With new Bail-in laws in place, the government and banks have plans to take your money in the next economic crash.

You think your money is safe in bank accounts and protected by FDIC insurance? Think again.

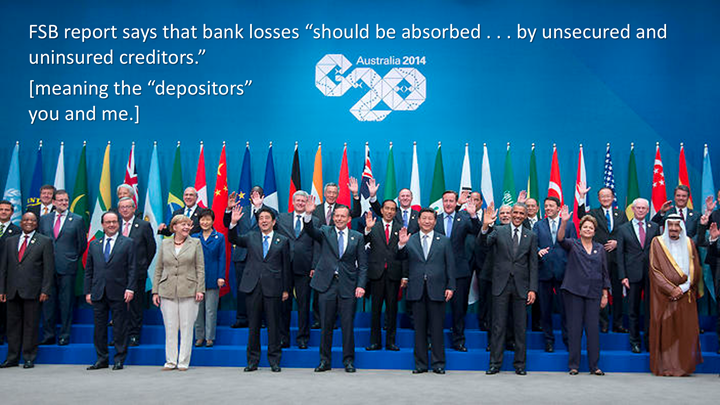

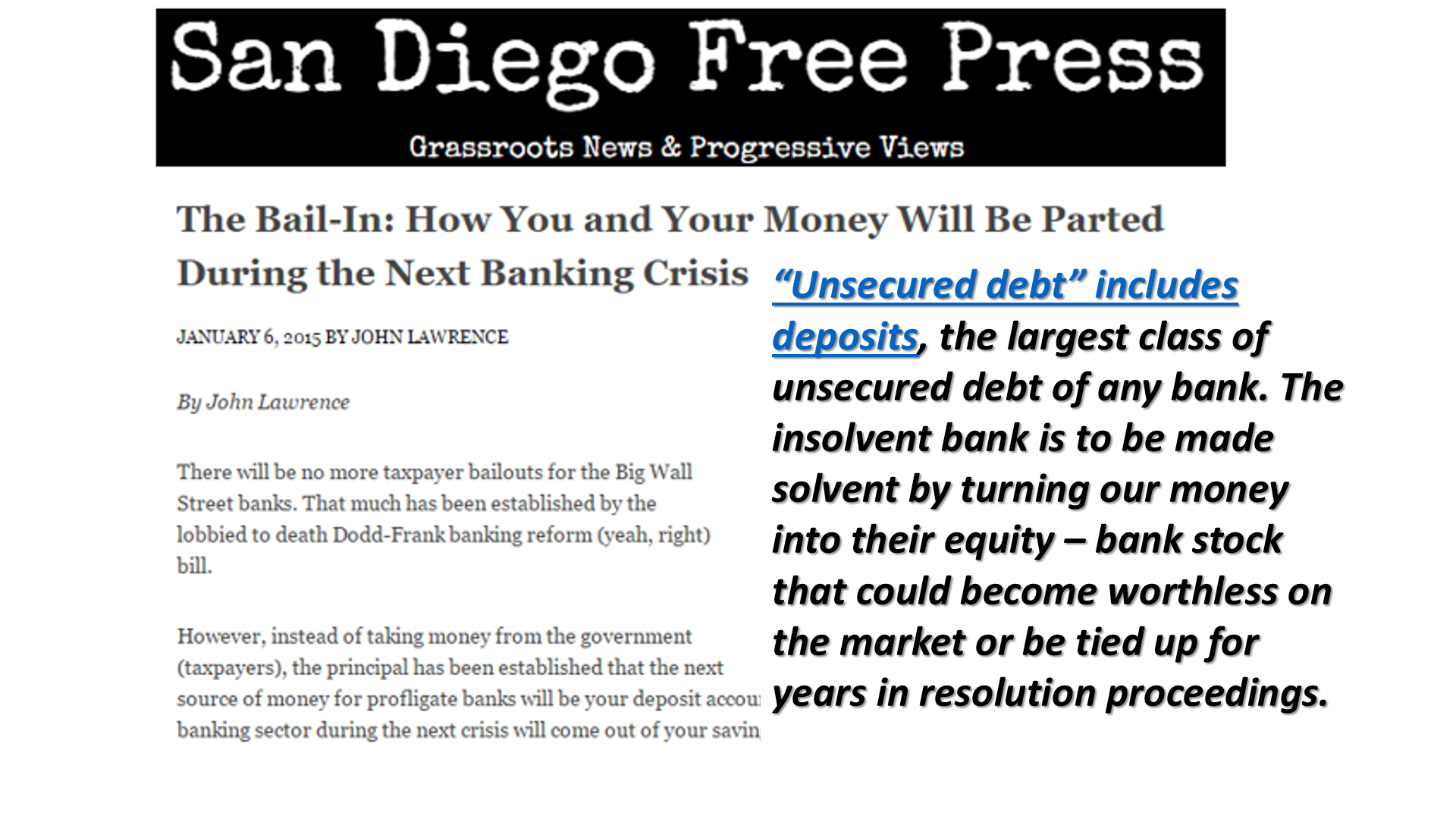

On November 15, 2014 a G20 summit of world leaders welcome the proposal of the Financial Stability Board, or FSB. The report says that bank losses “should be absorbed . . . by unsecured and uninsured creditors.” In this context “creditor” means depositor – you and me. The report then describes “bail-in power . . . [and] to write down and convert into equity all or parts of the firm’s unsecured and uninsured liabilities . . . to the extent necessary to absorb losses.”

On Wednesday, July 23, 2014, the U.S. Securities and Exchange Commission (SEC) approved a new rule on a 3–2 vote that allows money market funds to suspend investor redemptions. The SEC rule pushes this thievery beyond banking into the world of investments. Now money market funds could refuse to return investor money. James Rickard says, “In the next financial panic, not only will your bank account be bailed in, your money market account will be frozen.”

WHEN EVERYTHING ELSE CRASHES AND BURNS, PEOPLE WILL FLEE TO PRECIOUS METALS AS A HEDGE AND FOR SAFETY. BY THEN IT WILL BE TOO LATE. THE INVESTORS AHEAD OF THE CURB WILL HAVE BOUGHT UP THE LIMITED SUPPLIES OF GOLD AND SILVER ON THE MARKET. THE PRICE WILL SHOOT TO THE MOON. I DECIDED TO BY GOLD NOW WHILE IT IS STILL CHEAP AND WHILE I STILL CAN.

By opening up your own GoldMoney account, you can have your own debit card linked to gold you own and have physically stored in an secure Brinks vault. Start saving in #gold with @Goldmoney today

https://www.goldmoney.com/r/eYzKtT

To see what shape the economy is really in today, go to this link: https://steemit.com/economics/@nicodemus/evidence-the-us-economy-is-set-to-crash-and-burn

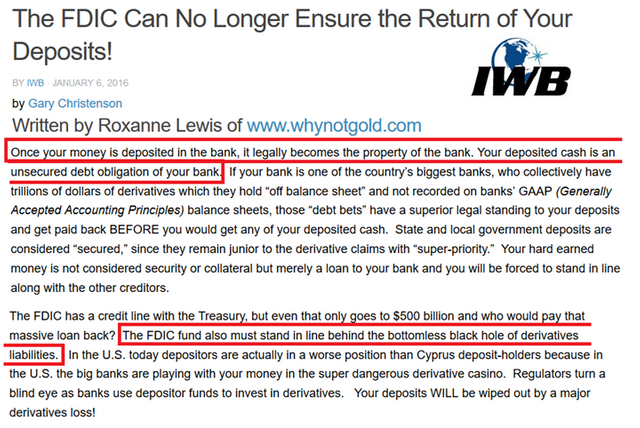

Most people will read but still will not believe. They will say but the fdic protects my account up to a specified level. Can't remember what the level is right now. They don't understand the fdic does not have enough funds when it all crashes. Wake up!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

gem777,

Exactly. You are right on. The FDIC insures up to $250,000. However, newer laws make derivatives top priority leaving nothing left for the depositor. The new laws make us unsecured creditors. With the new bail-in laws, the banks can take our money to cure their default then issue us worthless bank stock in place of the money they stole from us.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit