My posts are simply my opinion and not to be misconstrued as investment advice.

If you like my posts please upvote, resteem and follow:)

My Bravatek DD: Why BVTK May Be Worth $$$ Soon

(by reader3)

We’ve all seen the hilarious poopy pants comments. We’ve all seen the dropped hints about equity investors, and billionaire friends, and the suggestion that we hold onto our seatbelts. But this is a pink sheet subpenny stock, so we discount it, massively. We trade for small percentage gains, and we are grateful to make that, rather than lose it all. Business as usual on the OTC.

But what if it isn’t business as usual? What if something massive really is coming to BVTK, and soon? How could it happen? And how soon?

On June 12, Tom made his ‘hold onto your seatbelts’ tweet, without explanation, and then didn’t appear to follow through. Subsequent inquiries from several sources have produced responses about lawyers, and stakeholders, and coming soon.

Meanwhile, we’re also waiting for financials. Which have also now been coming soon for a while, but which are, apparently, per several tweets from third parties, with the auditors.

The easy assumption is that Tom expected financials to be done already, and was expecting to release news soon thereafter, to make sure the company was current before news was released. That’s probably partly correct.

It’s also reasonable to assume that the final details of their contract negotiations are a little more involved and taking a little more time than he’s letting on. So it’s probably a little of one, and a little of the other.

It will happen when it happens.

But what kind of contract can suddenly produce such huge news and revenues that the CEO of a publicly held company would state that people will poop themselves?

The company has two basic lines of business:

- Highly-secure email servers (and other related security software)

- Telecom tower services

Item 1:

The whitelist-only email server with always-on encryption and antivirus is a brilliant combination of technologies. But the company is waiting for customers to start buying. Some of those purchases may be huge (hello, they’re in discussions with the U.S. military, and at least a few F1000 companies), but they are also almost certainly not final yet. There’s a long demo, trial, and decision-making process for organizations of this size to acquire major software… and a replacement email server is very major indeed. It’s not the sort of thing that Tom can predict with 100% certainty either. That kind of decision takes time.

So what about Item 2?

Viking telecom was a relatively small organization until very recently. Then, this spring / summer, they hired a rockstar project manager, and signed funding/profit allocation agreements with an additional 2 companies in virtually the same business. If you read the description of those agreements, it makes the companies very nearly subsidiaries. Independent, still, but contractually bound to allocate most of their revenue to Bravatek/Viking, while Bravatek/Viking provides funding and manages the difficult task of getting projects.

Revenues are projected to be at least a few million for each deal, per annum.

I believe this is the seed, and foreshadows, a much larger version of the same business model that is about to be revealed.

Bear in mind that Tom has been tweeting for over a month about his multiple meetings with high-dollar equity investors. What on earth for? He doesn’t need high dollar equity investors for the email server part of the business. That has already been developed, and is just starting to get major customer interest. It will sell without millions in equity infusions.

Likewise, we’re all excited about the hints Tom has dropped about being on NASDAQ sooner than we expect, and his billionaire friend and investment funds, etc. Some assume that the high-net-worth individuals are going to buy up shares on the open market, themselves; others understand that this wouldn’t require negotiations with the company, and doesn’t provide the company any cash for future projects. No, the equity investors will expect either preferred or restricted shares for their investment, and they won’t provide the cash for growth or a buyback out of charity; they expect a major return on their investment. And not just a return due to a buyback using their cash. If they wanted to run up the stock price they could damn well do that themselves. Probably any one of them could run up the stock price to 10 cents in a matter of days if they really wanted.

So what kind of major return on investment can a company with a small telecom tower service operation provide to gigantic equity investors?

Simple: they buy into a MAJOR telecom tower service operation (or perhaps two, given Tom’s communications about there being two major deals now) using the equity investors’s money, and the know-how and familiarity of their existing telecom services staff. These major tower service operations will already have major revenue, but might be regionally constrained, or might not have the cash to outcompete or acquire their larger competitors.

Enter a public company with a large group of equity investors looking over its shoulders. They can make acquisitions, or provide funding for expansion, and do it all secure in the knowledge that they will make money because the companies they are acquiring are ALREADY making money. And I wouldn't be surprised if the deal is very similar to the ones we've already seen, funding, projects, and organization in exchange for majority revenue share.

How so?

Let’s take a moment for a brief introduction to one aspect of the telecom tower industry: collocation service companies.

A long time ago, in a galaxy far, far away, telecom companies all built and operated their own towers. (Or contracted companies to put the towers up for them.) But that quickly revealed itself to be expensive and inefficient. It takes time and money to put up a tower. And if each company is putting up its own towers, then there may be almost half a dozen towers covering the same area, when all that is needed is one, with ALL the telecom company’s equipment up on it.

So the business rapidly changed. The telecom companies started selling the towers, and leasing back the space on them to locate their telecom equipment. Thus the term ‘collocation’. The collocation company builds / owns / maintains the towers, and leases the space on the towers to the telecom company. Maybe they also perform equipment maintenance and upgrades. Or maybe they hire subcontractors like Viking to do the actual equipment maintenance, and upgrades. Their choice.

Meanwhile, the major wireless telecom company bills wireless customers, manages the network, and pays their subcontractors and collocation companies regularly to keep their towers operational. The cost of the lease becomes a clear business expense, meaning it can probably be deducted from federal taxable revenues.

Consider this tweet:

Quote:

BVTK negotiating JV agreement for large stake in Telecom site ownership/ operations worth significant multiple of announced Telecom services

https://twitter.com/bravatek/status/872806307354607616

That was from June 8, just days before the hold onto your seatbelts tweet, on June 12:

Quote:

Let's make it simple today: "Hold on to your seat-belts" folks. We've been busy at BVTK and it'll show this week...

https://twitter.com/bravatek/status/874247169154396160

I’d hazard a guess that this tweet meant that an agreement in principle had been made regarding the above JV stake. But of course it’s a long way from an agreement in principle to a final contract, and the execution of the same, so we’re still waiting for that news to drop.

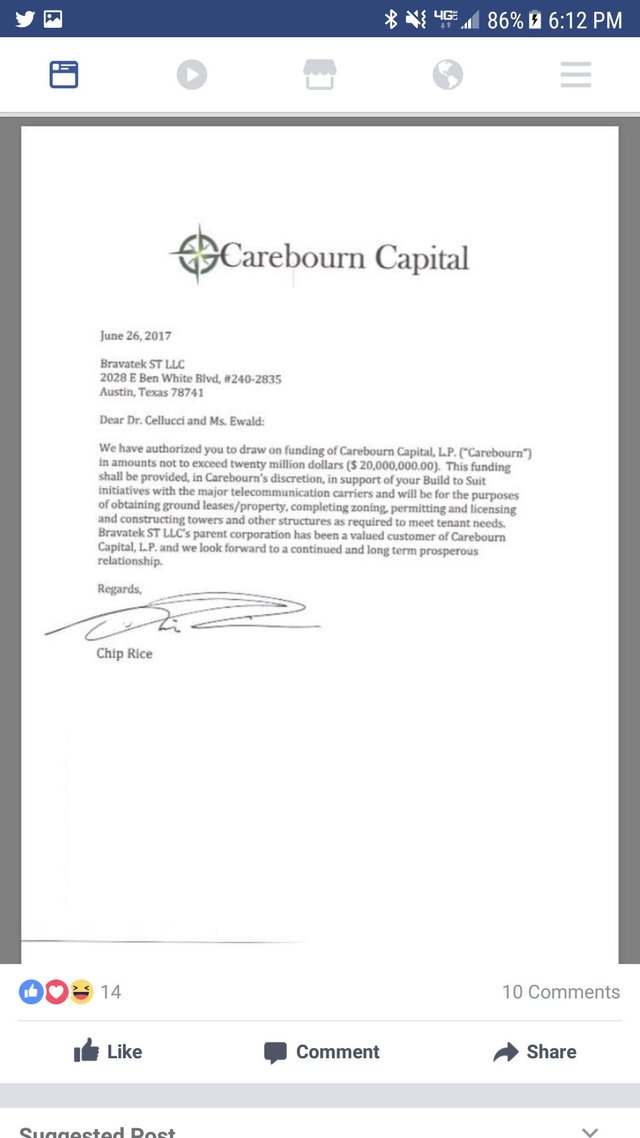

Another hint was dropped in the recent (accidental ?) release of a large loan agreement letter on ihub and twitter (yep, 20 mill!) :

https://investorshub.advfn.com/uimage/uploads/2017/7/13/kpav[IMG_0475.PNG

The relevant quote is: “This funding shall be provided, in Carebourn’s discretion, in support of your Build to Suit initiatives with the major telecommunication carriers”

Look up build to suit, and telecommunications, together. The reading gets very interesting.

www.3480g.com/build-to-suit/ :

Quote:

The idea behind the build-to-suit concept is to shift all aspects of tower siting-including zoning, construction and maintenance, to a third party. Carriers, increasingly burdened with competitive pressures, now can pass the time, capital and risk involved with tower siting to a vendor and focus their money on their core business, say build-to-suit companies.

So how big is the telecom services, build to suit, and collocation industry?

A sizeable fraction of the US telecom industry.

Here are a few examples of public companies in this industry. (There are a lot of private companies, about which I couldn’t find detailed information, and we are probably doing our deals with one or more of these private companies. The public companies here are being provided for informational purposes only. Do not expect to see them mentioned as partners in these pending deals. They are already public, and likely can already get all the funding they need.)

Lend Lease Group (www.lendlease.com). Ticker LLC.AX:

Stock price: 17.35. Shares outstanding: 564 Million. Market cap: 10.12 Billion. Revenue 2016 15 Billion Gross Profit 2016: 1.7 Billion

Of course that particular company has other non-cell-tower properties as well, so it might not be the best example, but try this:

American Tower Corporation (www.americantower.com , an REIT) : Ticker: AMT

Stock price: 136.04 Shares outstanding: 425 Million Market Cap 57 Billion Revenue 2016 5.7 Billion Gross Profit 2016 3.9 Billion

Crown Castle ( www.Crowncastle.com, another REIT): ticker: CCI

Stock price: 101.1 Shares outstanding: 366 Million; Market Cap: 36.9 Billion; Revenue, 2016: 3.9 Billion Gross Profit 2016 2.11 Billion

Additionally, read the following page, and you should get an idea of how deeply the wireless carriers are dependent on the tower owners these days:

So owning a tower owner / operator, or partnering with a couple of them, may come with significant revenue, if the money involved is significant enough to worry the major telecom companies enough that they are trying to renegotiate existing leases.

If Tom is able to strike deals with a few mid-sized private tower site operators for funding and revenue sharing, at even a fraction of the above revenue numbers, we could see a very large share price appreciation VERY QUICKLY. And if the plan is to keep making these deals until BVTK controls a nationwide cell-site development company on the order of the above public REITs? The sky is the limit!

But how can a sub penny stock make those kinds of major deals?

Again, this is where the equity investors come in. They will most likely be providing funds SPECIFICALLY to acquire or partner with existing private cell-site operators, SPECIFICALLY for the virtually-guaranteed revenue they provide. As those revenue numbers are released (and depending on who Bravatek is partnering with they could range from a few million to several hundred million), the BVTK stock price will appreciate dramatically, and be supported by massive public interest. THAT’S what is attracting the equity investors. They’ll be in for a few years at least, during which the stock price will continue to grow, and they will count their preferred or restricted stock as an asset. And they really won’t be in any rush to sell.

And that stock price appreciation can begin very soon after Tom

- Updates financials

- Announces finalized equity investments (one set of stakeholders)

- Announces finalized JV agreements with private telecom site operators (another set of stakeholders).

I seriously doubt 3 happens without 2, since it’s ultimately all about the money for the telecom site operators, who probably need cash to expand; and it’s likely that 2 can’t happen without 1, since many of these large equity investors will have stringent requirements for documentation and being current.

So, yes, we’re probably all waiting on financials, and the auditors. Tom is probably as impatient as the rest of us. And if the rumors that they could be released as soon as this coming week are true, well, watch out.

Some eagle-eyed people have noticed the creation of a new company recently. It was mentioned in Carebourn’s loan letter: Bravetek ST LLC. BVTK hasn’t discussed it at all, but I wouldn’t be at all surprised if we one day soon find out that it is to be the vehicle for some very large partnerships or joint ventures…

I don’t know how much longer it will take Cellucci to get all his ducks in a row, but once he does, it really could be explosive.

Know what you own, folks, and hold on for dear life.

(Note 1: This is a slightly updated version of my original post, which has since been reproduced by others several times, but in which I got the original seatbelt tweet date wrong by one day the first time I mentioned it, and cited the same numbers for two different pubco tower companies due to a sloppy copy-and-paste operation. I have now corrected the numbers for CrownCastle. They're still impressive, though.)

(Note 2: BVTK did in fact release their first 10K last Friday, so the rumors were spot on; it shouldn't be long before we're seeing more financials and ongoing news.)

(Note 3: Though I didn't discuss it here much, since I focused on telecom, the profusion of tweets have me more and more convinced that there are in fact ALSO major deals for the Ecrypt One email server product pending with the government and military.)

reader3

https://steemit.com/life/@poppashaun/breaking-penny-stock-alert-life-changing-sub-penny-stock-about-to-explode-with-govt-contracts-in -cyber-security

-cyber-security

![Tommy Boy.gif]

( )

)

![celluci education.JPG]

()

![career accomplishments.JPG]

()

Congratulations @poppashaun! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Bro, Wow you have been here awhile. I just found you today.

I am Glad you listened and bought BVTK ! ;)

I am working on my Introduction post. I highly recommend you get yours done asap. You will make higher rewards, I just found out.

Glad to have found you here Shaun, look at my wallet amount... not much but I am buying 50k worth asap.

You should to and then lease out STEEM at 22% without having to sell it.

https://www.minnowbooster.net

https://www.cryptoversity.com/courses/the-complete-steemit-course/ref/41/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Shaun, I was able to buy 4500 STEEM at $1 last night on Bittrex. I will be depositing it asap into healthiswealth account.

Did I not say BTC was going to drop to $3000, accually went down to $2900. nice short ralley right now. Within a day or two we will see it drop down to about $2000, make sure to buy some then.

I will buy more STEEM at about 75 cents.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Now what?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit