge fund called SorosFundManagement. After some time, the fund was renamed QuantumFund. For nearly twenty years he maintained a life QuantumFund in the status of an aggressive and successful hedge fund. The annual yield was about 30%. Also, in the history of QuantumFund were two cases where the annual income exceeds 100%.

John (Jack) Bogle

In 1974, the "Jack" Vanguard Group has created an investment fund, and eventually turned it into one of the largest and most successful sponsoring funds. He founded the first mutual index fund and uncompromising, also played for the low-cost index investment for millions of people. John founded and introduced the first index fund - the Vanguard 500, 2 years after Vanguard Group base.

Investment philosophy "Jack" Bogle includes the direction of investment in mutual index funds, followed by removing the gains. When are those funds should have a low volume of turnover, a low cost, be cost-effective and have a passive management.

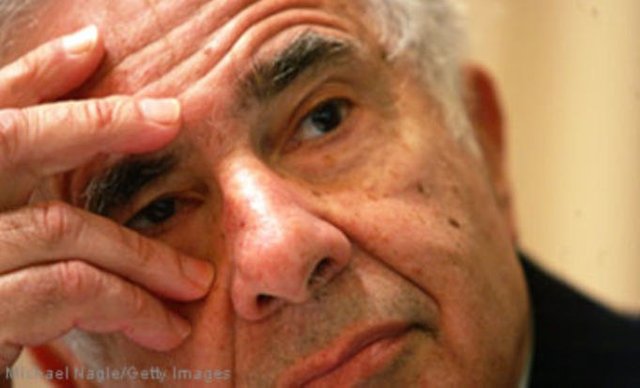

Carl Icahn

Carl Icahn is an activist and "aggressive" investor who uses a position in public companies to get the price of its shares to rise. Icahn started his corporate raider activity in the late 1970s, and in 1985, after absorbing TransWorldAirlines largest airline (TWA) in North America, was in the big leagues. Icahn is best known by the nickname "Icahn Lift". This catchphrase Wall Streer, describing the phenomenon when, after Carl Icahn buys shares in companies (which, in his opinion, poorly controlled), the price of the same shares increase by several times.

A few words about these investors ...

Every experienced investor is aware how difficult it is to follow your own path and good account of themselves in the world of investments. Thus it is not difficult to see how hard all of these investors could "cut" a place for themselves in financial history.

Source- http://www.investopedia.com/slide-show/worlds-greatest-investors/?article=1

This article is a rewrite/foreign translation of the above source. Copying/Pasting full texts is frowned upon by the community. Sharing content by itself adds no original content and no value.

You can share content and add value by:

Repeated copy/paste posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

If you are actually the original author, please do reply to let us know!

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@moneymaker - nice summary! Which one you like the most?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit