There will always be an endless list of things you wish you knew or acted on earlier in life.

It’s part of being human. As kids, we always had these awesome fantasies of being one of the awesome superheroes on the team. Who knew we would all end up being Captain Hindsight.

We all know that one person that likes to say: “Ohh I should’ve invested in Apple’s stock!” or “I knew this person who told me to buy some bitcoins!” Reality is that they shouldn’t have invested in either Apple or Bitcoin without learning what constitutes a good investment. Blindly following the crowd is not one.

If there’s one thing we can learn from the crowd after surviving and often times thriving through even the hardest of conditions like wars, mass epidemics, and natural disasters - it’s that the crowd will always keep on moving. Someone somewhere is solving a problem and needs capital to make those visions and goals a reality. So instead of following the crowd you could maybe stand on the sideline and predict what the crowd will do next.

With experience, trial and error your predictions will become better, the patterns become clearer and you’ll start to see things before the general population catches on. That’s where your value will lie. Being a wisdom driven visionary.

2. The sooner the better

It’s time to start using the critical part of your brain instead of letting your emotions do all the thinking. The earlier you start the more rewards you’ll reap from your investments. So say bye, bye to Captain Hindsight and hello to the new and improved Captain Oversight.

Some of you might decide to wait a while to start reading up about investing. I know for a fact that future-you is shaking his/her head right now at the thought of all the extra gains a couple of years of investment could’ve made.

Just to illustrate how hard the future-you is shaking his/her head I will show you two scenarios.

2.1 Scenario number 1

Let’s say that you’ve decided to follow your brain. After checking your income and expenses, you decide to invest $1.000,- every year —- starting when you are 18. The brain decided to do some research and after a careful consideration picked an investment fund that averaged a 12% interest rate per year. Then eight years later, at the age of 25, your brain decides that it had put enough money into the investment fund. This would make it a total of $8000. For the next couple of decades, until you reach the young age of 74, the investment funds keep performing on an average annual 12 % interest rate.

2.2 Scenario number 2

Letting your emotions do all the talking you decide to just wait a couple of years. At the age of 26, your emotions suddenly mature and think it’s a great time to start investing. Luckily, since the brain from scenario 1 and the emotions are close buddies the brain hands him the same investment firm. Realizing that it has some catching up to do in comparison to the brain your emotions decide to invest $1000 every year until the ripe age of 74.

Since its the same company it will have the same 12% average interest rate. With the same 12% interest and a total investment of $49.000,- over a period of 49 years your emotions think it must have beaten the brain.

As you can see the clear winner is definitely the brain. Not by a couple of dollars but a whopping $1.155.640! That’s more than 1 million dollars ahead while investing 41.000 dollars less because the brain decided to start eight years earlier. That’s the magic of compound interest!

We will all be older one day, but we won’t all be wiser. Start using your brain.

3. Principles

Benjamin Graham announces from the start in his famous book The Intelligent Investor that nothing in life can tell you how to beat the market. All you can do is follow, in his case, three powerful lessons:

#Minimize the odds of suffering irreversible losses;

#Maximize the chances of achieving sustainable gains

#Control the self-defeating behavior that keeps most investors from reaching their full potential

But no matter how careful you are, the price of your investments will go down from time to time. According to Benjamin Graham, an intelligent investor has nothing to do with IQ or SAT scores. It simply means being patient, disciplined, and eager to learn. You must also be able to harness your emotions and think for yourself.

You won’t always pick winners, but when you follow principles instead of hypes, you increase your chances substantially.

So instead of wishing you could go back in time to make the investment of a lifetime, you could start to look at the future. The value of investing lies in the ability to accurately predict the future, not the past. Without further ado, here is the list.

4. The never-ending list of things you should remember before you start investing

We’re not the same.

We might look and act alike from the outside but we’re not the same. No two companies are the same. They might sell the same service (barbers) or product (cars) and even have similar concepts (supermarkets), but their fundamentals will always be different.

Something inside each and every business makes it different from every other business. Investing in a company that you deem undervalued because a similar looking company has a higher market price, is not a sound investment strategy.

Companies can create phones but not every company will create the next Samsung or Apple. It’s the whole formula that counts, not just parts of it. A company might have a great product, but without a good marketing and sales team, the project will most likely fail. A restaurant may sell the best burgers but if the location is hard to reach than that will have a negative impact on its growth. MacDonalds definitely doesn’t have the best burgers. The locations of the franchise sure do give them a great advantage. Businesses have commonalities, they are never the same.

Blindly in love

As soon as we invest money into something it holds a different kinda value. Now we’re emotionally attached. The relationship between you, the company and the people talking about the company changes immediately.

Bad news from people means that your hard earned money could become worthless. Most people will actively defend their investment. Other people simply don’t see what they see.

It’s crucial to remember that you don’t see what other people see as well. Staying rational and honest to yourself should be a priority. You’re not going to hit the bullseye with every shot you take. Nobody does. Yes, even Warren Buffett made mistakes on his way towards the top.

Company Vs. Company Z

Competition is good. Without competition, we wouldn’t push ourselves to our limits. It keeps companies sharp. There is no incentive for a company to improve if it’s the only one around.

The journey towards creating a great customer experience starts as soon as competition enters the market and people have options. No competition, no innovation. With competition, the one that does not improve will eventually be removed from the market.

Set and don't forget

This one is hard. What is the perfect balance between keeping up to date with how the company is doing and being a stalker?

If you’re not a day trader then reading every little piece of news has no value at all. Prices move up and down on a daily basis, but the fundaments should stay the same. No investment is a set and forget investment. Review your positions every once in a while. Be critical and see if your predictions were accurate and the fundamentals are still strong.

Dude, where's my money?

You should diversify. Do not put all your eggs in one basket. There are loads of people out there that jumped on some kind of hype and bought stocks/cryptocurrencies. Years later the stock gets mentioned in another hype and the person comes to the realization that they still have some laying around somewhere. Because we’re constantly being bombarded with information we have a tendency to forget a lot. We think we remember a lot, but that is only because we forgot the things we forgot. Everything we remember is nothing more than the things we did not forget.

Don’t believe me? Just google: “I forgot/lost my cryptocurrency wallet” and you should see plenty of stories of people that wished they would’ve stored their information in a safe place.

If you’re just starting out you can begin with a simple excel sheet where you keep track of what you bought and how much you paid for it. Future you will thank you for this.

The government isn’t going to magically disappear

While a lot of us know that not every government is as efficient when it comes to spending money, we should also remember that the government is not a single person. It’s a large group of “anonymous” people that collectively decide to enforce the law it has created; often times with good intentions but bad results.

With an authority far beyond your reach, it’s of little value to spend your whole life fighting the system. Instead, you should know the rules of the game to the best of your ability. Everything changes and so does the law. Try to keep up to date so it doesn’t come and hunt you down when you least expect it. And everything always happens when you least expect it.

Sounds like a great idea

But having a great idea is not enough. You can make anything sound like a great idea. If I had a dollar for every idea I’ve ever had or heard I’d have enough money to slap the Queen of England and pay the price. The possibility of creating or doing something does not equal the probability that it will happen. I’m sure there were and are a lot of great ideas that, if were they to become a reality, would be a game changer. Yet they are not here.

The idea by itself is never good enough. A good team, a working product, and a market to sell it to, are just some of the things that are far more important than an idea. Ideas change all the time, the fundamentals do not.

Anybody remember the Google Glasses? Somebody thought this sounded like a good idea back in the day.

But having a great idea is not enough. You can make anything sound like a great idea. If I had a dollar for every idea I’ve ever had or heard I’d have enough money to slap the Queen of England and pay the price. The possibility of creating or doing something does not equal the probability that it will happen. I’m sure there were and are a lot of great ideas that, if were they to become a reality, would be a game changer. Yet they are not here.

The idea by itself is never good enough. A good team, a working product, and a market to sell it to, are just some of the things that are far more important than an idea. Ideas change all the time, the fundamentals do not.

Anybody remember the Google Glasses? Somebody thought this sounded like a good idea back in the day.

This of course, unless those Google Glasses provided the fundamentals to build this:

This of course, unless those Google Glasses provided the fundamentals to build this:

If that’s the case, the Google Glasses were a great first step!

Trade temporary pleasure for long-term satisfaction

The point of money is to spend it. If nobody were to spend money than money would serve no purpose. It would just be another piece of paper. Being brought up in a consumer-oriented society which always wants you to have the latest of the latest makes it difficult to think about a long-term strategy.

What you need to realize is that you don’t need the latest. What you need to do is create your own safety net. Something you can fall back on when things go wrong for a while. Trust me, your 500 dollar shoes and diamond earrings won’t save you when times get rough.

Since the point of money is to spend it, you spend it wisely. Invest the money into things that increase in value over time. If it doesn’t increase in value than it’s only a matter of time before it becomes worthless.

As soon as you invest it you should consider that money as non-existent. If you’ve done enough research than your future self will thank you for your past judgments.

Everything changes

The giants of the past will most likely not be the giants of the future. Companies need to grow with the changes in our society or risk becoming obsolete. Toys R Us was founded in June of 1957. It took 60 years for it to sub come to the ever-changing world, but it did. And so will most companies. Eventually, a newer, better idea will take place and it will be too late for the giant company to partake in it.

If you realize a big societal change and notice the company you’ve invested in has become too slow to adapt to the change than it is time to let them go. Change can take a long ass time, but it always comes. You simply don’t get electricity by improving the candle.

Here is a trip down memory lane of the Giants of the past:

This doesn’t mean that these companies aren’t big right now. It just means that investing in them at their prime would’ve been a bad investment.

Losing customers is not always a bad thing

Would you rather have 20 people who buy your product for 10 dollars or 10 people that buy your product for 30 dollars?

Increasing the price and a losing customers doesn’t automatically mean the company is or will be doing bad. That’s why you don’t see a Bugatti every other day but have no problem finding a Suzuki/Chevrolet/Toyota. Long-term it might be more beneficial to increase the price and lose some customers. There is enough room for both.

No, you shouldn't have invested back then

Don’t even think about the missed opportunities. They are no longer relevant. Don’t invest with luck. Strategically plan out your investments. You don’t just throw every spice into a dish you’re making. It takes years and years of practice to become a good cook. It will take years and years of investing to become a good investor. But you either eat shit for the rest of your life, or you learn how to cook.

Hence, what you should do is the bare minimum and investigate into what you’re investing. Learn the principles embedded in successful companies and find the next big things. Let’s change the “If only I would’ve invested in that one thing that one time in the past” to: “I’m going to do the right thing right now for my future.”

There was an endless list of things you could’ve invested in to make a decent return on investment. I think we can safely assume that there will be an endless list of things you can invest in. The next big thing is being created as we speak. If you pay attention, form different arguments and stay consistent you’ll start to see them.

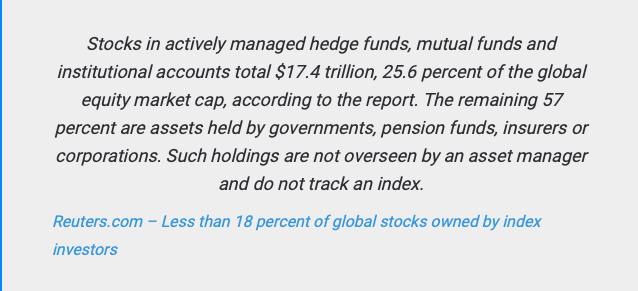

The big whales

Around 80% of shares in major companies are controlled by major institutions. Meaning the average joe investing a couple of thousands of dollars will have less than 0,00001% of influence on most of the big stocks their trading.

If you’re reading this and are investing then you’re most likely a little fish swimming next to a group of big whales. Your presence will most likely go by unnoticed. They do not care what you do, but you should care what they do.

Don’t try to keep up with the whales. Find the patterns. Figure out where the whales will be in the future and make sure you’re there before they are. That’s when you stand to gain the most.

A stock only becomes most interesting when large companies show their interest in the stock. The bigger the company is the more energy it takes to move it. But when it moves, you’ll notice.

Don't wait for the right time

Warren Buffett could have never known that he’d be worth 90+ billion dollars. What he did understand is that time in the market beats timing the market. At a certain point, you should start to look around you and try to figure out why everybody else is failing. Most people are actively waiting for the right time to start; other people just start.

When your investment has reached a certain amount of capital, you won’t even think about the couple of thousands you missed. You will only think about the hundreds of thousands you missed because you wanted to wait for the perfect moment to jump in.

If you’ve done your research and you’re convinced by the evidence that it will increase in value; then like the old Chinese Proverb says:

How many lefts make a right?

The more right you are about any one investment, the more wrong you can be on all the others and still triumph as an investor. Your losses are limited to the amount you’ve invested in each stock (it can’t go lower than zero), while your gains have no absolute limit. A 1000 dollar investment in a piece of garbage company will in the worst case become 0 dollars. However, a 1000 dollar investment in a great company could become as much as 10.000, 20.000 or a lot more. No, I am not exaggerating.

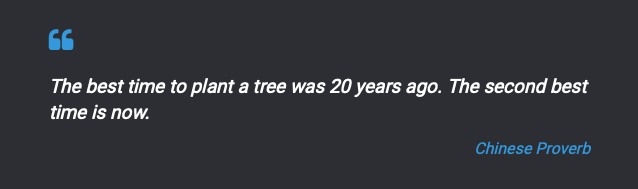

Here is a chart for Apple’s stock:

If you had invested $1000 on the day Apple launched at 0,51 cents, you’d be sitting on a little over $432.000.

The same goes for a stock in Amazon. 1000 dollar at its launch would now equal $1.140.000. If that doesn’t get your attention then I don’t think you interested in investing.

What’s even more amazing is that even decades after their initial launch it still would’ve been a great investment.

The last thing I want you to look at on this chart is the green line. No line ever moves straight up. Just like you take time to grow, so do companies. There are setbacks and corrections where it dips below its all-time high. Those corrections will always happen when you buy stocks/cryptocurrencies. But a company with strong fundamentals will always overcome those setback. Just like humans.

But what do you earn

Let’s just imagine that you’re the busiest person in the world and only have time to follow one piece of data before you invest in a company. Yes, one. I think we should all agree that social media followings would be a bad piece of data to follow. With all the fake bots you can buy anybody can become virtually famous.

One of the most important pieces of data to follow is the companies earnings. A company that has steadily increased in value over time and has a healthy earnings report should be in your portfolio.

Twitter’s stock went life in 2013 but it wasn’t until 2018 that it made its first profit. I’m not trying to argue if that is a long or short time, but any investment before a company generates a profit should be considered as extremely risky.

Will it generate more profit? Or is the market saturated and the competition fierce? Follow the data instead of your emotions and you can create a clearer picture for yourself.

Myspace and a bunch of other giant social media’s ruled the world once. There’s no saying who will be the next giant driving twitter to the ground. One thing is for sure: without innovation, you’ll eventually run dry.

5. Recommended books

So...

The list is far from done. The list could go on and on about all the pieces of data you should/could pay attention to. You have to decide for yourself when you think you’ve done enough research. There is no such thing as 100% certainty when it comes to investing. All we can do is minimize the risks.

Feel free to share this post with your friends. Hopefully, it opens up the conversation about how we spend our money. And the more knowledgeable people we have on the lookout for great new investments, the easier it will be to find the next big thing.

If you have any piece of advice or something people should remember when they start investing, don’t even hesitate and share your thoughts down below :)

Congratulations @rahimmansana! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @rahimmansana! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit